At the time of writing this analysis, China is down another 7% and today's trading has been halted. Europe is currently down over 2%.

For the past six years, buying the dip has rewarded the investors every time. This time it’s different, because the Bears are back from hibernation and they are ready to pounce on each and every rise. If I informed you that this is the start of a new Bear market, many will laugh it off and give me 100 reasons why this is an excellent time to buy.

Therefore, I will prove my point with the 6 charts below. Here's why this is the start of a bigger fall and as investors, it’s important that we are aware of this, to both profit from it and to protect ourselves.

Dr. Copper suggests we will go down:

.

Market participants believe in the forecasting capability of Copper, hence, it’s also known as Dr. Copper (rumored to have a PhD in Economics). It has retraced 76% of its rise from the 2009 lows and is threatening to test the crisis lows.

Oil is below its 2009 lows

Oil is at the 2009 lows and is likely to go much below it. The crude oil bulls have been in a denial mode all along, with price threatening to go below and remain low for a few years, deflation is a real risk for the US and the world economy.

Junk Bonds (via SPDR Barclays (L:BARC) High Yield Bond (N:JNK)) are signaling the impending defaults in the debt market

Standard & Poor’s Ratings Service recently warned that 50% of the junk bonds in the oil sector are “distressed”, which is $180 billion of debt at default risk. If oil prices remain low for a considerable period of time, the number of defaults will rapidly increase.

The Bloomberg Commodity Index is 25% below 2009 Lows

If you thought that only oil and copper are down, take a look at the Bloomberg Commodity Index. In the past year alone, the index is down 26%. You can see how far below the index is trading and looks to be heading lower.

Oil is not the only one where the junk bonds are “distressed”, 72% of the metals, mining and the steel sector bonds are also at a risk of default, no wonder the commodity index is way below its 2009 lows.

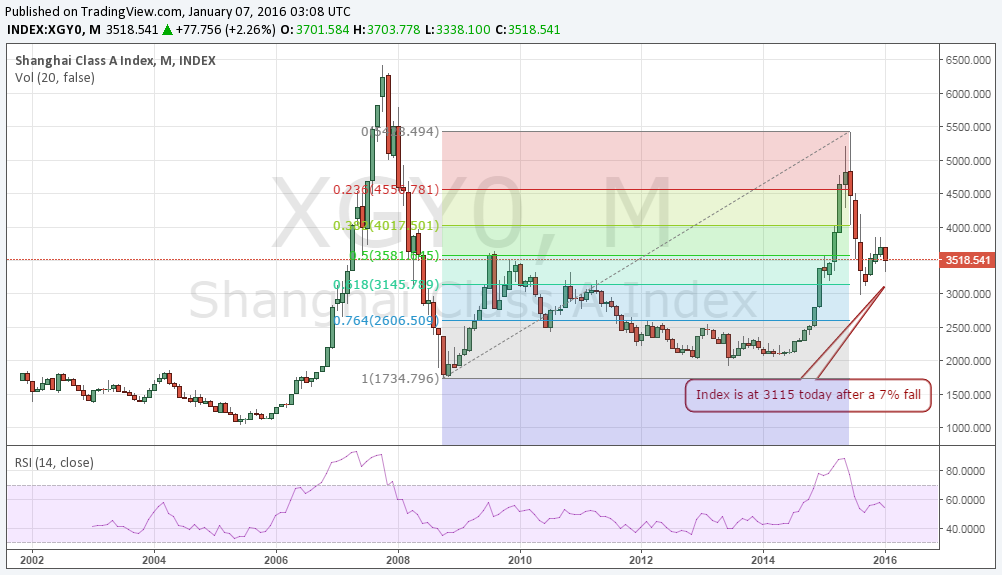

Where’s China, which propelled the world growth following the “Great Recession”?

China, the growth leader, the second largest economy in the world, has also fallen more than 60% from its recent highs. It’s looking to fall near to its 2009 lows. There’s no China to support world growth this time. So after all this, the last question comes to mind is, Where’s the S&P 500 headed?

Where’s the SPX headed?

We have seen five charts which are struggling and have fallen more than 50%, an important point to note in them is that they are closer to their 2009 crisis lows. Now let’s turn our attention to S&P 500. If we take a simple 50% fall of the rise from its lows, which is considered a normal correction during the course of any bull market, the target for SPX comes to 1395, which will still be closer to the 2000 and 2007 highs.

Buy on dips is dead

That is a 600 point fall from the current levels, a buy and hold strategy, or the buy on the dips strategy will wipe out your wealth during this decline. You need a different strategy to benefit from this imminent fall, the regular experts won’t be able to guide you, you need a person who is able to predict the fall and devise a strategy to benefit from it. You will need to find one for yourself if you want your wealth protected.

The US Fed can’t save us this time

Is this going to be a quick 50% fall and we go back up again? No, I expect this fall to be painfully long. All the money printing and the easy money policy of the Fed and other central banks has come to its resolve, it’s going to take time. Please NOT be under the impression that the Fed will again print more money and take us out of the financial collapse again. This is real and the Fed will find itself without any ammunition as it has already used up all possibilities. It’s balance sheet is already inflated to unmanageable levels.

Conclusion

There is no reason for panicking, it’s a normal correction in the scheme of things. A fall should be looked upon by smart traders as an opportunity to make money rather than get scared by it. The fall will not be one sided, it’s likely going to be with many sharp pullbacks, it’s time you devised a strategy to safeguard your wealth or look for an expert who can help you in doing so. As and when my models suggest a good alternate investment, I will bring it to light. The Bears are back and they are here to stay.