S&P 500 (SPY)

Stocks will try to advance once again, in the New Year shortened trading week. The S&P 500 closed around 3,240 on Friday, and it leaves the next level of resistance around 3,255. The index finds itself in overbought territory with an RSI at 78.4, which is too high. The index is likely to continue to climb over the next several weeks, but it needs to fall by 1-2% and soon to get the RSI below 70 again. Let’s hope that we can get a pullback this week. Preferably, back to around 3,200, which would be support.

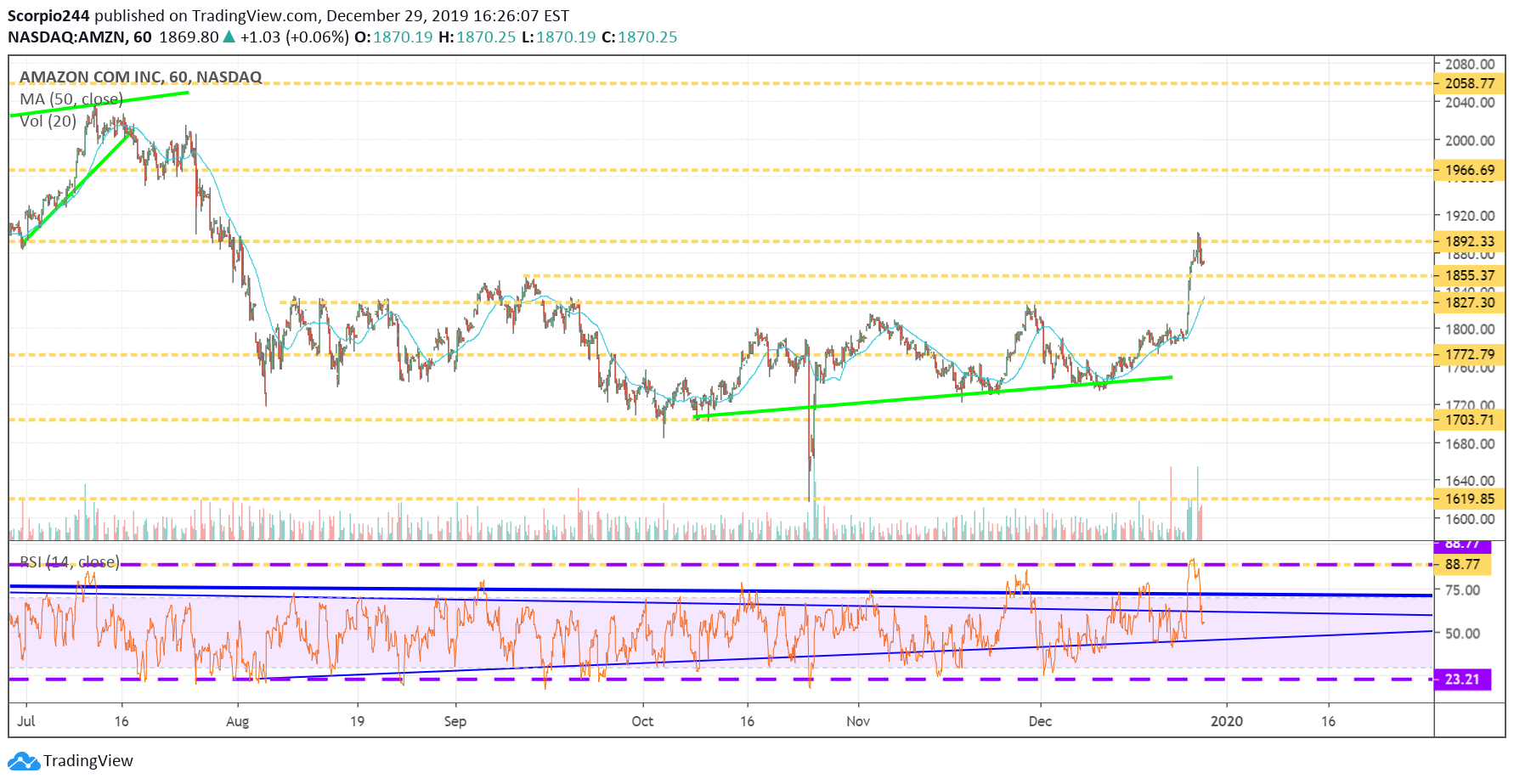

Amazon (AMZN)

Amazon (NASDAQ:AMZN) had a good week rising to resistance around $1,890. The stock failed at that resistance level and is likely to retest support this week around $1825.

