Investing.com’s stocks of the week

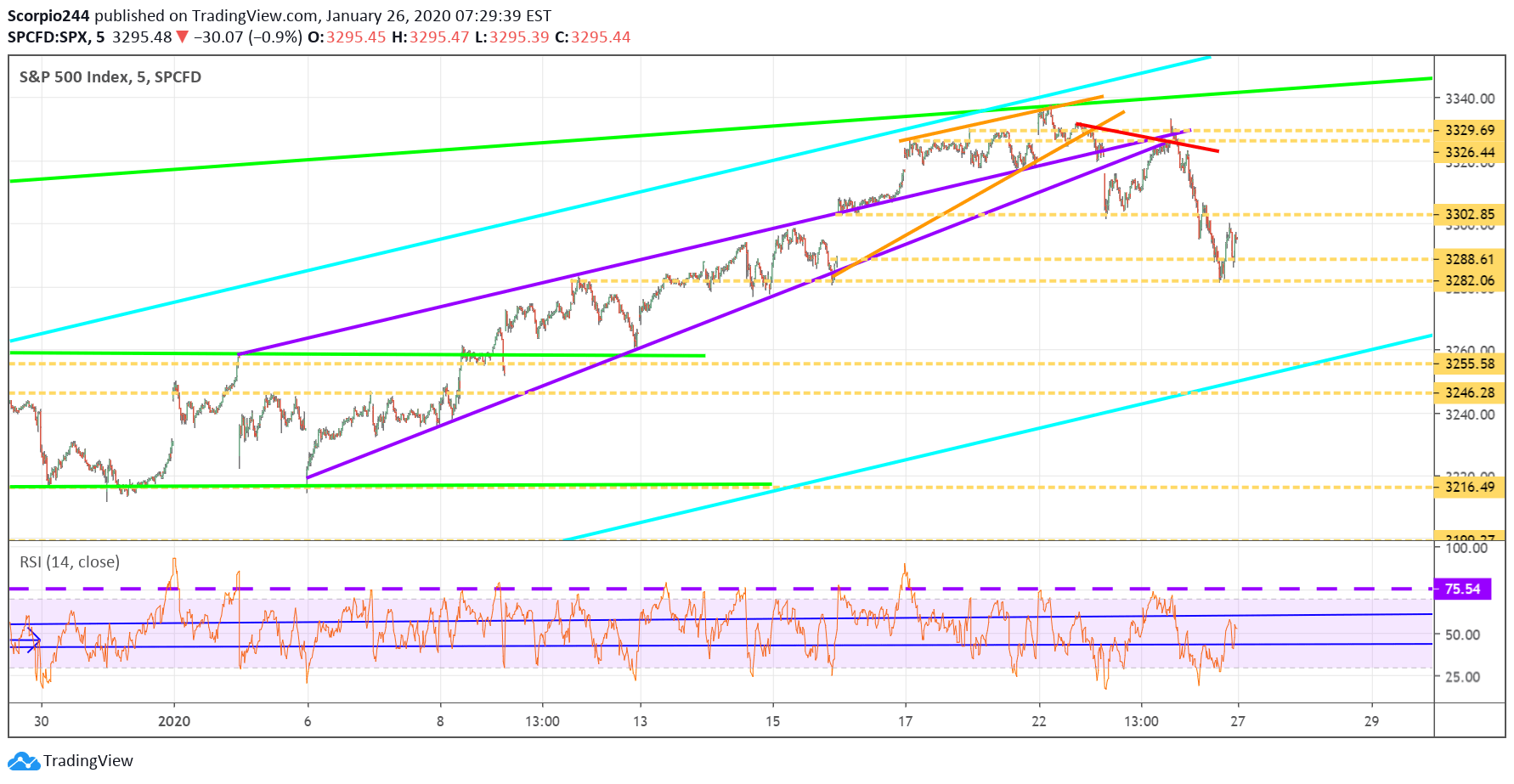

S&P 500 (SPY)

This week will be packed with economic data and earnings. It will be, to some extent, a defining week for the market, with many of the biggest companies reporting results.

The good news for the S&P 500 is that the index found some support around 3,282, but it may find it hard to get back above 3,300. If the index fails to rise above 3,300 on Monday, it seems likely we are heading lower to 3,255, and then 3,240.

