Investing.com’s stocks of the week

The week of March 16 is likely to be wild as the bulls and bears continue to fight it out. It certainly seems like the late-day rally on Friday at least gave investors a chance to go home over the weekend feeling a little positive. But the recent patterns in the market suggests that we likely have more work to do before we can start feeling better about anything.

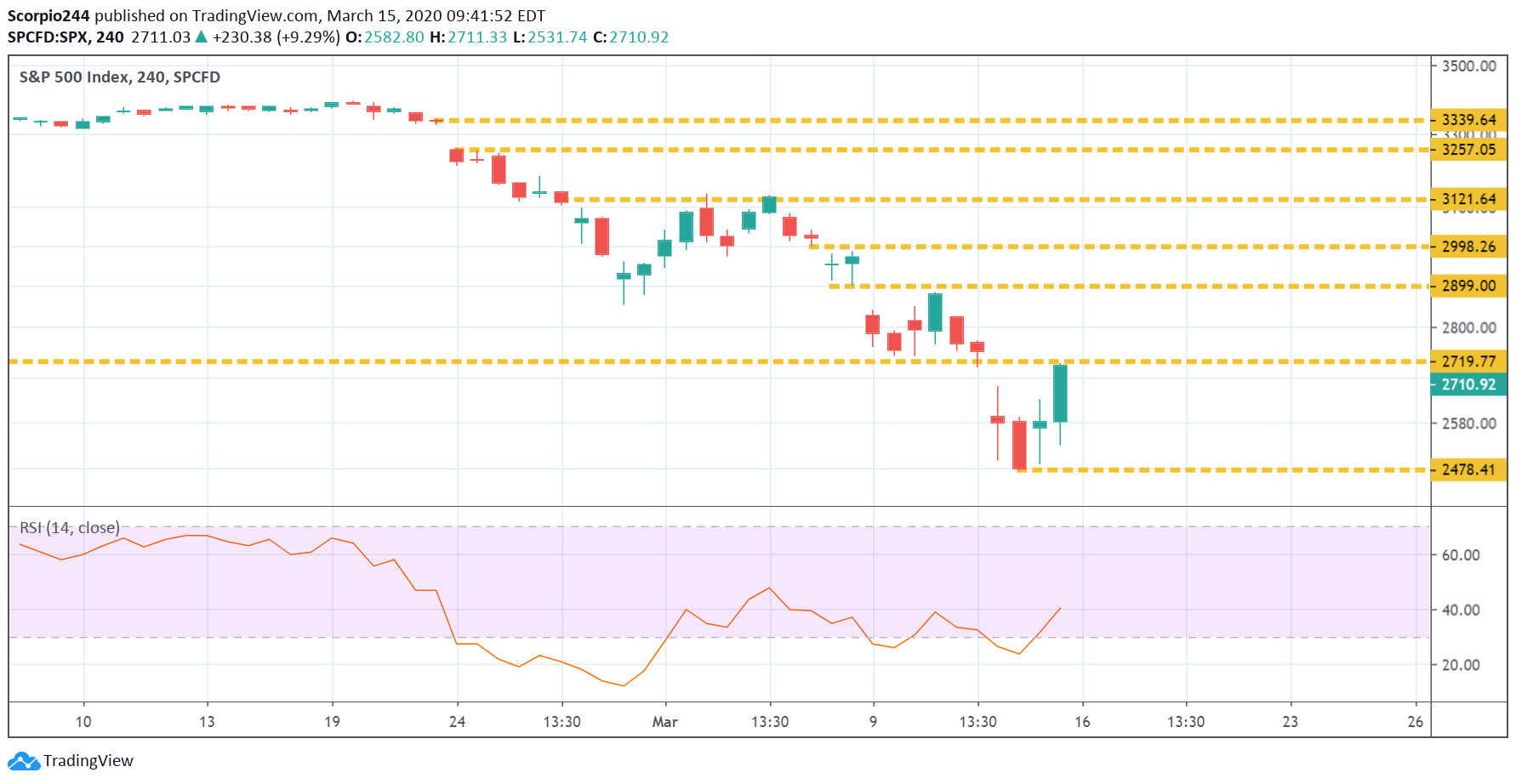

S&P 500 (SPY)

The S&P 500 has been in a mode of gapping lower and working to fill those gaps back up, but that has been followed by moves lower. It likely means we re-test the lows in the 2,500 levels this week. Again, the important thing is that we make through the week without making new lows.

It means that we should likely prepare for a pretty brutal start to the week, with hopefully some signs of improvement towards week’s end.