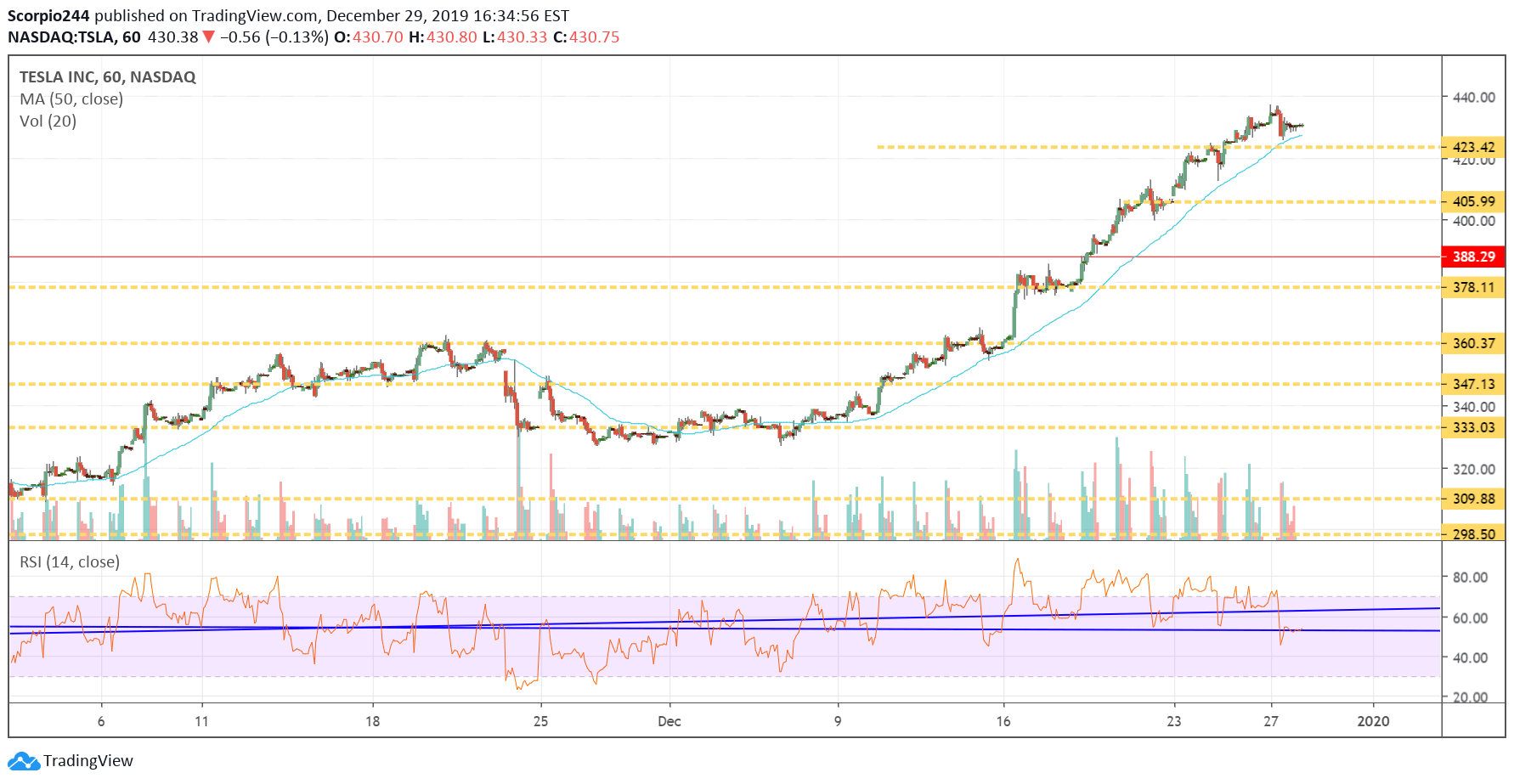

Tesla (TSLA)

Tesla (NASDAQ:TSLA) has had no leaked emails about production or delivery rates, which is surprising. I can’t remember the last time a quarter was complete without a leak. If the stock pulls back, this is likely to be the week. But with no leaked emails, the only question is what investors’ expectations are for deliveries. Should the stock fall, $420 is the first support level, followed by $406 and then $390. We find out what those delivery numbers are no later than January 3.