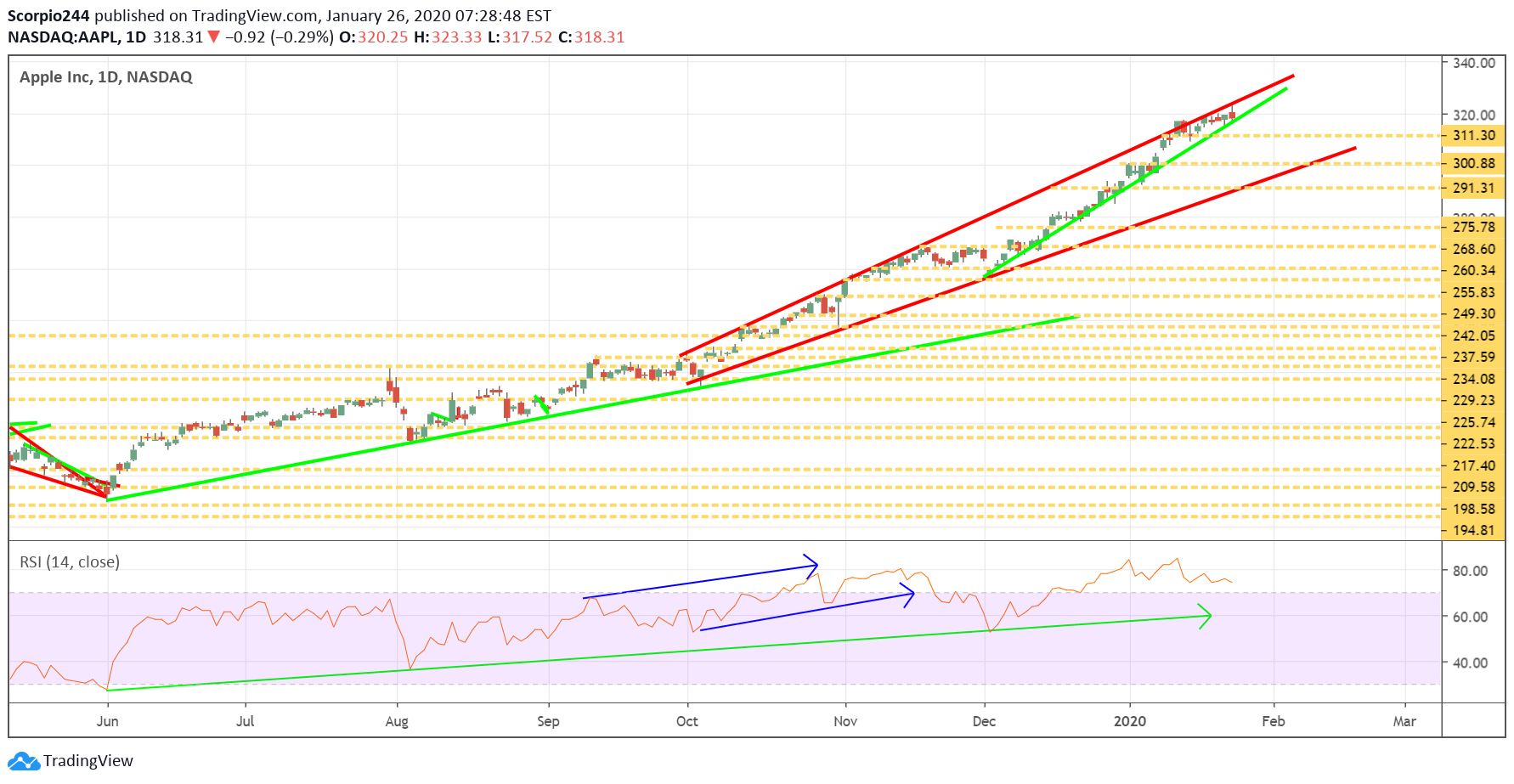

Apple (AAPL)

Apple (NASDAQ:AAPL) will report results on Tuesday, and this company will have a ton of pressure on it to deliver a beat and raise quarter. I own the stock, but I think it might be hard to live up to that pressure. The shares are overbought based on the RSI. Additionally, the RSI is starting to diverge from the rising stock price. There is also a rising wedge pattern forming in the chart, and it suggests to me the stock falls after results, with support first at $310, then $300, and $290.

