Investing.com’s stocks of the week

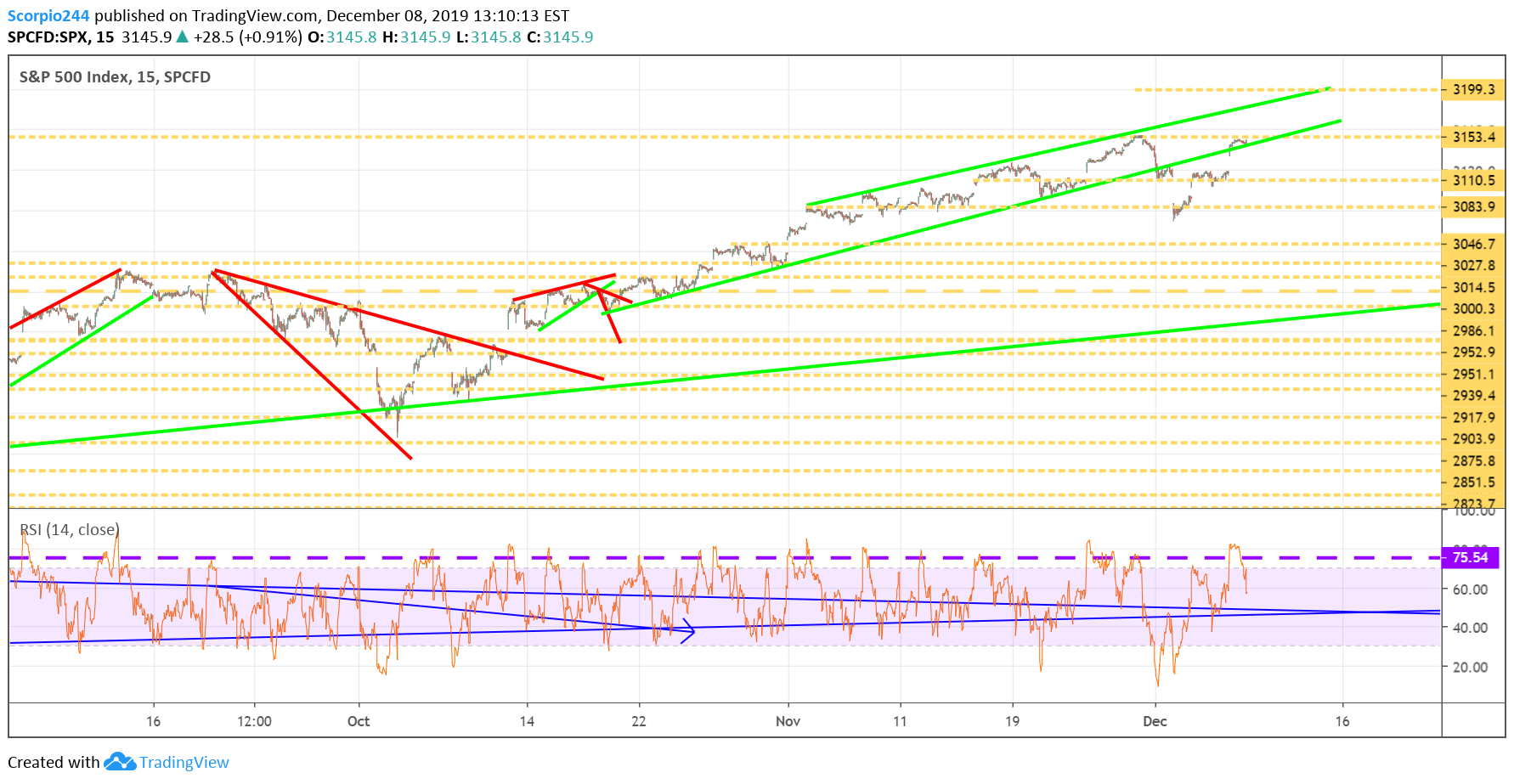

S&P 500 (SPY)

Stocks will try to pick up where they left off on Monday, following the strong jobs report. This week will feature CPI, PPI, the Fed, and the ECB. With that, the S&P 500 will try to advance to 3,200 its next level of significant resistance based on a projection of the current patterns.