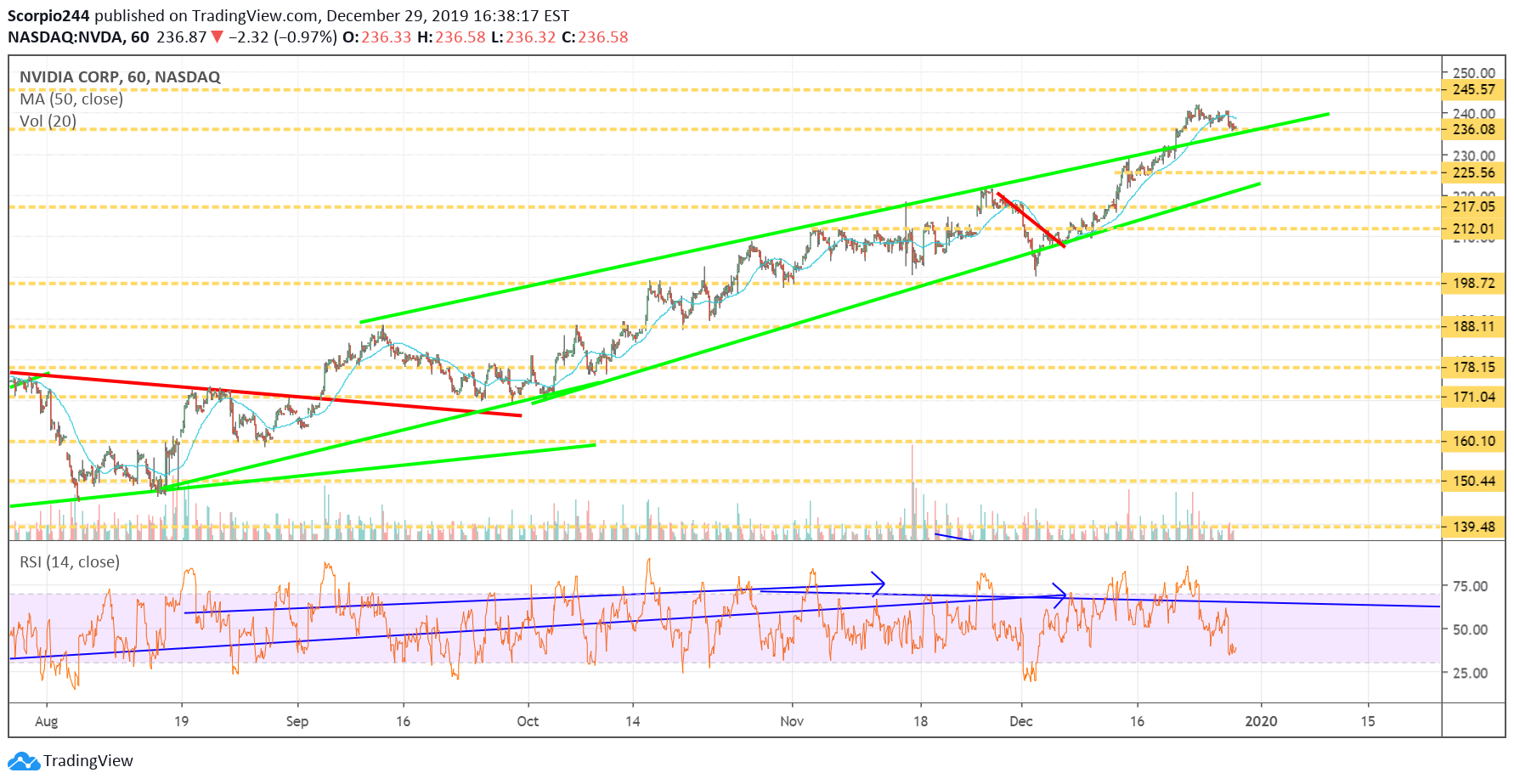

NVIDIA (NASDAQ:NVDA)

NVIDIA Corporation (NASDAQ:NVDA) is flirting with support at $236, a drop below support sends the stock back to $225.