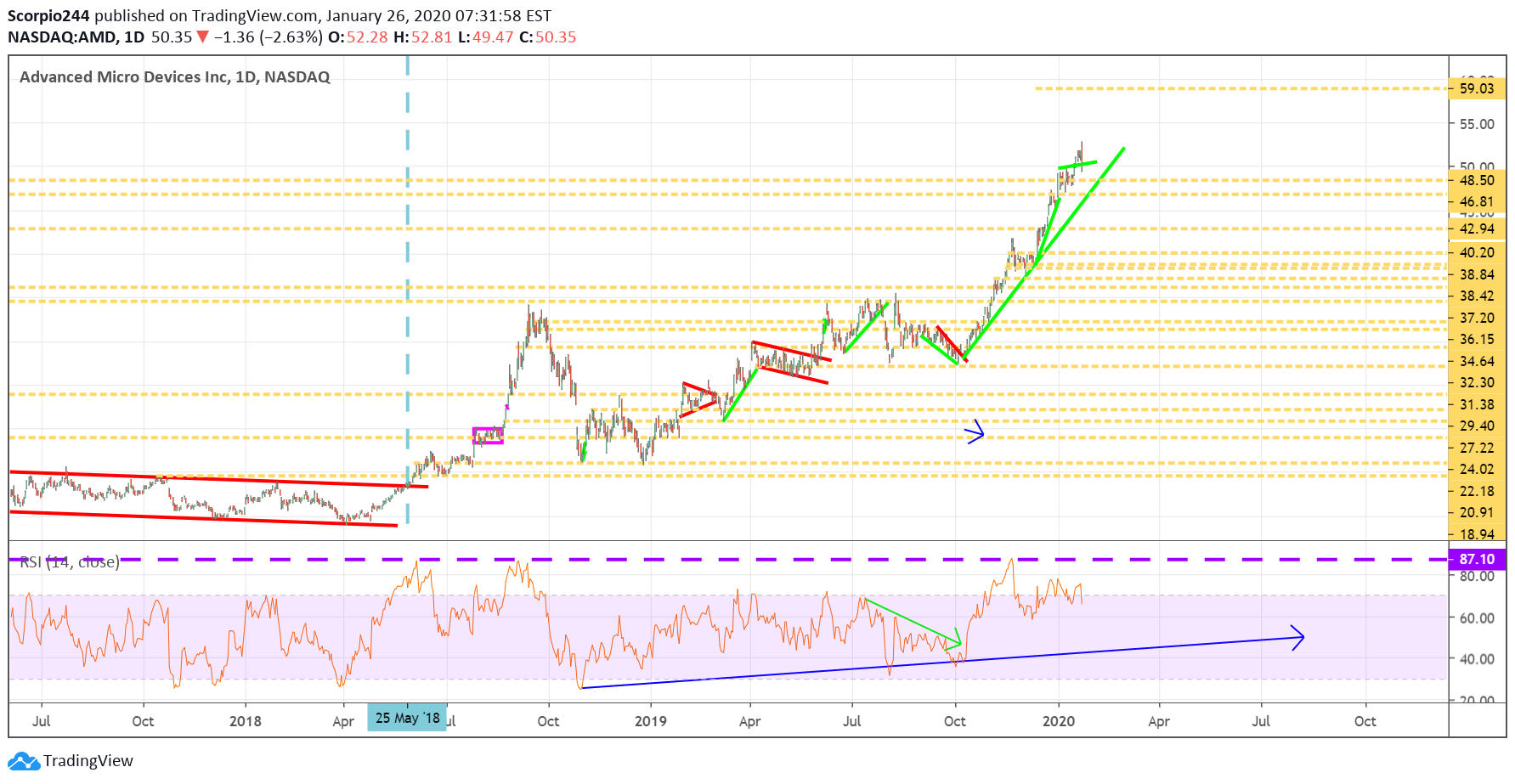

AMD (AMD)

Advanced Micro Devices (NASDAQ:AMD) will report results on Tuesday, too; I still think this stock will rise to around $59-$60.

