The grocery industry is having a tough time currently. The industry has been grappling with challenges like stiff competition, tight margins and aggressive promotional environment.

Traditional grocery companies are facing competition from rivals, which are strengthening their franchises and are offering alternative outlets for food and other staples. Customers are also becoming more inclined toward private label products as they are low-cost alternatives to national brands, which are hurting the food companies.

The problems worsened when e-Commerce biggie Amazon.com, Inc. (NASDAQ:AMZN) announced an all-cash $13.7 billion deal on Jun 16 to acquire the natural and organic foods supermarket chain Whole Foods Market Inc (NASDAQ:WFM). WFM. Shares of a number of grocery store chains, including Kroger (NYSE:KR) and Sprouts Farmers Market, dipped on Aug 28, after the deal officially came into effect. Losses spread across the food sector as shares of Kraft Heinz, Post Holdings, Kellogg Company (NYSE:K), ConAgra Foods (NYSE:CAG) and Treehouse Foods tumbled.

We note that Amazon’s move to cut as much as 43% prices on Whole Foods’ products on its first day has made investors skeptical, as the traditional food companies are now apprehensive of pricing pressure, squeezed margins and dwindling customers. Amazon’s deal has changed the retail landscape and has intensified competition both in stores and online.

While traditional packaged food companies are taking a number of initiatives to boost sales amid industry woes, the weakness is expected to persist. Nevertheless, not all food biggies are underperforming. There are still quite a few food stocks that have excellent prospects and can prove to be good bets for value investors.

How to Pick the Best Stocks?

With the help of our new Zacks Style Score system, we have identified five food stocks that can be a great stock for value-oriented investors.

Our Value Style Score condenses all valuation metrics into one actionable score that helps investors steer clear of ‘value traps’ and identify stocks that are truly trading at a discount. Our research shows that stocks with Style Score of A or B when combined with a Zacks Rank #1 (Strong Buy) or 2 (Buy) offer the best upside potential. You can see the complete list of today’s Zacks #1 Rank stocks here.

To arrive at the best value picks, we have shortlisted food stocks that have a Zacks Rank #1 or 2 with a Value Style Score of A or B.

5 Prominent Picks

Based in Ridgefield, CT, The Chefs' Warehouse Inc. (NASDAQ:CHEF) is a distributor of specialty food products in the United States. The company currently carries a Zacks Rank #2 and has a Value Score of B. The company has a long-term earnings growth rate of 19.00%, which also makes it a viable investors’ choice.

Investors can also count on Chicago-based Ingredion Inc. (NYSE:INGR) , which is an ingredients solutions provider specializing in nature-based sweeteners, starches and nutrition ingredients. It currently carries a Zacks Rank #2 and has a Value Score of B. It has a long-term earnings growth rate of 11.00%.

U.K.-based Nomad Foods Ltd. (NYSE:NOMD) , a manufacturer and distributor of frozen foods, can also be a good stock for value investors. It presently carries a Zacks Rank #1 and has a Value Score of B.

Coming to the share price movement, Chef’s Warehouse has rallied 12.9% over the last three months, while Ingredion grew 8.5%. On the other hand, the industry declined 8.5% in the said time frame.

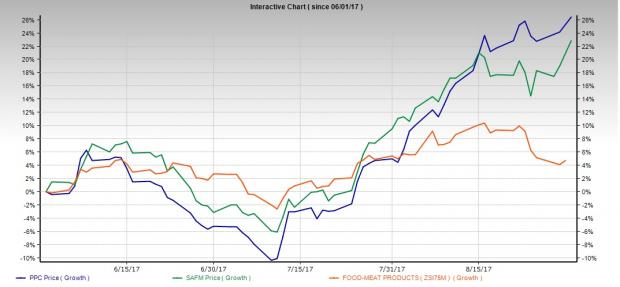

We also suggest investing in Sanderson Farms, Inc. (NASDAQ:SAFM) , which is engaged in the production, processing, marketing and distribution of fresh and frozen chicken products. The company currently carries a Zacks Rank #1 and has a Value Score of A.

Another company which warrants a look is Pilgrim's Pride Corporation (NASDAQ:PPC) .The company deals in chicken products. The company presently sports a Zacks Rank #1 and has a Value Score of A.

If we look into the share price movement, we note that while Sanderson Farms has rallied 22.8% in the last three months, Pilgrim’s Pride grew 26.4%. Both the stocks outperformed the industry, which gained only 4.7% over the said time frame.

Bottom Line

Intelligent selections of stocks greatly benefit investors. The above mentioned stocks can prove to be valuable additions to your portfolio.

You can also use the Zacks Stock Screener to find other stocks with this winning combination. Your search ends at stocks with a favorable Zacks Rank of either #1 or #2, which encompasses its strong fundamentals, promises price movement and highlights analysts’ constructive view on the same via positive estimate revisions. As we know, a sturdy portfolio always gives favorable returns.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Sanderson Farms, Inc. (SAFM): Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Free Stock Analysis Report

Original post

Zacks Investment Research