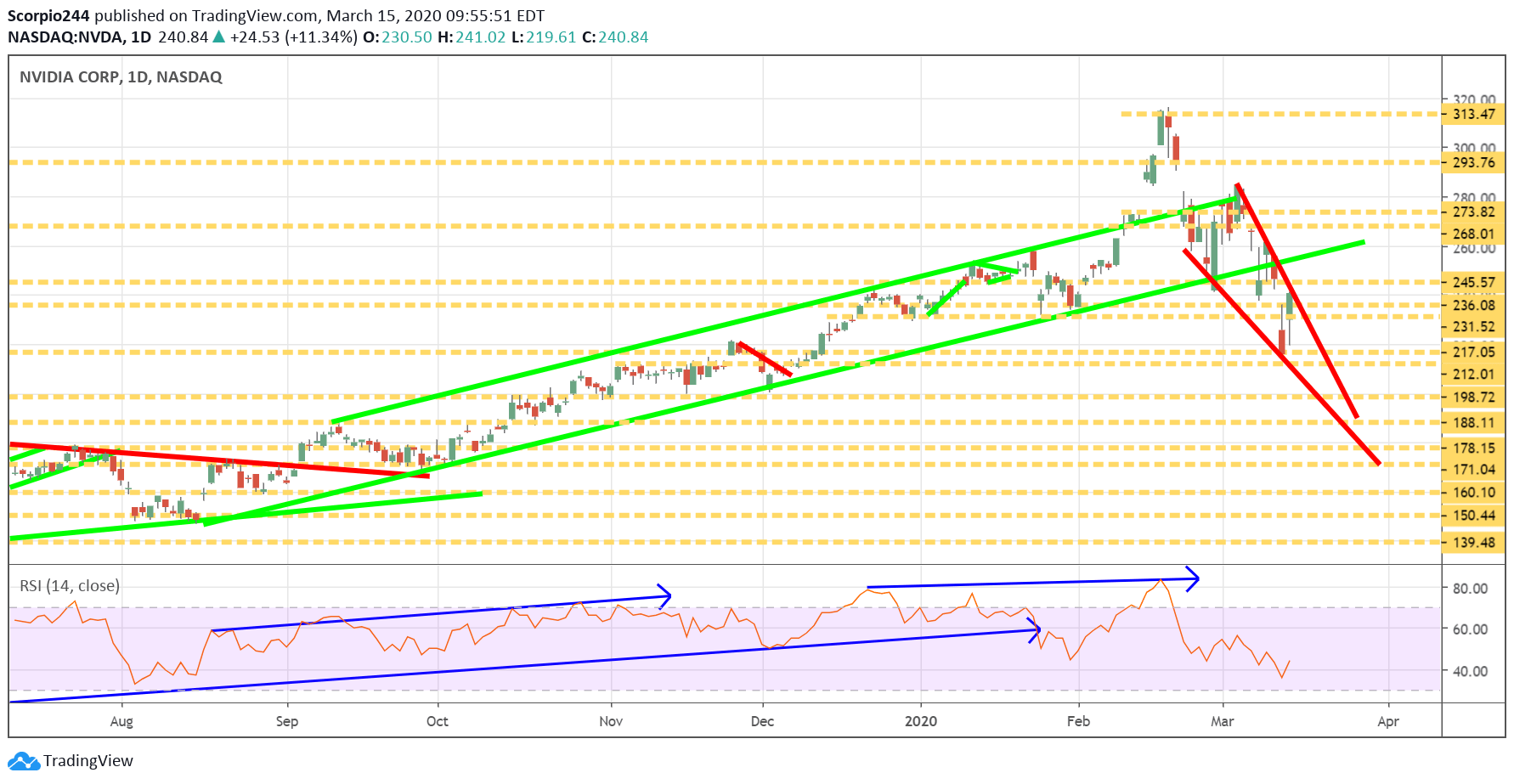

Nvidia (NVDA)

NVIDIA (NASDAQ:NVDA) looks as if it is in the early stage of forming a falling wedge pattern, and that eventually means the stock is likely to reverse. But first it probably has further to fall to around as low as $200.

