After performing impressively in 2018, despite severe stock market volatility, the wireless infrastructure developers industry is set to rally again in 2019. In fact, the wireless infrastructure developer industry gained nearly 13% in 2018, while the benchmark S&P 500 ended in the red. Moreover, the Communication Services Select Sector SPDR (XLC), which majorly comprises wireless infrastructure developers and operators, is up 11.6% so far in 2019.

The next-generation 5G Network will be a major driver for wireless operators going forward, which in turn will aid immensely the wireless infrastructure developers. All major wireless operators are currently upgrading their networks. Consequently, it will be prudent to invest in wireless infrastructure developers stock with a favorable Zacks Rank.

Strong Wireless Infrastructure Market

With rapid growth in video and other bandwidth-intensive applications, the wireless industry participants are making considerable investments in LTE, broadband and fiber in order to provide additional capacity and ramp up Internet and wireless networks. The LTE network has the highest penetration rate of 91% in the North American region. This in turn will help wireless equipment manufacturers.

Moreover, the Trump administration is deeply concerned about China’s drive to unseat the United States as the primary developer and supplier of products in the field of high-tech products. Earlier this month, POLITICO reported that President Donald Trump is likely to sign an executive order banning Chinese telecom equipment from being utilized for U.S. wireless networks before Feb 25.

So far, the U.S. government has imposed tariffs worth of $250 billion on Chinese goods. Most of these products fall in high-tech telecom sectors. U.S. companies that rely on Chinese imports are unhappy about the move as it will raise prices of wireless equipment. However, a hike in product prices will certainly help wireless equipment manufacturers.

Additionally, the corporate tax rate has been lowered from 35% to 21%., marking its lowest in 78 years. Trump’s tax cut resulted in a huge windfall for wireless operators. The carriers can utilize this money for 5G network R&D and its deployment. This has naturally bolstered demand for wireless equipment.

5G Wireless and IoT Market Prospects

The impending 5G boom is likely to propel the wireless industry to newer heights. The success of 5G technology hinges on substantial investments to upgrade wireless network infrastructure.

Per Reuters, global 5G wireless market size will reach $1,271 billion by 2025. The market will grow more than 49.1% over the period 2018-2025. DELOITTE Global has predicted that 25 telecom operators will launch 5G in 2019 and 26 others will follow suite in 2020. About 20 vendors will launch 5G-enabled smartphones in 2019 and over 1 million 5G handsets are likely to be shifted this year.

Moreover, high-speed 5G wireless networks will be of utmost importance in managing the exponential growth of internet-connected devices, popularly known as Internet of Things (IoT). Research firm IDC predicted that technology spending IoT will reach $1.2 trillion by 2022. Research firm Bain estimated that combined IoT market size will reach $520 billion in 2021 from $235 billion in 2017.

Our Picks

At this stage, it will be lucrative to invest in wireless infrastructure developer stocks to strengthen portfolio in 2019. We narrowed down our search to five such stocks each having a Zacks Rank #2 (Buy) and strong growth potential. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

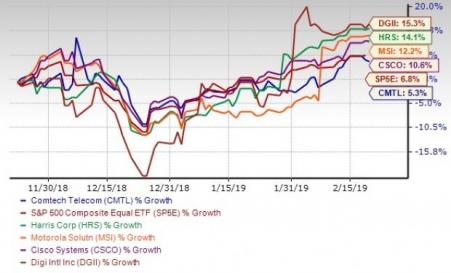

The chart below depicts price performance of our five picks in the last three months.

Cisco Systems Inc. (NASDAQ:CSCO) designs, manufactures, and sells Internet Protocol based networking and other products related to the communications and information technology industry worldwide. The company has expected earnings growth of 17.3% for current year. The Zacks Consensus Estimate for the current year has improved by 1% over the last 30 days.

Digi International Inc. (NASDAQ:DGII) provides Internet of Things connectivity products, services, and solutions in North America, Europe, the Middle East, Africa, Asia, and Latin America. The company has expected earnings growth of 680% for current year. The Zacks Consensus Estimate for the current year has improved by 39.3% over the last 30 days.

Harris Corp. (NYSE:HRS) provides technology-based solutions that solve government and commercial customers' mission-critical challenges in the United States and internationally. The company has expected earnings growth of 22.8% for current year. The Zacks Consensus Estimate for the current year has improved by 1.5% over the last 30 days.

Motorola Solutions Inc. (NYSE:MSI) provides mission-critical communication solutions the United States, the UK, Canada, and internationally. The company has expected earnings growth of 6.7% for current year. The Zacks Consensus Estimate for the current year has improved by 1.3% over the last 30 days.

Comtech Telecommunications Corp. (NASDAQ:CMTL) designs, develops, produces, and markets products, systems, and services for communications solutions. The company has expected earnings growth of 29.3% for current year. The Zacks Consensus Estimate for the current year has improved by 1% over the last 30 days.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Digi International Inc. (DGII): Free Stock Analysis Report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL): Free Stock Analysis Report

Harris Corporation (HRS): Free Stock Analysis Report

Motorola Solutions, Inc. (MSI): Free Stock Analysis Report

Original post