Netflix (NFLX)

Netflix (NASDAQ:NFLX) is set up to rise into the final few weeks of the year after it emerged from a falling wedge pattern late last week.

Again the pattern suggests the stock rises to around $320.

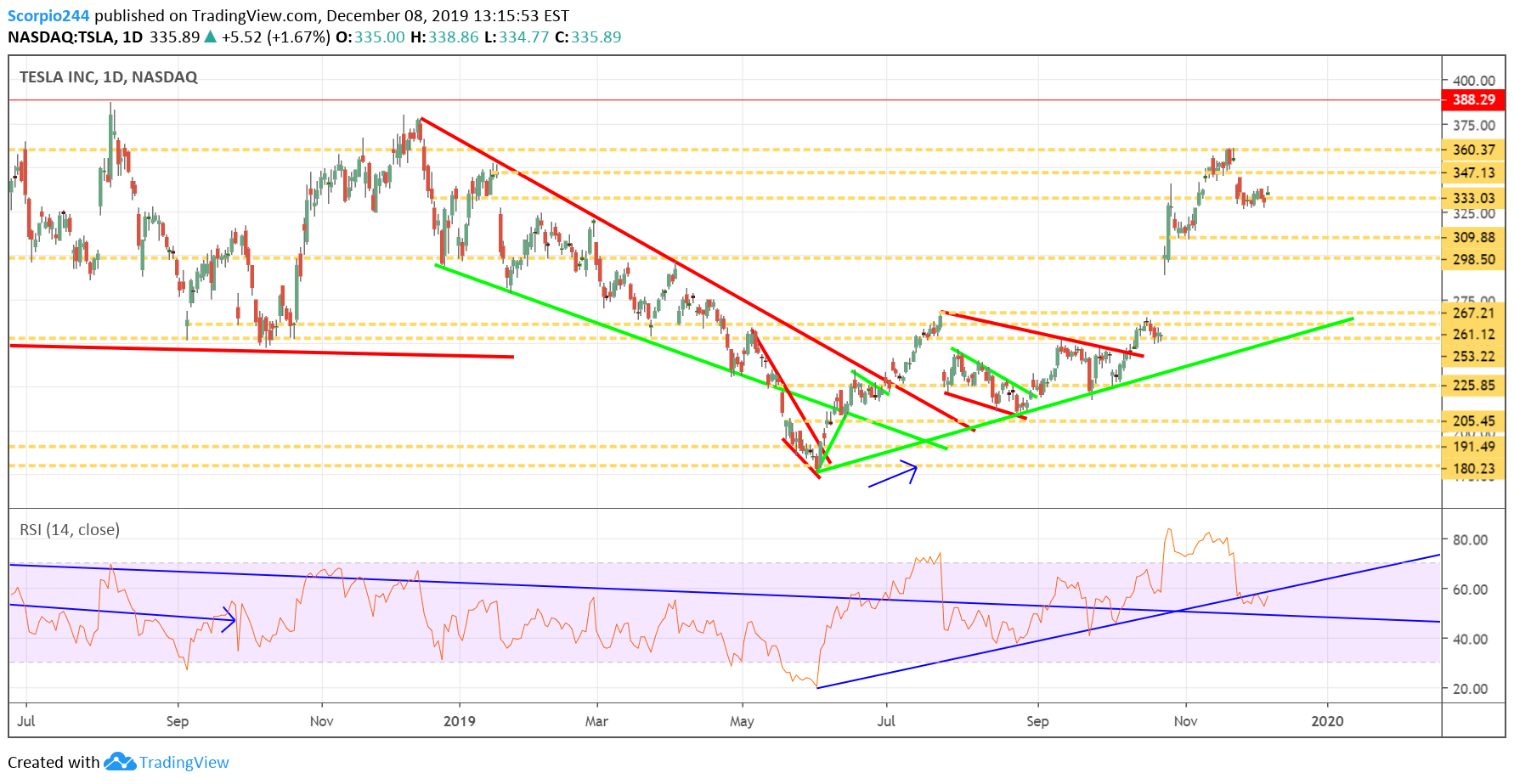

Tesla (TSLA)

It is a little bit early, but we should see some “leaked” emails about how production and deliveries are going for the fourth quarter. Meanwhile, there is still a gap that needs to be filled up at $360. That is likely where the Tesla (NASDAQ:TSLA) stock is heading over the final few weeks.