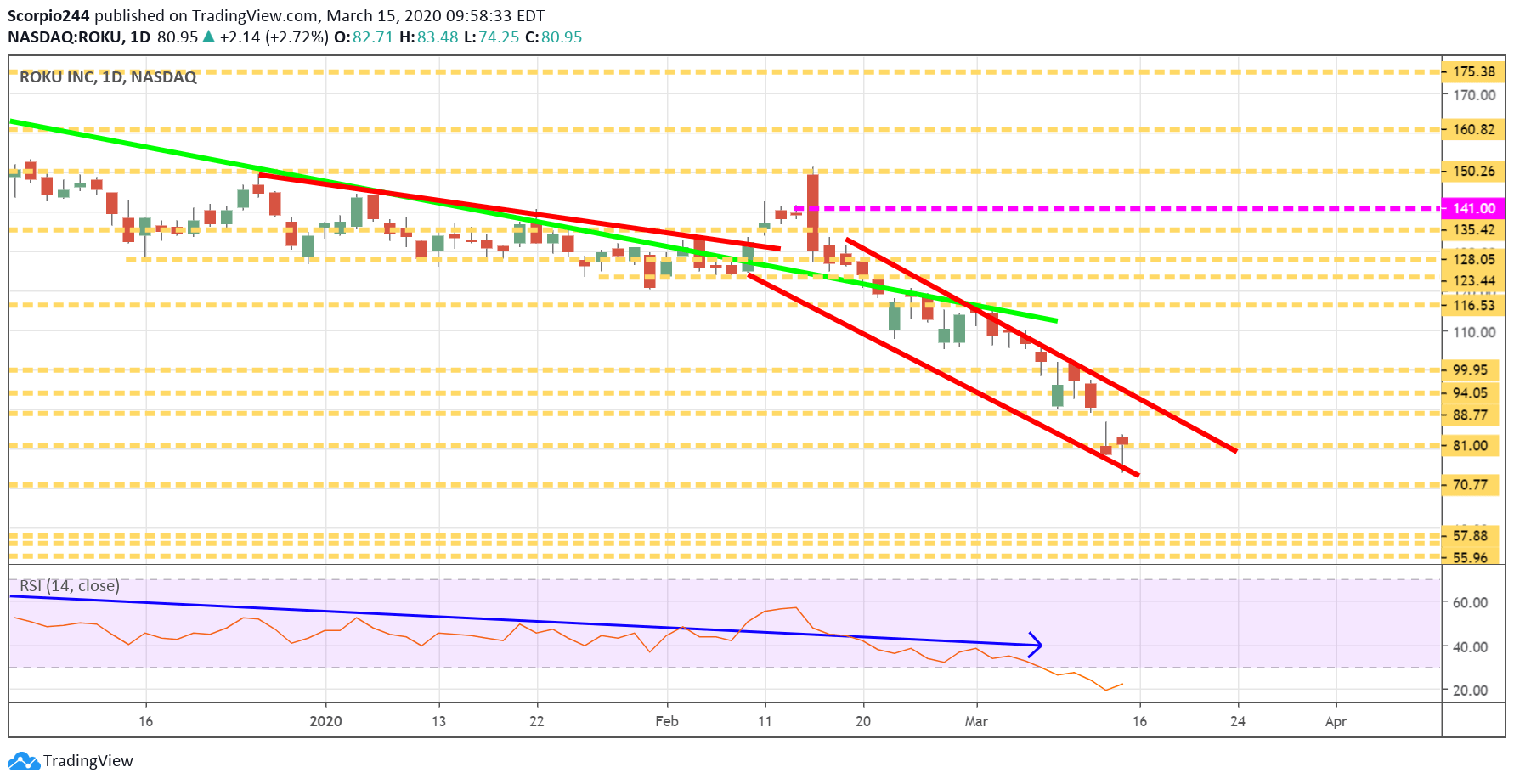

Roku (ROKU)

Roku (NASDAQ:ROKU) has been trending lower and is now in a trading channel, and I think that means the stock continues lower still towards $70.

