Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +0.86%, Hang Seng +2.27%, Nikkei +1.20%

- In Europe 13 out of 13 markets are trading higher: CAC +0.32%, DAX +0.01%, FTSE +0.54%

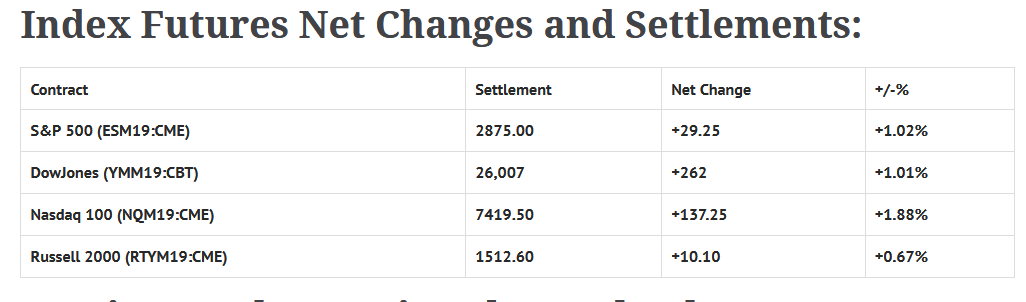

- Fair Value: S&P +0.54, NASDAQ +3.06, Dow +9.54

- Total Volume: +1.67 million ESM & 417 SPM traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes JOLTS at 10:00 AM ET, and TD Ameritrade IMX at 12:30 PM ET.

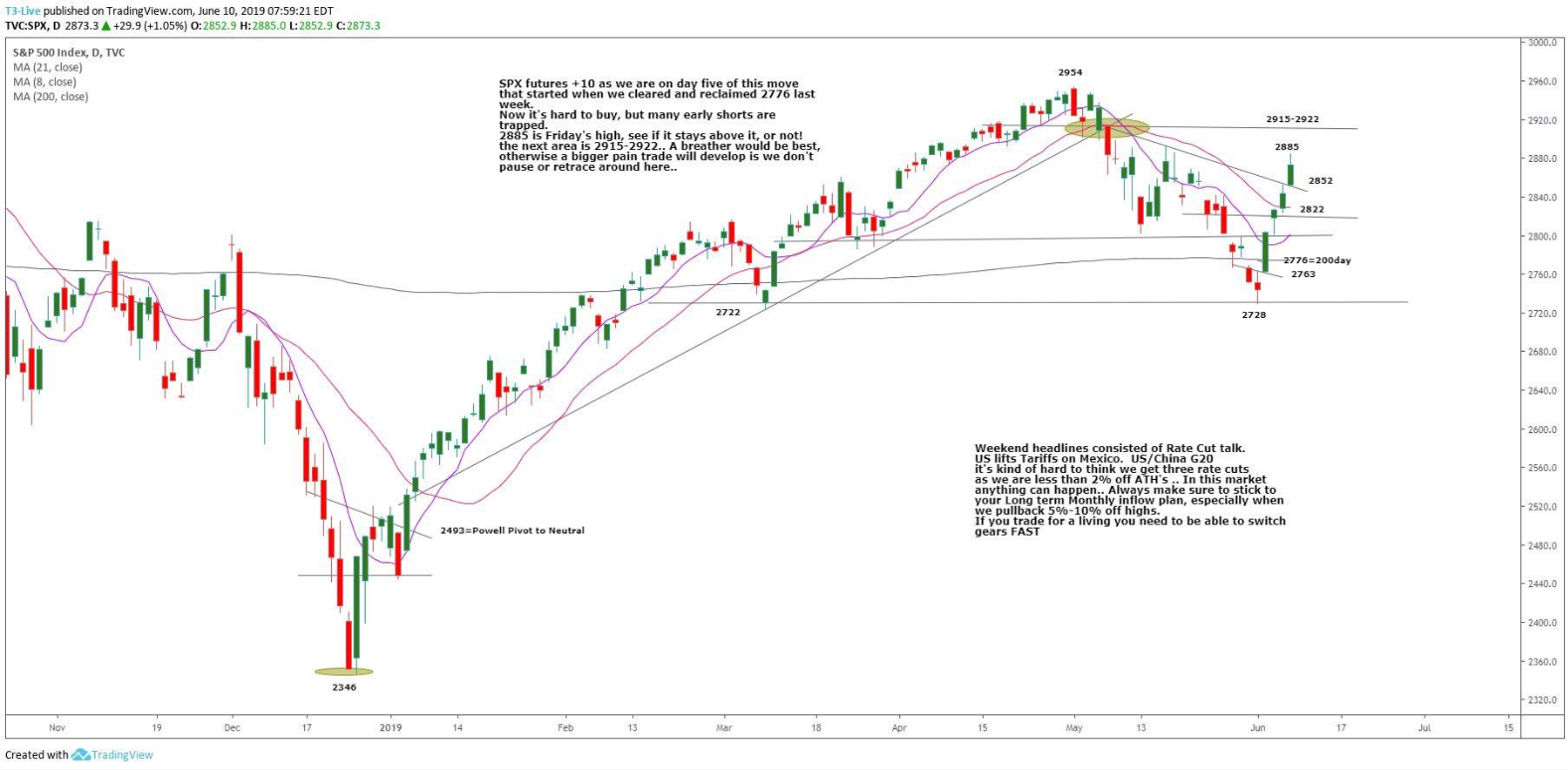

S&P 500 Futures: #ES Up 157 Handles In 5 Sessions

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +10 as the rally extends five sessions. If you didn’t buy anything last week, you probably shouldn’t be chasing Today.

After a weaker than expected jobs number, the S&P 500 futures (ESM19:CME) opened Friday’s regular trading hours at 2856.75, and proceeded to rip higher. The first stop was 2872.25, then after a little back and fill, made its way up to 2880.00.

The day started off as a textbook trend day, with relentless buying, and small pullbacks. It wasn’t until a 10:00 sell program activated that the ES finally topped out and started to pull back. After that, the futures traded sideways in a 9 handle range for the rest of the day.

Going into the close, when the 2:45 cash imbalance reveal came out showing $621 million to buy, the ES was trading at 2876.75, and would then go on to print 2873.50 on the 3:00 cash close, and 2875.25 on the 3:15 futures close, up +29.50 handle for the day.