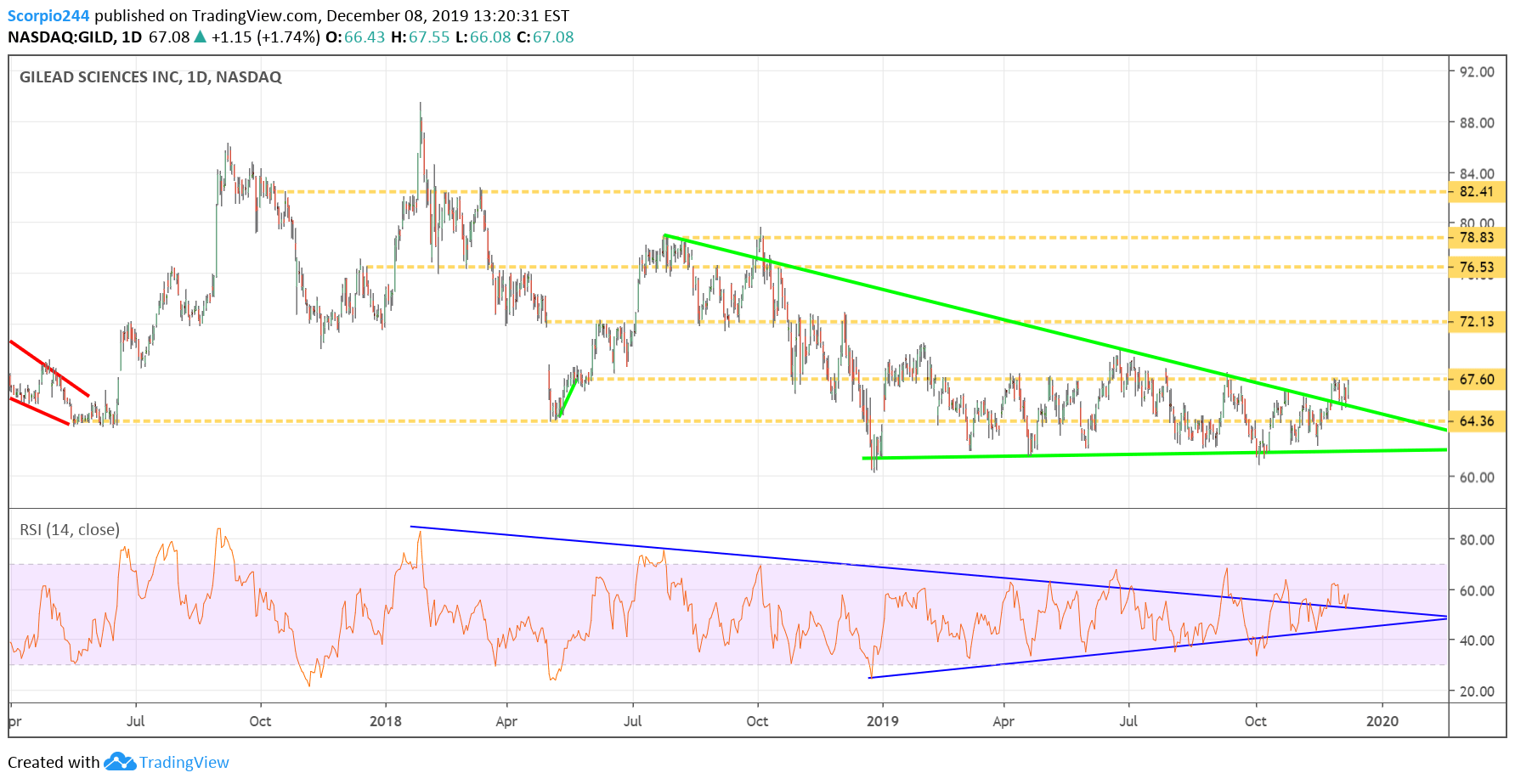

Gilead (GILD)

Gilead (NASDAQ:GILD) has been testing resistance around the $67.50 level. A rise above that price gets the stock moving to $72. The RSI is trending higher, and it suggests the stock moves higher.