AMD (AMD)

AMD looks like it may be double topping, and drop below $45.50 gets the stock heading back to 42.95.

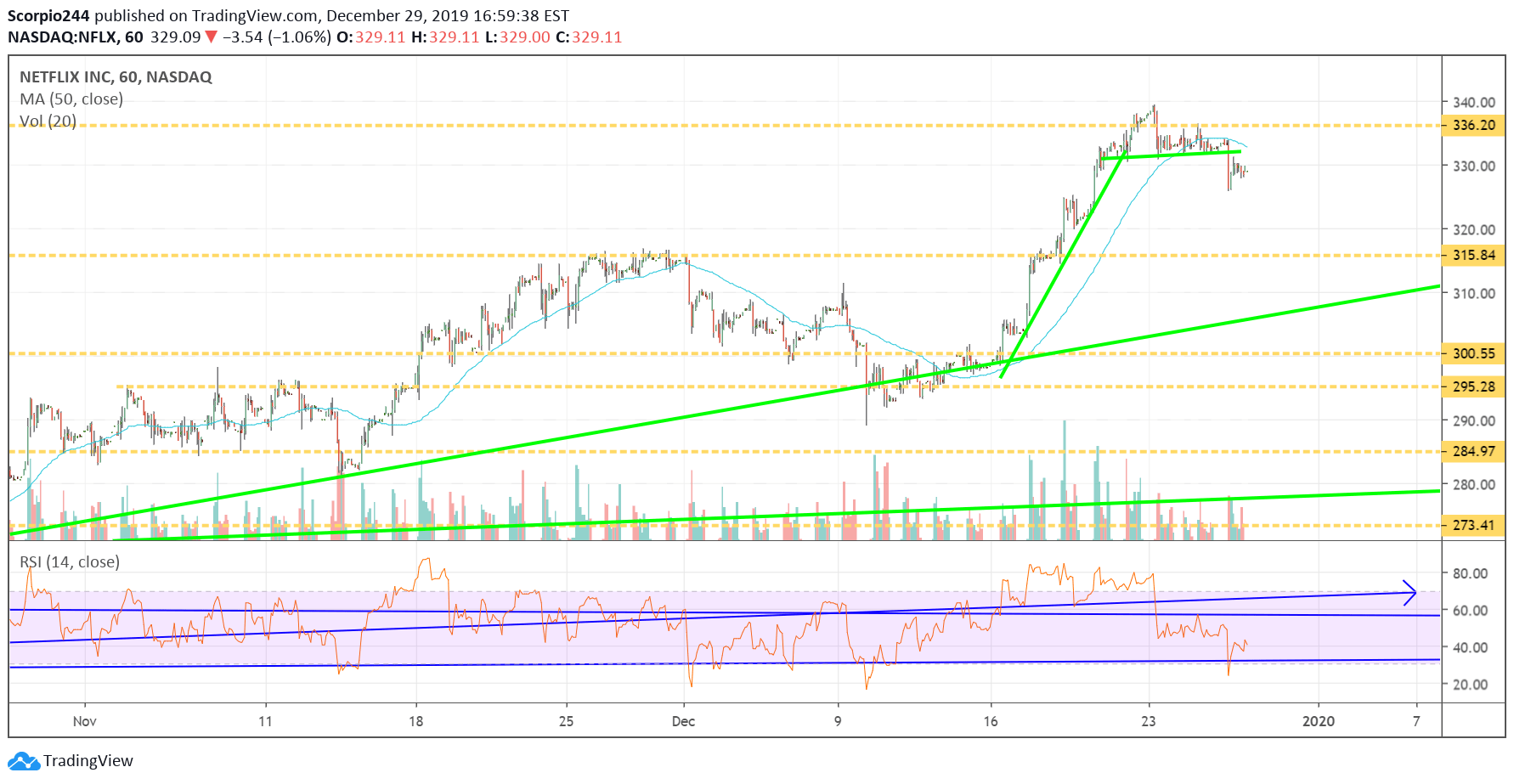

Netflix (NFLX)

Netflix (NASDAQ:NFLX) is falling, and support doesn’t come until $315.