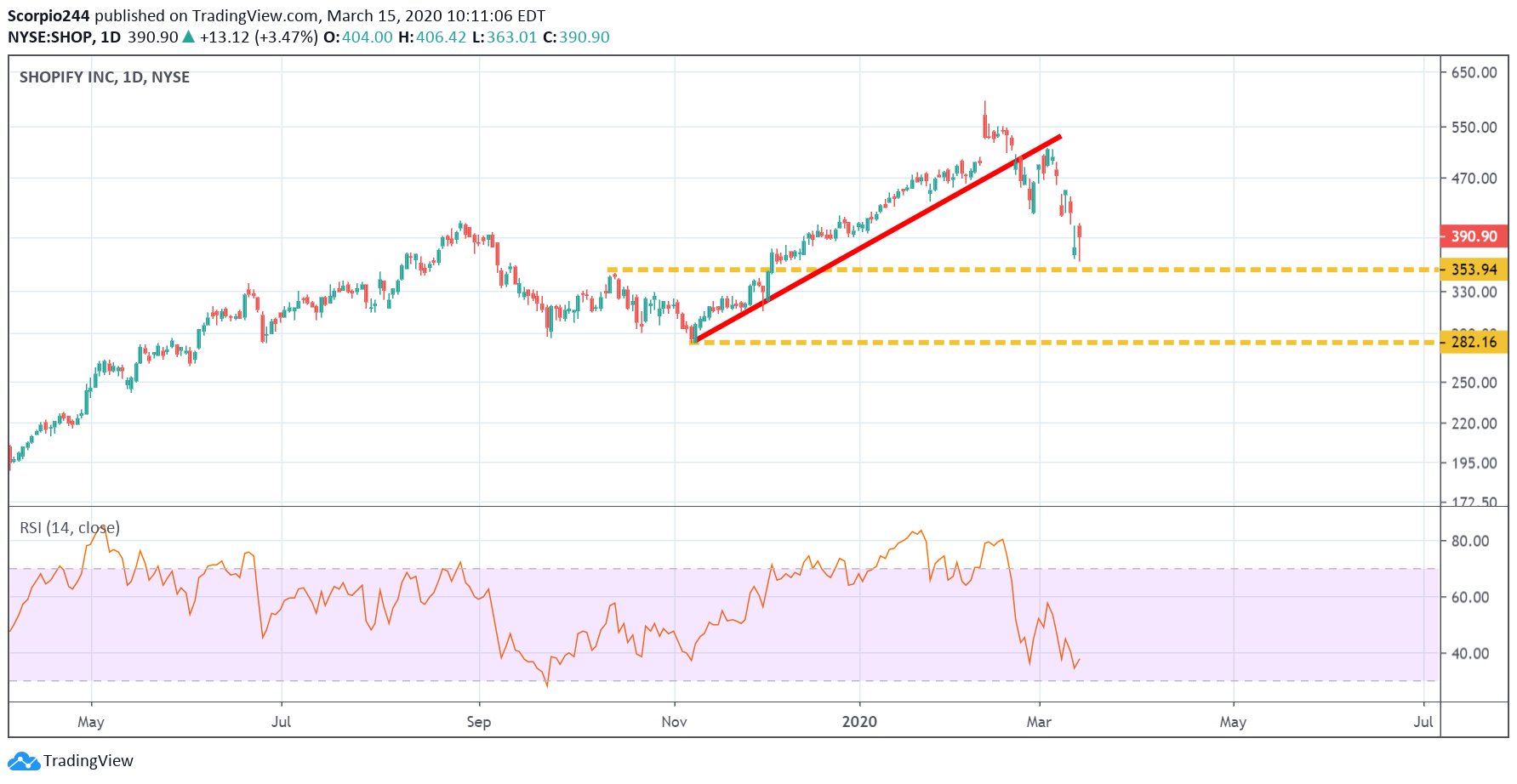

Shopify (SHOP)

Shopify (NYSE:SHOP) is approaching support around $353, and a break of that level sends shares lower towards $282. The RSI still hasn’t hit oversold levels.