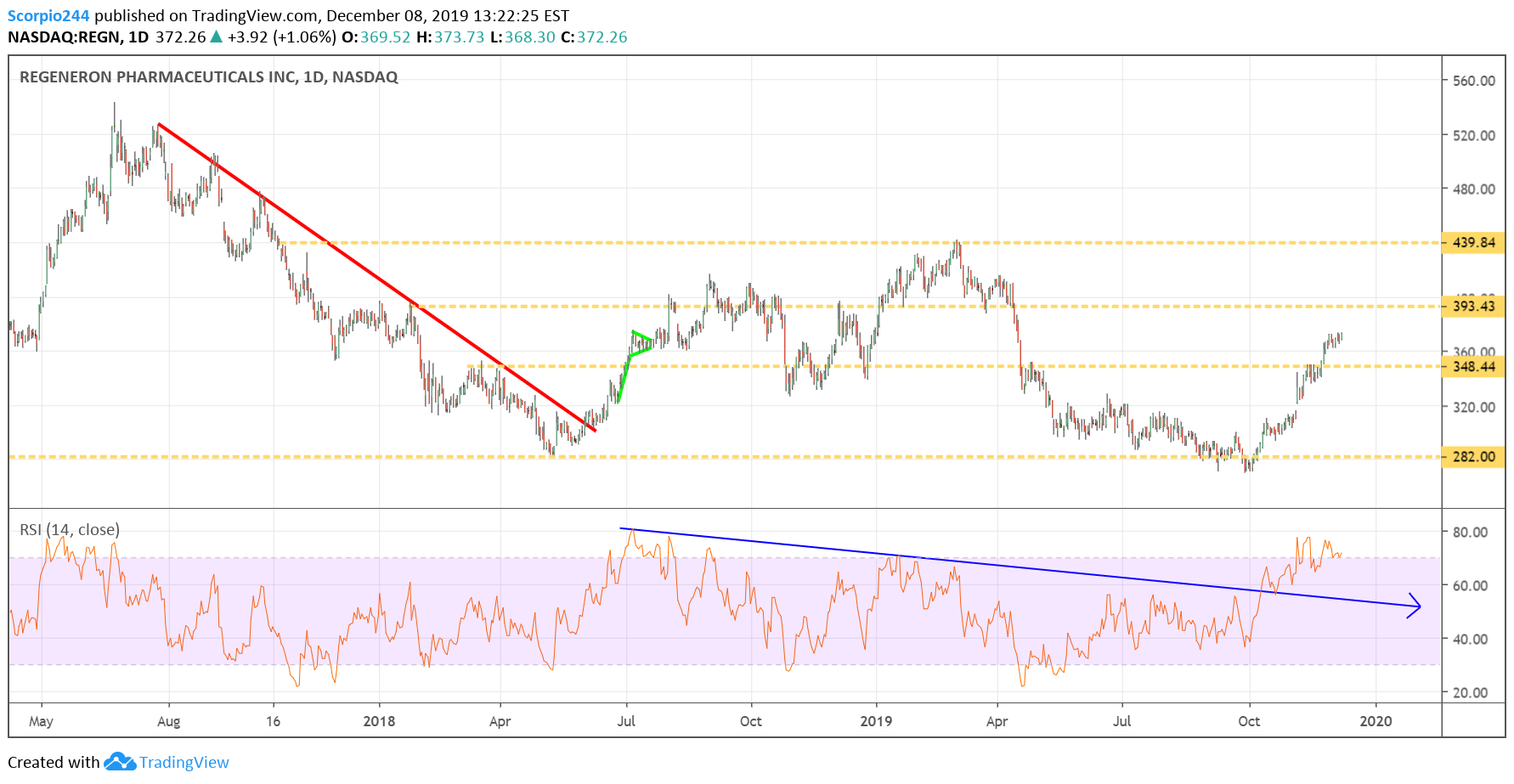

Regeneron (REGN)

Regeneron (NASDAQ:REGN) is another biotech stock that appears to be heading higher towards resistance at $392.