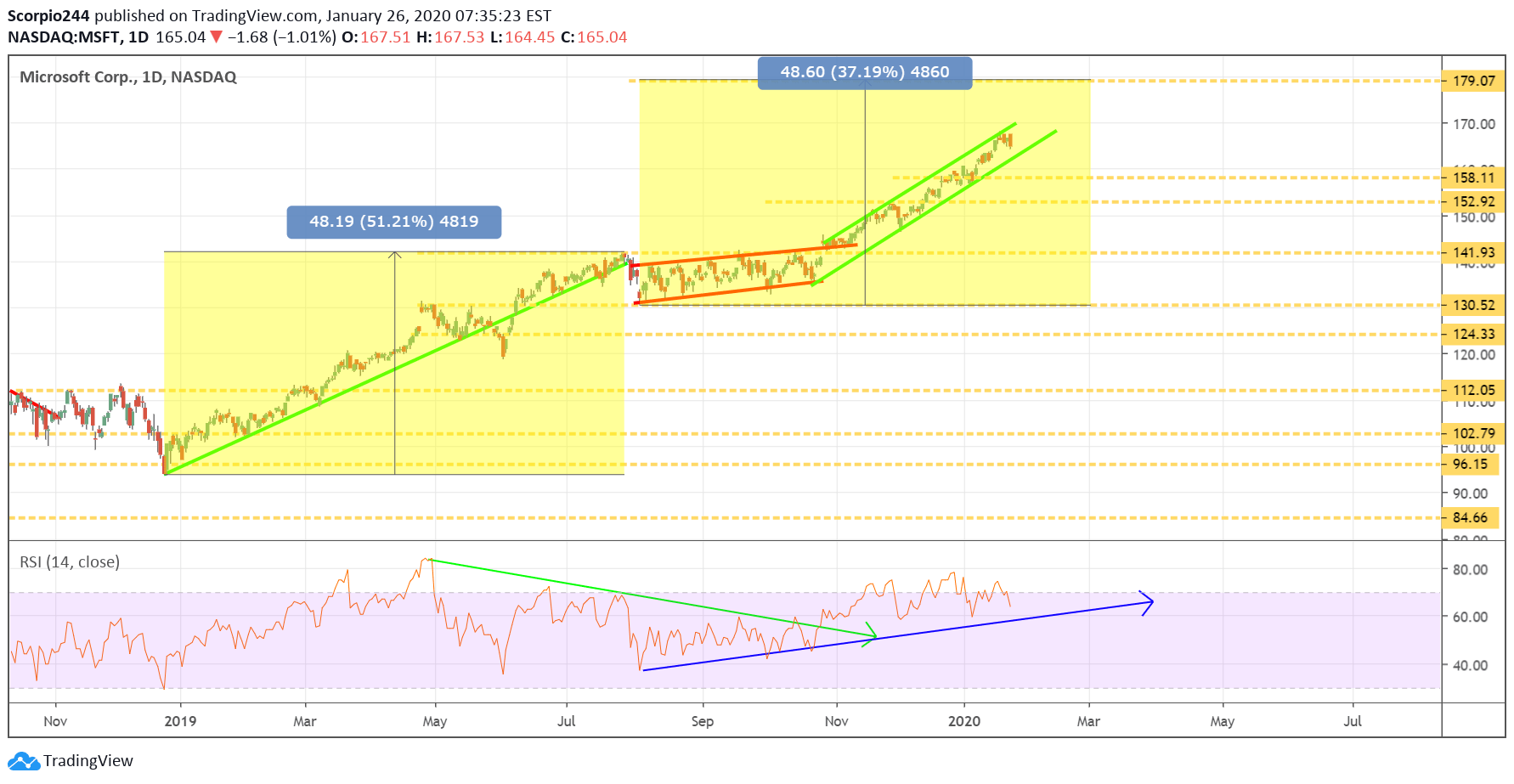

Microsoft (MSFT)

Microsoft (NASDAQ:MSFT) will report results on Wednesday, and I saw some bullish option betting in this stock a couple of weeks ago, which suggests the stock keeps rising after results. The chart shows the shares are on pace to increase to around $179.