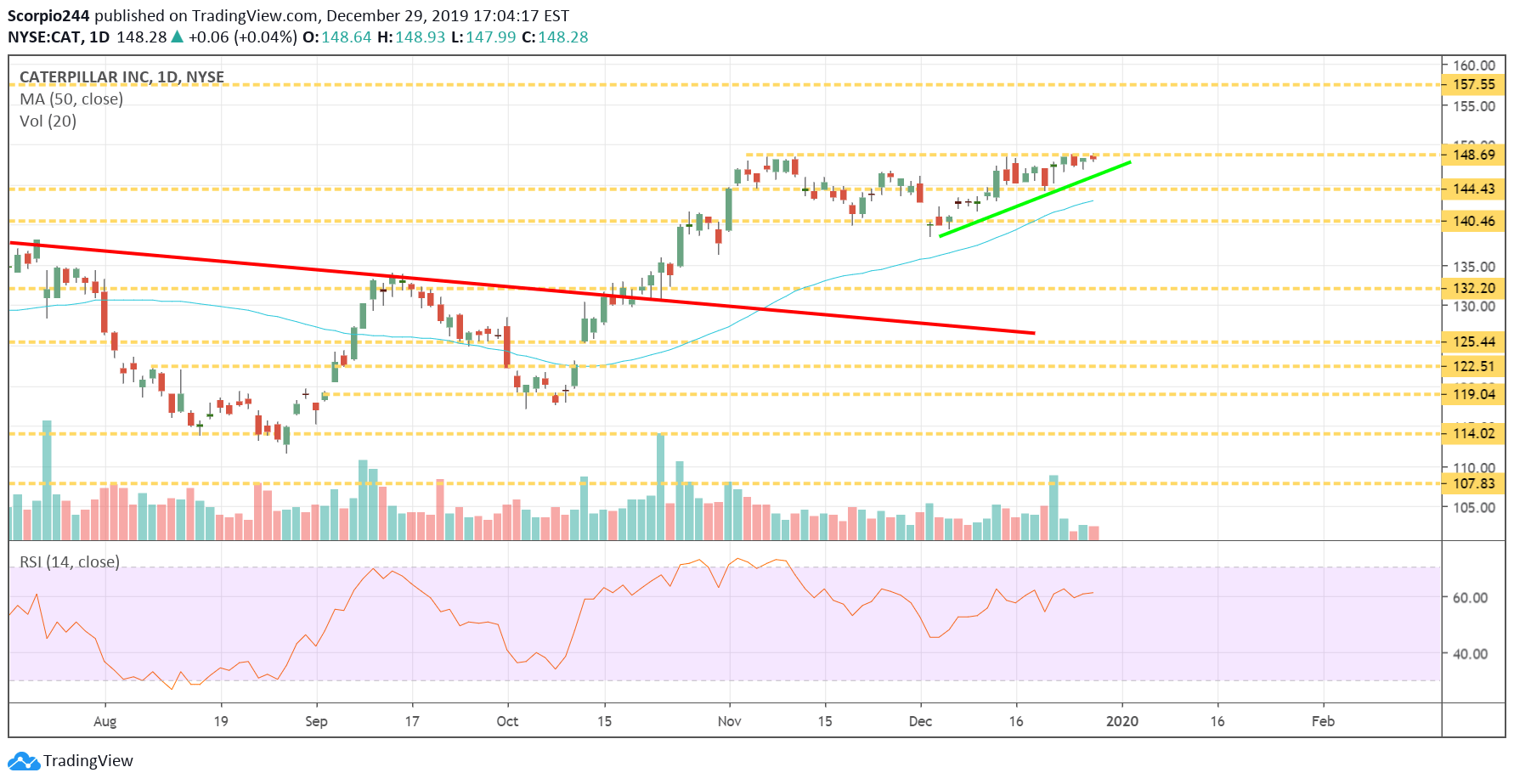

Caterpillar (CAT)

Caterpillar (NYSE:CAT) looks like it may be forming an ascending triangle, and it may be ready to rise to around $157.50.

