MACRO

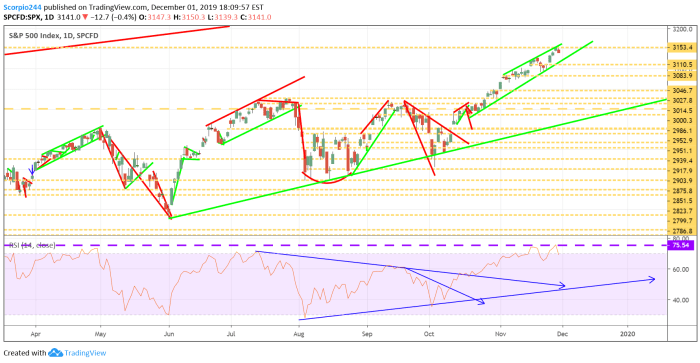

S&P 500

It will be a busy week for economic data with the ISM reports and plenty of job data. These reports are likely to decide which way the markets will go. But then again, the market knows weak data will force the Fed’s hand to take action. So it could be the return of bad news is good news, and good news is good news and a win-win situation for stocks.

However, we can see the S&P 500 has been rising in a channel and at least based on the chart, every time we have gotten to the upper end of the channel, the market has traded sideways or lower until reaching the lower end of the channel. That is likely to happen here too.

It will also give the RSI a chance to come down from overbought levels, at 70.

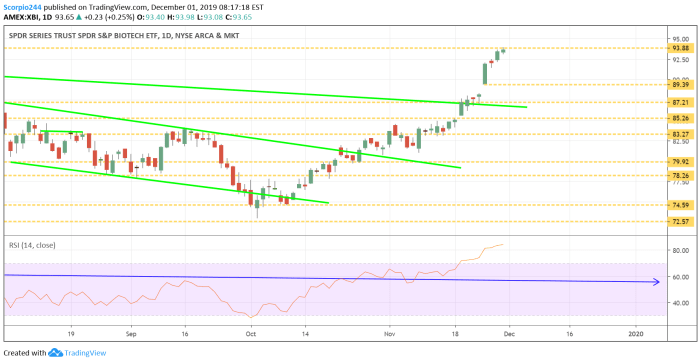

Biotech (XBI)

The Biotech ETF (NYSE:XBI) is completely overbought now and is butting up against resistance at $94. I think the ETF pulls back some and refills the gap at $89.

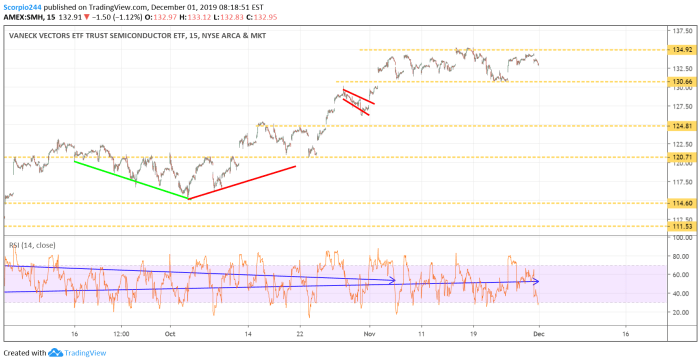

Semis (SMH)

The Semiconductor ETF (NYSE:SMH) appears to be struggling at resistance at $135, and I think it is likely heading back to $130.50.

STOCKS

Facebook (FB)

Facebook (NASDAQ:FB) is butting up against resistance around $203, and I think the stock fails to break out and moves lower to $191.

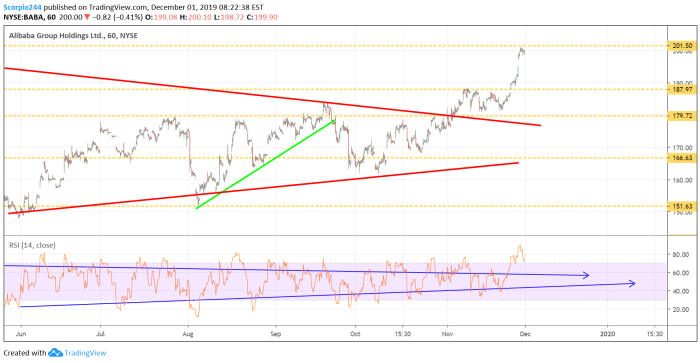

Alibaba (BABA)

Alibaba (NYSE:BABA) is hitting up against resistance, too, and I think it heads lower back to $188.

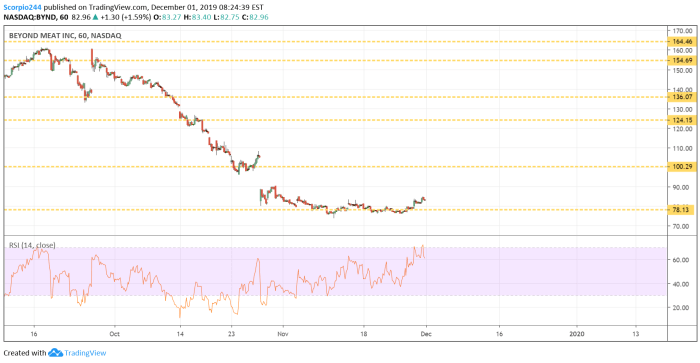

Beyond Meat (BYND)

Beyond Meat (NASDAQ:BYND) looks like it starting to turn higher in an attempt to fill the gap up to $100.

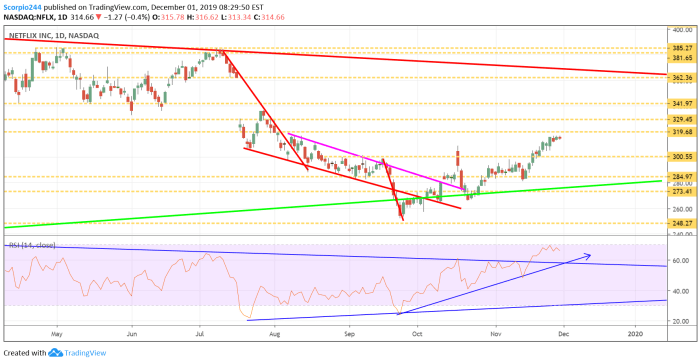

Netflix (NFLX)

Netflix (NASDAQ:NFLX) as broken free of its downtrend on the RSI, and I think the stock is heading higher to $330.

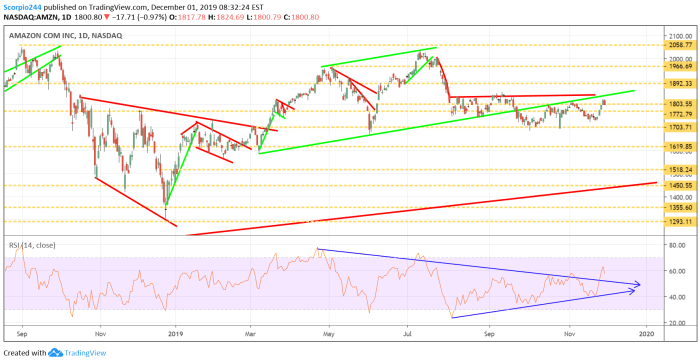

Amazon (AMZN)

Amazon (NASDAQ:AMZN) also broke free of its downtrend on the RSI, and I think the stock is heading back to $1900.