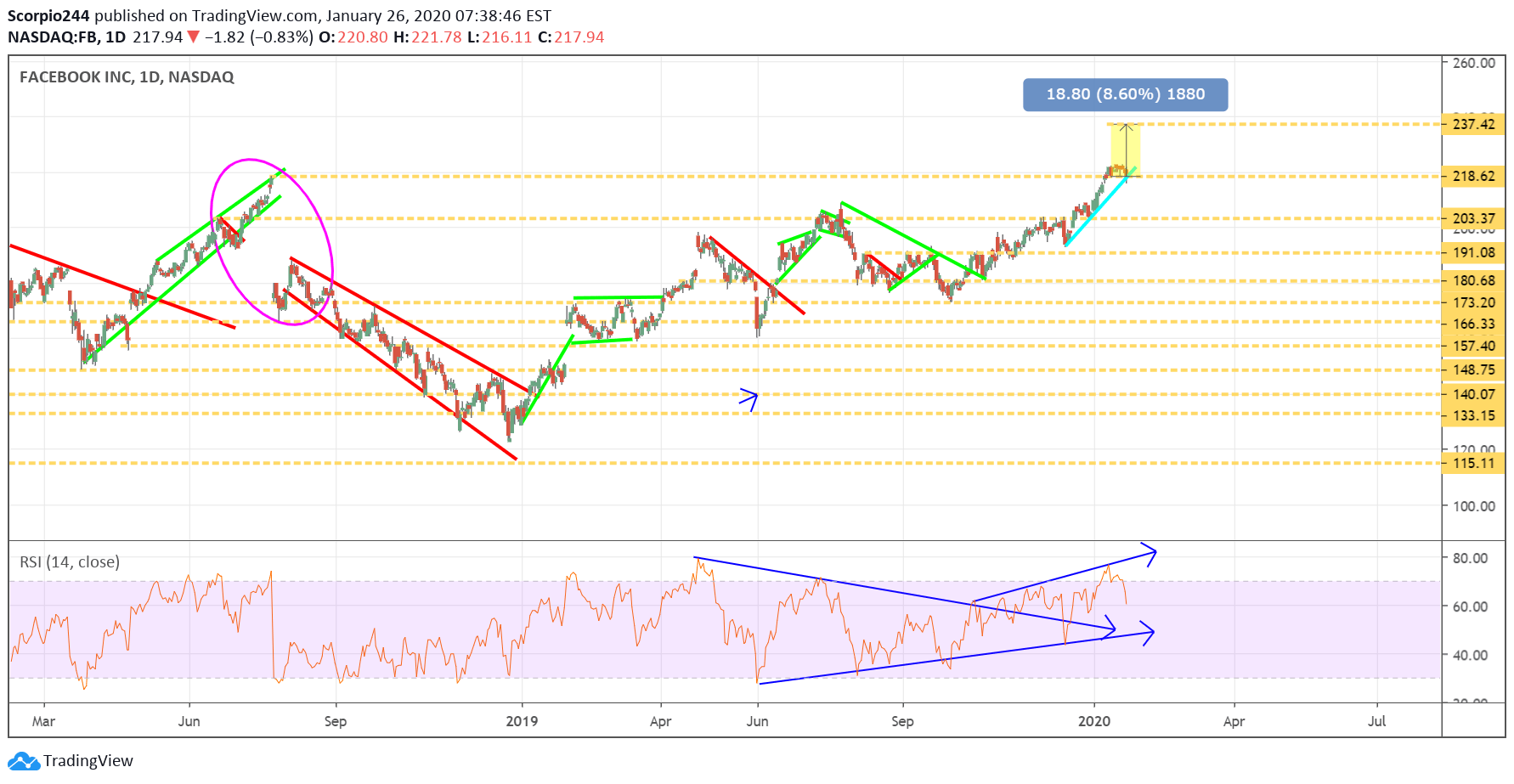

Facebook (FB)

Facebook (NASDAQ:FB) will also report on Wednesday, and again I have recently seen some bullish option betting in this one too, and based on the chart, I think we can see the stock head towards $237. Free story- Strong Quarterly Results May Push Facebook’s Stock Even Higher

