Terex Corporation (TEX) stock looks promising at the moment. We are optimistic about the company’s prospects and believe that the time is right for you to add the stock to portfolio as it looks full of potential and is poised to carry the momentum ahead.

Growth Drivers in Place: Terex will continue to benefit from progress on its transformation program. The North American market for AWP equipment is improving. Cranes returned to profitability in the second quarter, led by the benefits from restructuring action and it expects this trend to continue. Its Materials Processing segment is also progressing well. Terex met its commitment to focus on three core segments and continues to simplify the company, implementing footprint and cost-restructuring plans.

Altra Industrial Motion has expected long-term growth rate of 8.00%.

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Original post

Zacks Investment Research

Let’s delve deeper and find out what are the factors that make this manufacturer of a broad range of construction and mining related capital equipment an attractive investment option at the moment.

What’s Working in Favor of Terex?

Solid Rank: Terex currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

An Outperformer: Terex’s shares surged 55% in the past year, outperforming the industry’s growth of 38.5%.

Upbeat 2017 Guidance: The company continues to implement the strategy of focusing and simplifying its structure along with building capabilities in key commercial and operational areas. Its on-going efforts to expand capabilities in sales execution and account management through commercial excellence initiative reflects the company’s growing bookings and backlog. Terex has raised full-year adjusted EPS guidance to $1.05-$1.15 from the previous guidance range of 80-95 cents. This reflects improved net sales and operating profit guidance.

Positive Earnings Surprise History: Terex topped the Zacks Consensus Estimate in the last reported quarter, recording a positive surprise of 21.43%. In the trailing four quarters, the company posted an impressive average positive earnings surprise of 122.78%.

Positive Growth Projections: The Zacks Consensus Estimate for earnings is $1.15 for fiscal 2017 which reflects a year-over-year growth of 30.11%. For fiscal 2018, the Zacks Consensus Estimate for earnings is pegged at $1.95, a year-over-year growth of 70.04%. The company has long-term expected earnings per share growth of 19.67%.

Estimates Moving Up: Annual estimates for Terex have moved north in the past 30 days, reflecting analysts’ confidence on the stock. Over this period, the Zacks Consensus Estimate for 2017 and 2018, moved up by around 17% to $1.15 per share and 15% to $1.95, respectively.

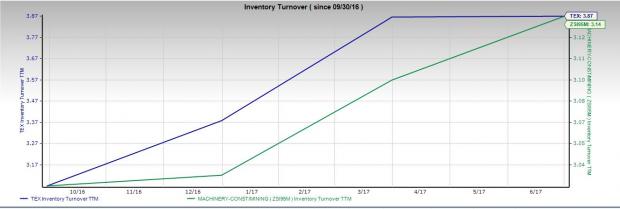

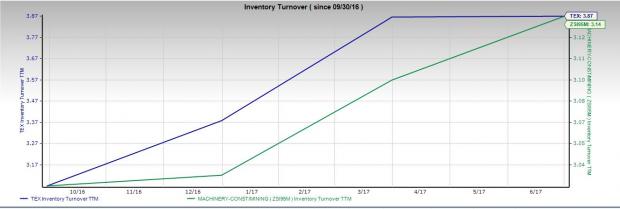

Higher Inventory Turnover Ratio: In the trailing 12 months, the inventory turnover ratio for Terex has been 3.87% compared with the industry’s level of 3.14%. A higher inventory turnover than the industry average means that inventory is sold at a faster rate, suggesting inventory management effectiveness.

Growth Drivers in Place: Terex will continue to benefit from progress on its transformation program. The North American market for AWP equipment is improving. Cranes returned to profitability in the second quarter, led by the benefits from restructuring action and it expects this trend to continue. Its Materials Processing segment is also progressing well. Terex met its commitment to focus on three core segments and continues to simplify the company, implementing footprint and cost-restructuring plans.

Other Stocks to Consider

Other top-ranked stocks worth considering in the same sector are AGCO Corporation (AGCO), Caterpillar Inc. (CAT) and Altra Industrial Motion Corp. (AIMC). All three stocks sport a Zacks Rank #1.

AGCO has expected long-term growth rate of 13.51%.

Caterpillar has expected long-term growth rate of 9.50%.

Altra Industrial Motion has expected long-term growth rate of 8.00%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

Terex Corporation (NYSE:TEX) stock looks promising at the moment. We are optimistic about the company’s prospects and believe that the time is right for you to add the stock to portfolio as it looks full of potential and is poised to carry the momentum ahead.

Let’s delve deeper and find out what are the factors that make this manufacturer of a broad range of construction and mining related capital equipment an attractive investment option at the moment.

What’s Working in Favor of Terex?

Solid Rank: Terex currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

An Outperformer: Terex’s shares surged 55% in the past year, outperforming the industry’s growth of 38.5%.

Upbeat 2017 Guidance: The company continues to implement the strategy of focusing and simplifying its structure along with building capabilities in key commercial and operational areas. Its on-going efforts to expand capabilities in sales execution and account management through commercial excellence initiative reflects the company’s growing bookings and backlog. Terex has raised full-year adjusted EPS guidance to $1.05-$1.15 from the previous guidance range of 80-95 cents. This reflects improved net sales and operating profit guidance.

Positive Earnings Surprise History: Terex topped the Zacks Consensus Estimate in the last reported quarter, recording a positive surprise of 21.43%. In the trailing four quarters, the company posted an impressive average positive earnings surprise of 122.78%.

Positive Growth Projections: The Zacks Consensus Estimate for earnings is $1.15 for fiscal 2017 which reflects a year-over-year growth of 30.11%. For fiscal 2018, the Zacks Consensus Estimate for earnings is pegged at $1.95, a year-over-year growth of 70.04%. The company has long-term expected earnings per share growth of 19.67%.

Estimates Moving Up: Annual estimates for Terex have moved north in the past 30 days, reflecting analysts’ confidence on the stock. Over this period, the Zacks Consensus Estimate for 2017 and 2018, moved up by around 17% to $1.15 per share and 15% to $1.95, respectively.

Higher Inventory Turnover Ratio: In the trailing 12 months, the inventory turnover ratio for Terex has been 3.87% compared with the industry’s level of 3.14%. A higher inventory turnover than the industry average means that inventory is sold at a faster rate, suggesting inventory management effectiveness.

Growth Drivers in Place: Terex will continue to benefit from progress on its transformation program. The North American market for AWP equipment is improving. Cranes returned to profitability in the second quarter, led by the benefits from restructuring action and it expects this trend to continue. Its Materials Processing segment is also progressing well. Terex met its commitment to focus on three core segments and continues to simplify the company, implementing footprint and cost-restructuring plans.

Other Stocks to Consider

Other top-ranked stocks worth considering in the same sector are AGCO Corporation (NYSE:AGCO) , Caterpillar Inc. (NYSE:CAT) and Altra Industrial Motion Corp. (NASDAQ:AIMC) . All three stocks sport a Zacks Rank #1.

AGCO has expected long-term growth rate of 13.51%.

Caterpillar has expected long-term growth rate of 9.50%.

Altra Industrial Motion has expected long-term growth rate of 8.00%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Original post

Zacks Investment Research