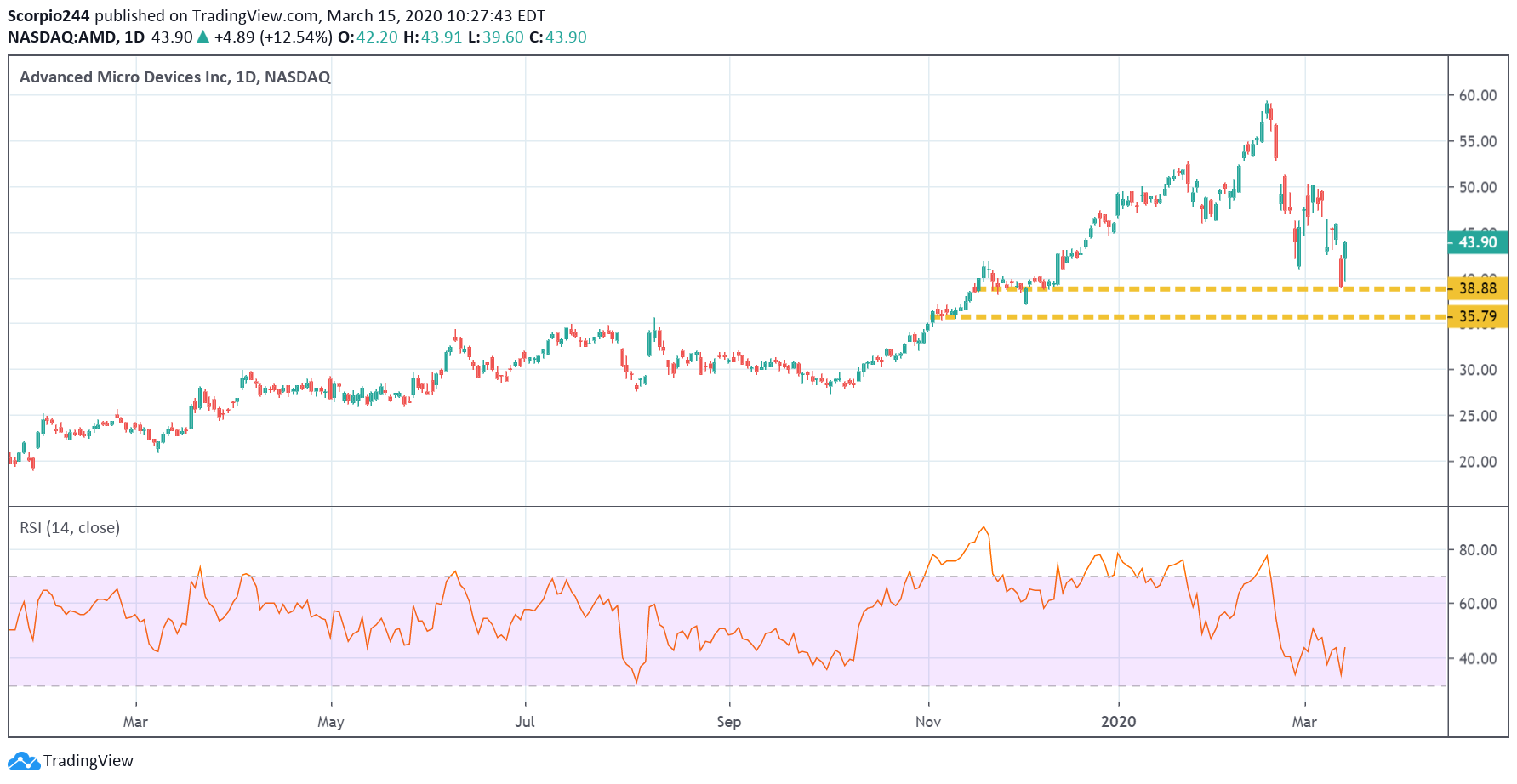

AMD (AMD)

Advanced Micro Devices (NASDAQ:AMD) is near support at $38.90 and could result in the shares falling to $35.80. Again, the stock isn’t even near oversold on the RSI.