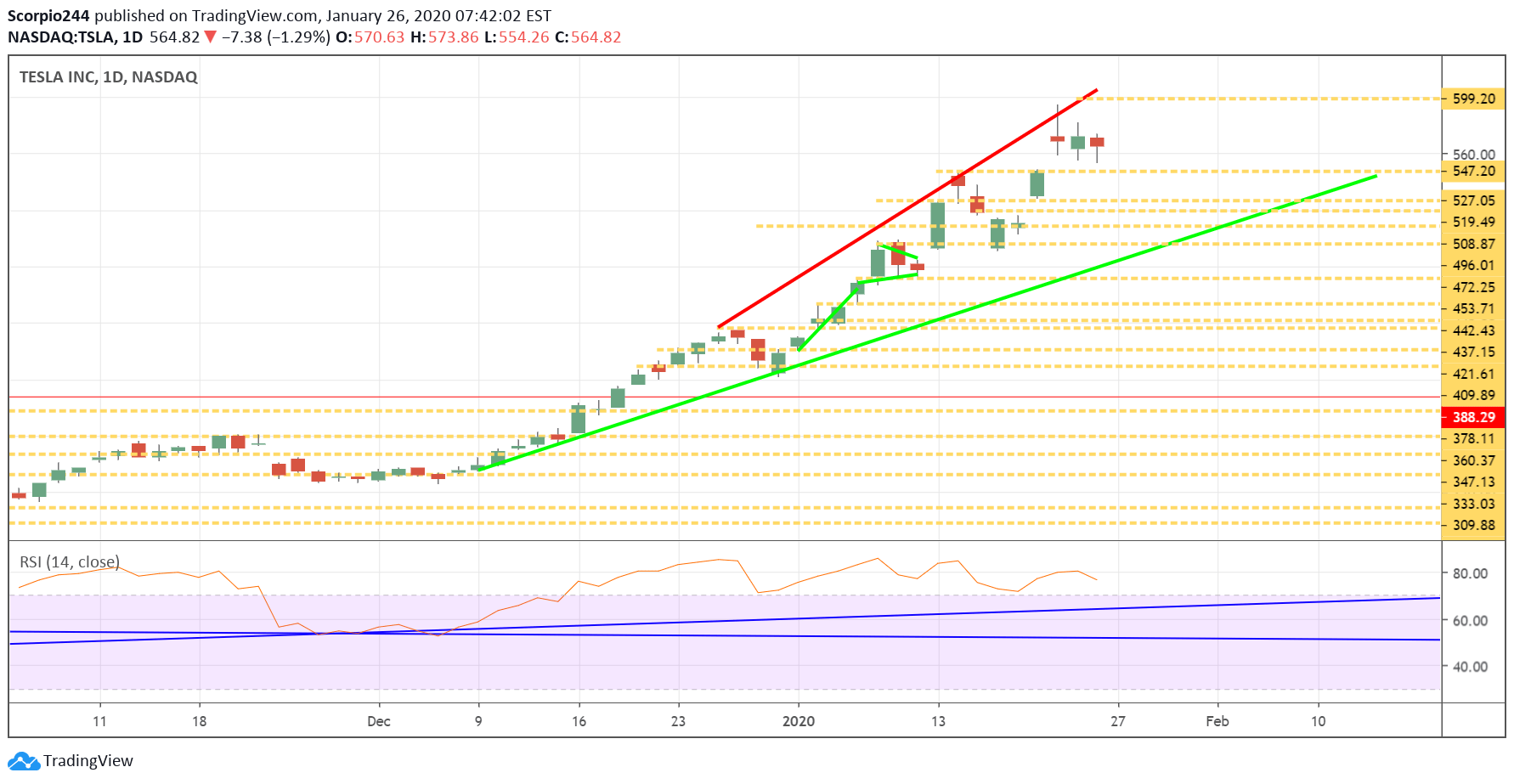

Tesla (TSLA)

There is probably no company that has higher expectations on it than Tesla (NASDAQ:TSLA), and honestly, anything can happen here. The risk here is higher towards a disappointment, because who knows what the right expectations are for this company given the massive move higher. I think the stock could fall back to the uptrend line, pulling the stock down to around $500.

