Here are the Rest of the Top 10:

Dupont Fabros Technology Inc (NYSE:DFT)

DuPont (NYSE:DD) Fabros, started higher form a low in February, reaching its top in August. It pulled back in a shallow retracement to the beyond its 200 day SMA from there, finding support at the April lows. Since mid-November it has been slowly turning higher and is back at resistance coming into the New Year. The RSI is in the bullish zone and the MACD is rising, both supporting more upside. Look for a push over resistance to participate to the upside….

Endo International PLC (NASDAQ:ENDP)

Endo, has fallen from a high over 96 in April 2015 finding a bottom a year later and over 85% lower. Since then it managed a small bounce to a high in August and then fell back. That pullback fond a higher low, a first bright spot for the stock, and has consolidated. The RSI is moving up and approaching the bullish zone while the MACD slowly trends higher. Look for continued upward price action to participate…..

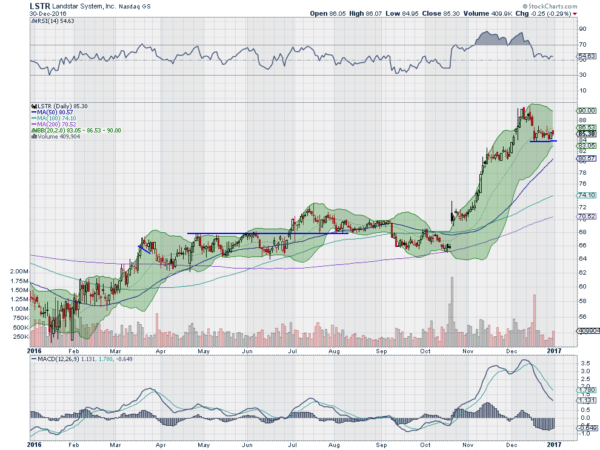

Landstar System Inc (NASDAQ:LSTR)

Landstar, broke a long consolidation to the upside in October. It continued higher for 2 months, reaching a peak in early December. From there it has pulled back, and sits in consolidation over support. The RSI has held bullish over the mid line while the MACD has reset lower. A break over the consolidation range would be a signal to participate to the upside…..

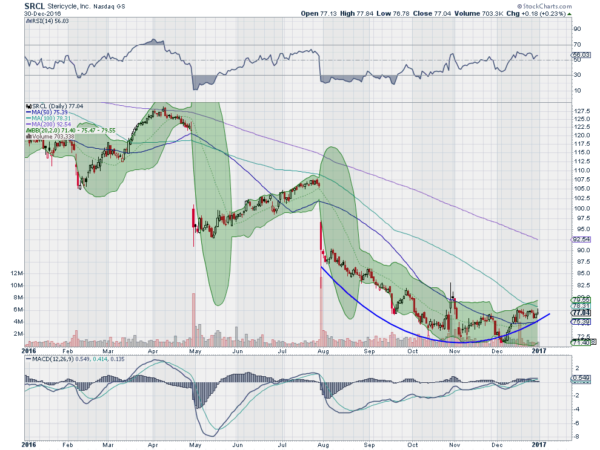

Stericycle (NASDAQ:SRCL)

Stericycle, dropped precipitously in April and then retraced in a trend higher for 3 months before another drastic drop. The second kept going and eventually found a bottom in December. Since then it has made some progress, making its first new higher high. It sits consolidating as the year starts. The RSI is pushing towards the bullish zone while the MACD is rising. Look for a push over the 100 day SMA to participate in the upside…..

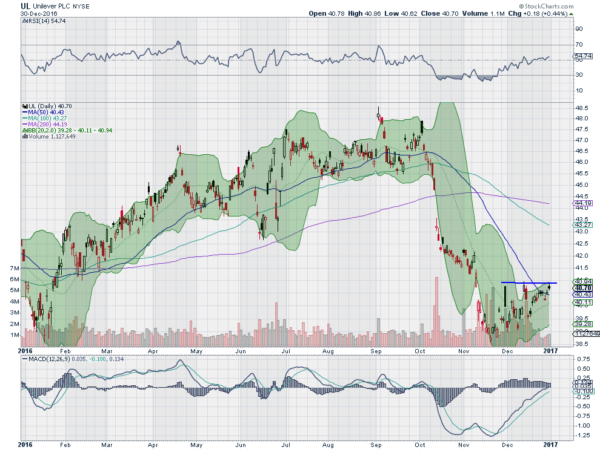

Unilever (LON:ULVR)

Unilever,, moved higher off of a February 2016 low and started to find resistance in April. A pullback to a higher low reversed and found a new high in July. A smaller pullback reversed back to another higher high in September and then thing went south. A strong move lower in October cut 20% off the stock price, where it found a bottom in November. Since then it has bounced top resistance a few times and made higher lows. The RSI is rising and at the edge of the bullish zone while the MACD is bullish. Look for a move over resistance to participate to the upside…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, with the calendar turning from 2016 to 2017 sees the equity markets retrenching in their uptrends.

Elsewhere look for Gold to continue its bounce in its downtrend while Crude Oil continues higher. The US Dollar Index looks to continue consolidation of the break out move while US Treasuries may have bottomed in their downtrend. The Shanghai Composite looks to continue to consolidate in the uptrend and Emerging Markets are consolidating the bounce in the downtrend.

Volatility looks to remain low but out of abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show short term pullbacks likely to continue within the long term uptrends. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.