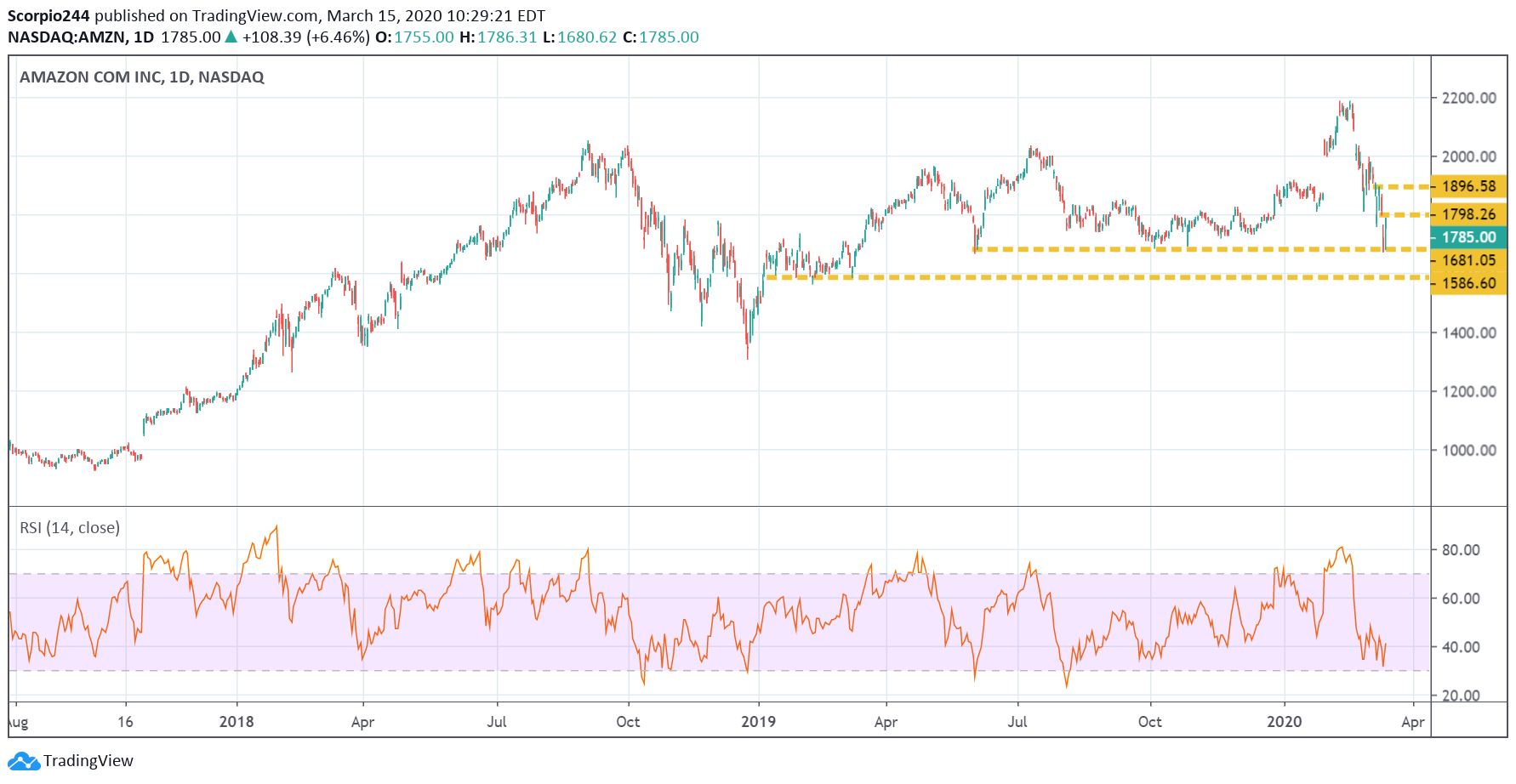

Amazon (AMZN)

Amazon.com (NASDAQ:AMZN) has not hit oversold levels yet either, and the break of support at $1680, sends the stock even lower towards $1585.