Illumina (ILMN)

Illumina (NASDAQ:ILMN) may also be heading higher, with that huge gap to fill up to resistance at $360.

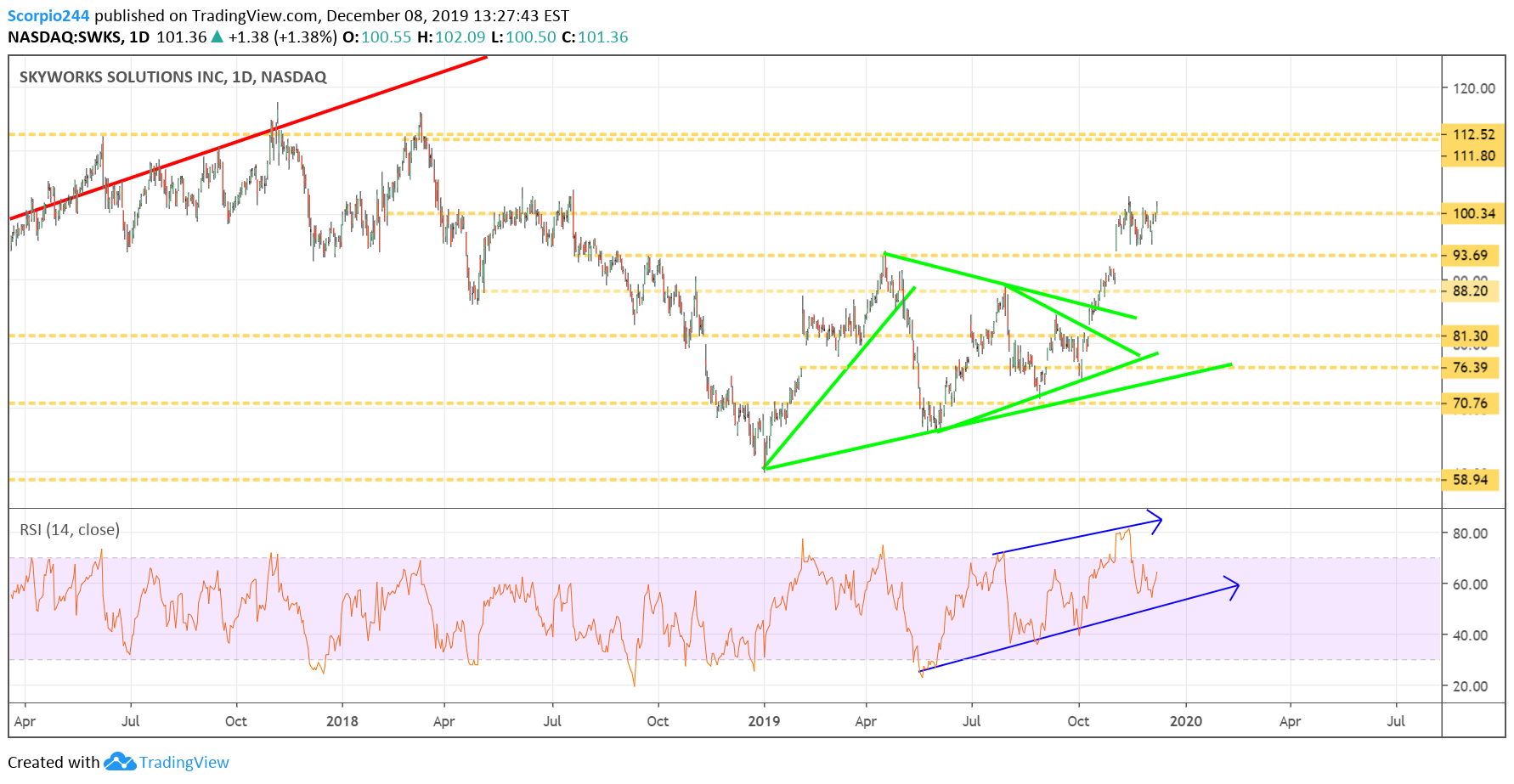

Skyworks (SWKS)

Skyworks (NASDAQ:SWKS) is breaking out rising above resistance at $100, and that could push shares higher towards $111.