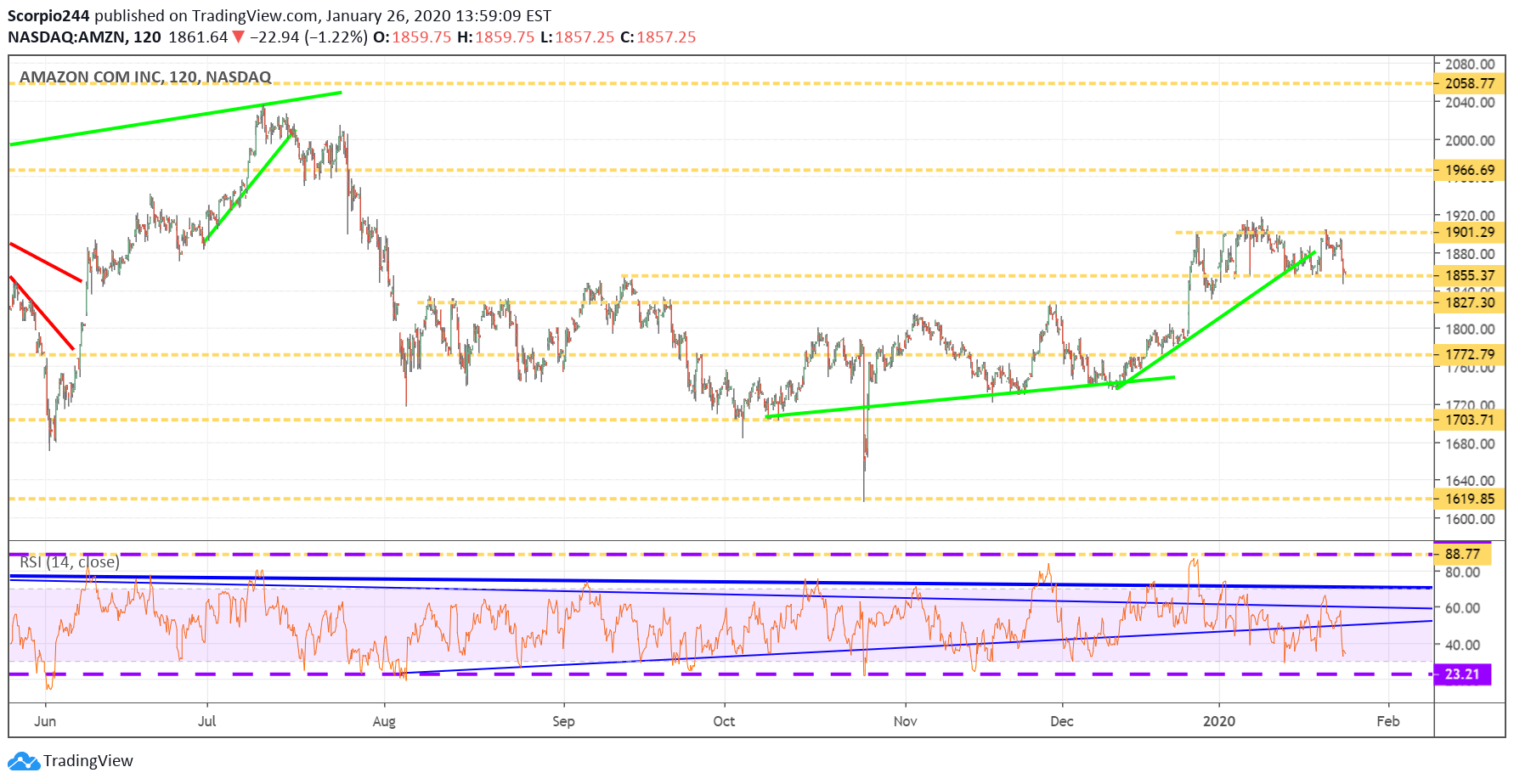

Amazon (AMZN)

Amazon (NASDAQ:AMZN) will report on Thursday, and I can’t remember the last time the stock has been this boring for this long. I think that is ending. It appears a cup and handle pattern is forming, and it would suggest the stock rises following results. The relative strength index is also pointing higher, and it indicates to me the stock moves up to $1970.