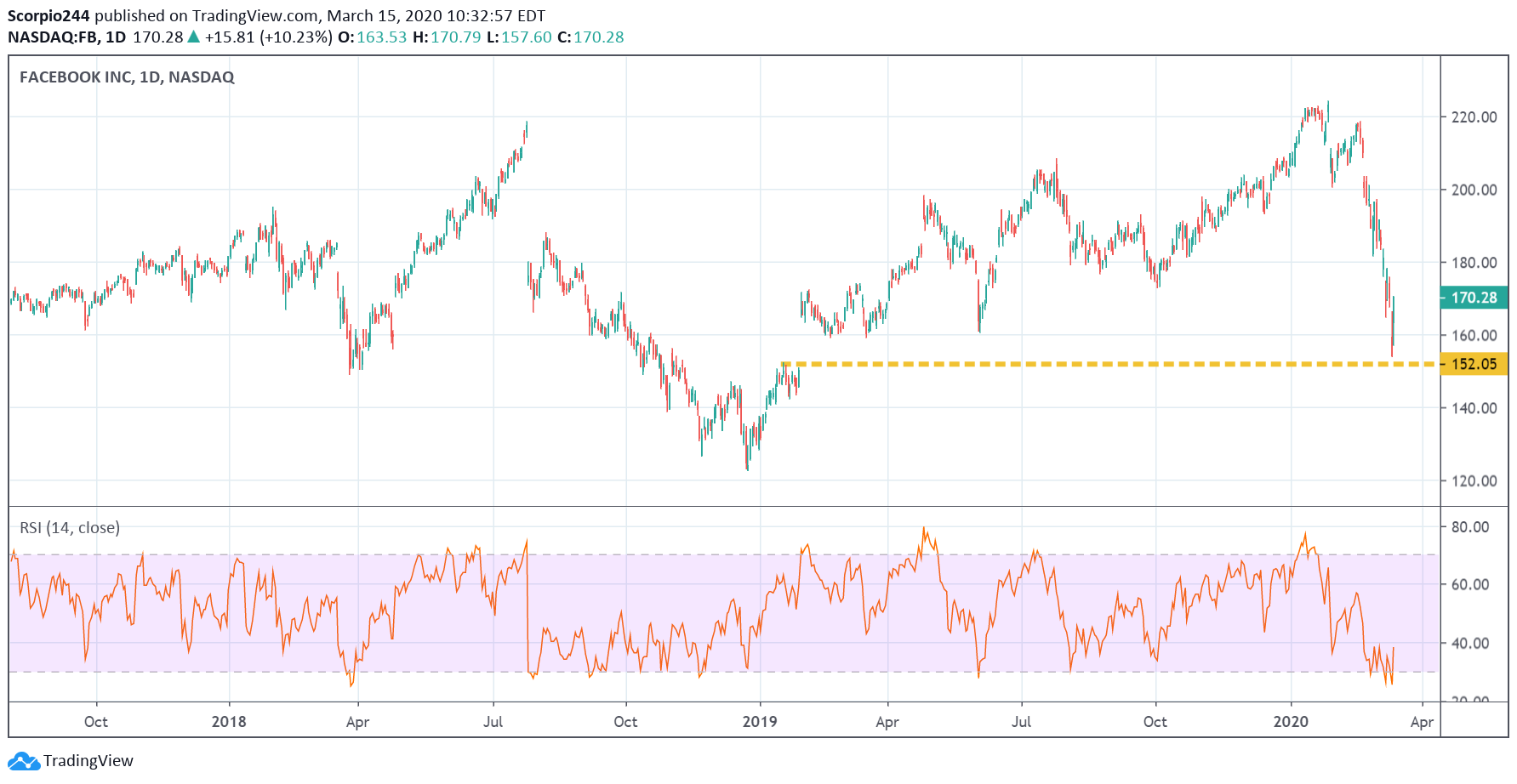

Facebook (FB)

Facebook (NASDAQ:FB) has almost filled its gap, which may mean there is still some further room to fall to $152, but the stock may be starting to put in a bottom here, as the RSI begins to shift.