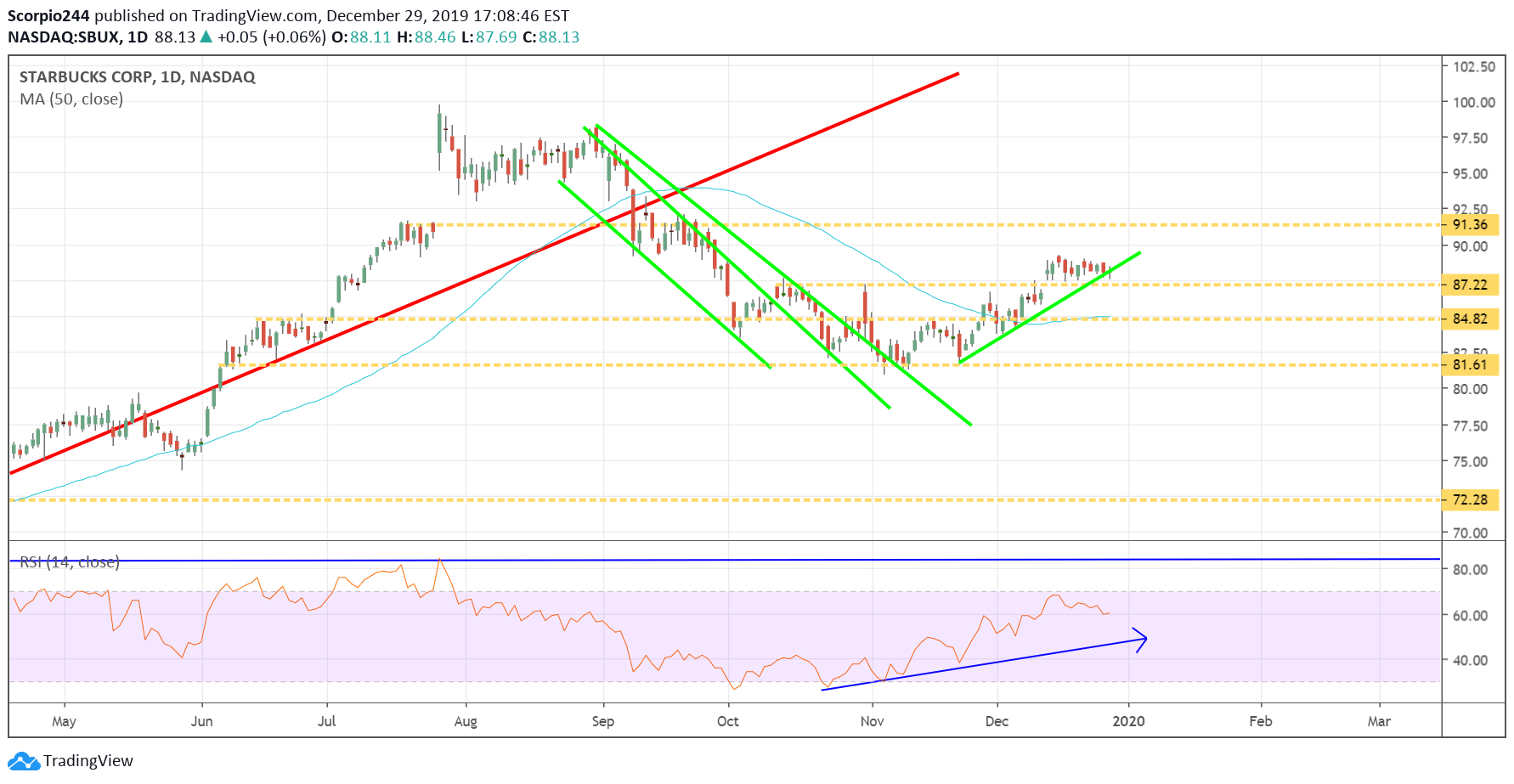

Starbucks (SBUX)

All signs are pointing to Starbucks (NASDAQ:SBUX) rising to around $91.50