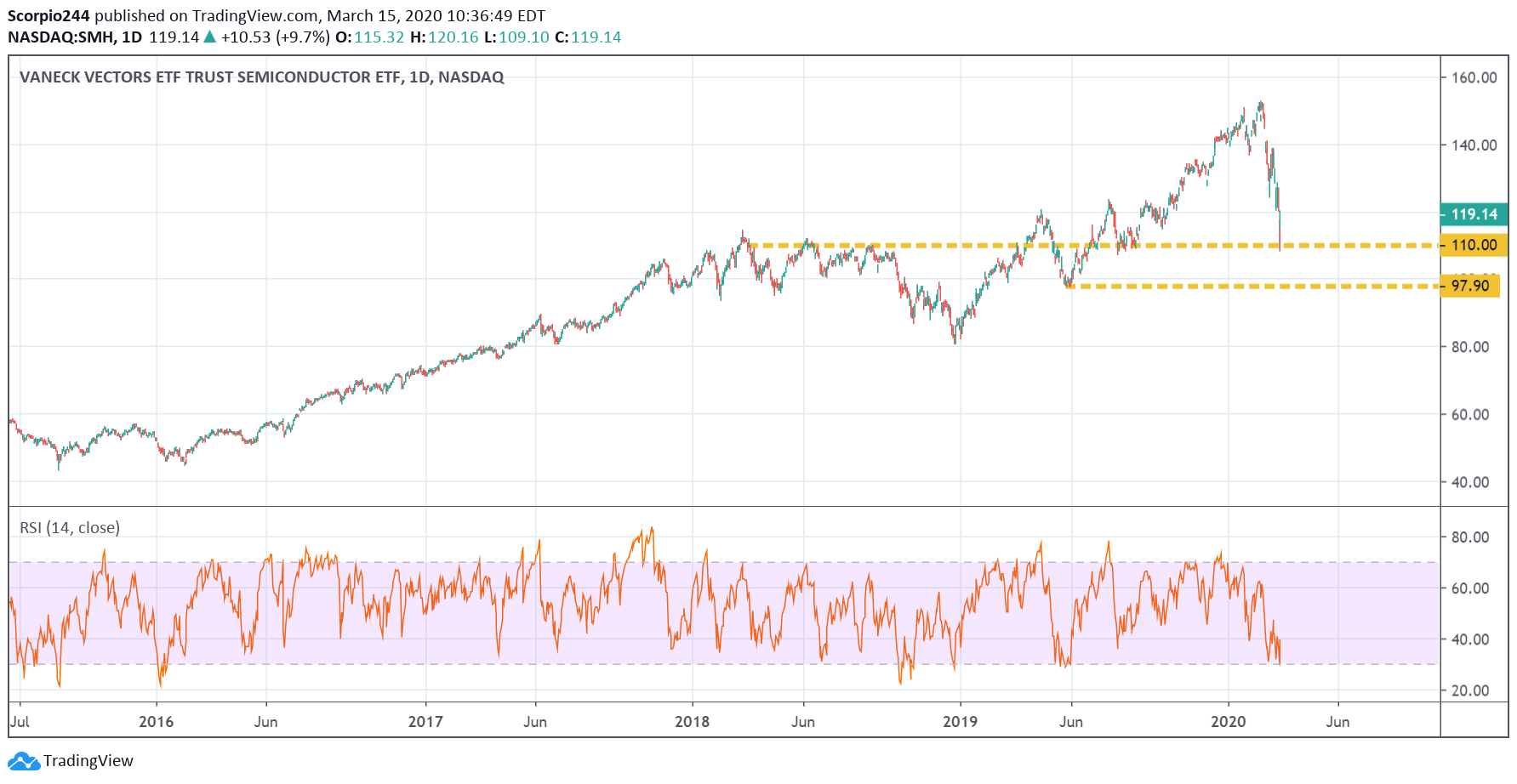

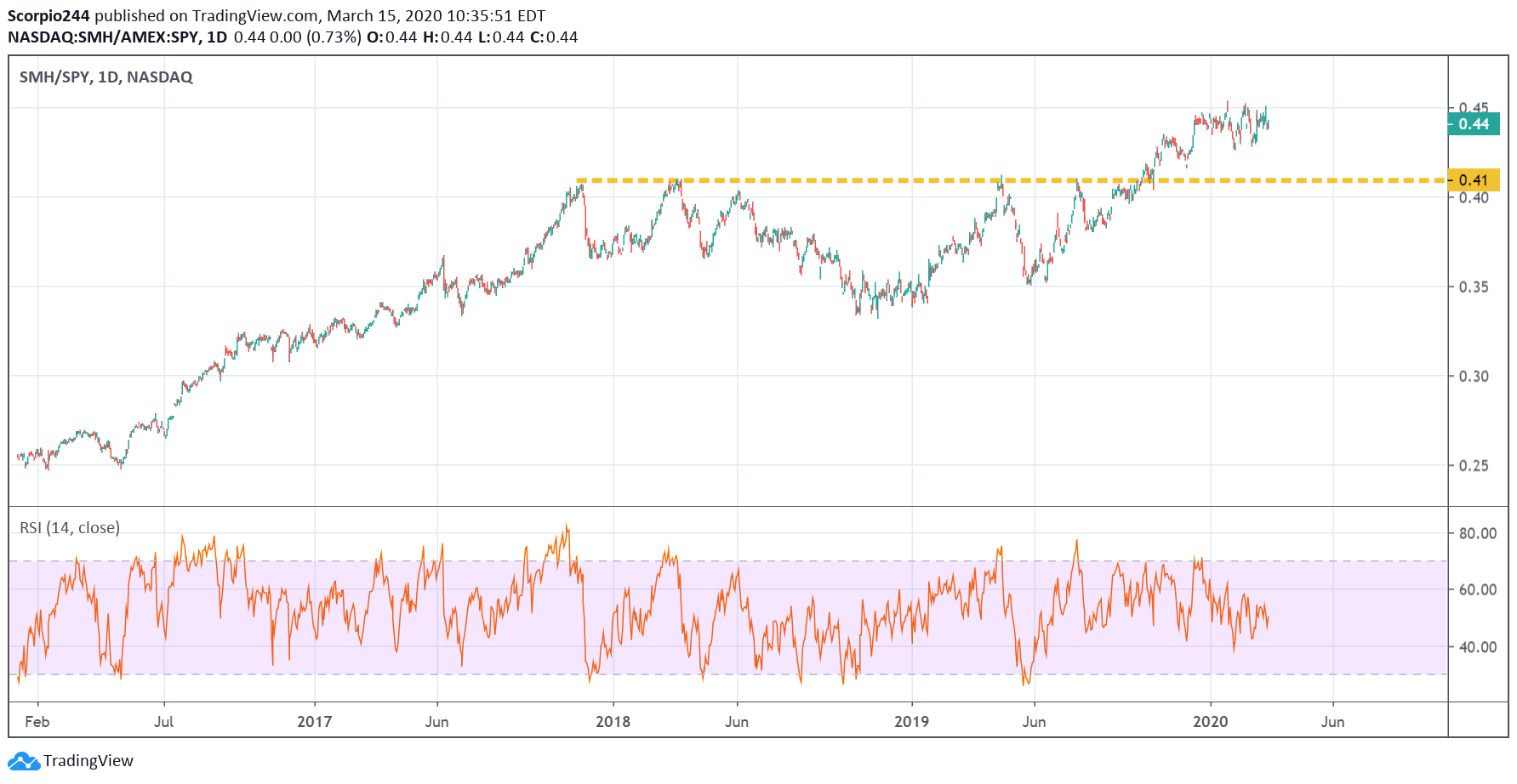

Semis (SMH)

The SMH/SPY ratio has remained relatively unchanged during this time, and that makes me think the Semiconductor ETF (NYSE:SMH) may still have further to fall.

Perhaps the SMH falls back to around $97.90.