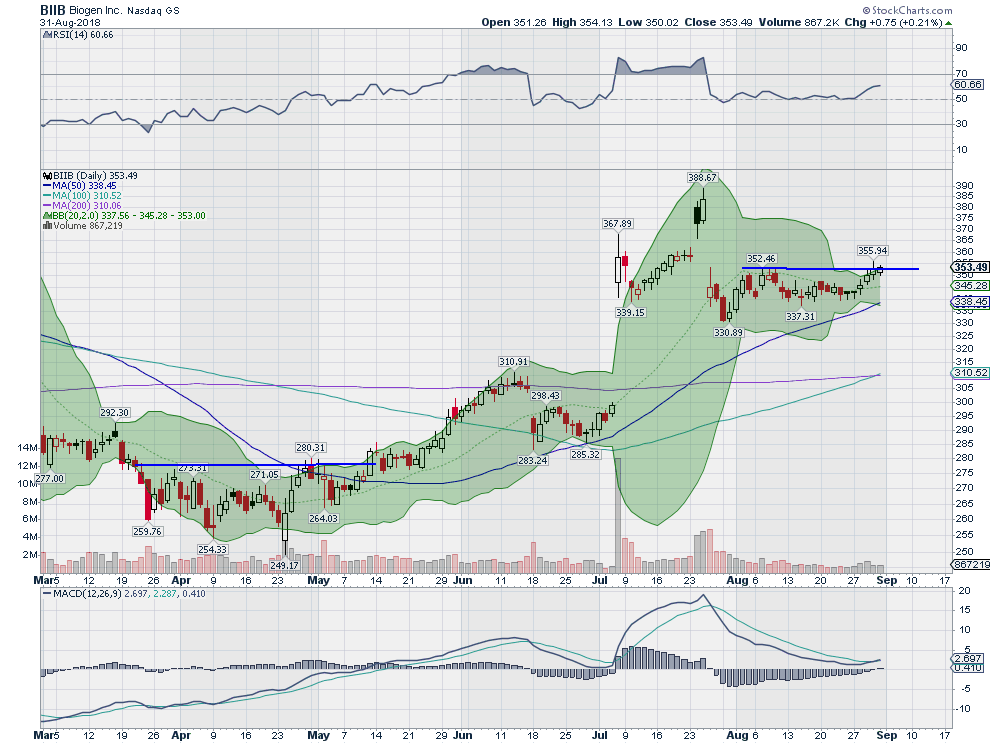

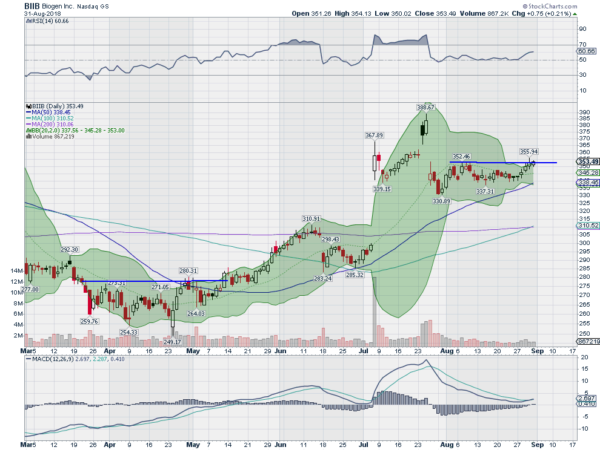

Biogen (NASDAQ:BIIB)

Biogen, $BIIB, gapped higher in July and consolidated for 3 weeks before a blow off top and Island reversal. This held in the original gap and has consolidated since. The end of last week saw price push over consolidation as the Bollinger Bands® expanded. Look for continuation to participate higher…..

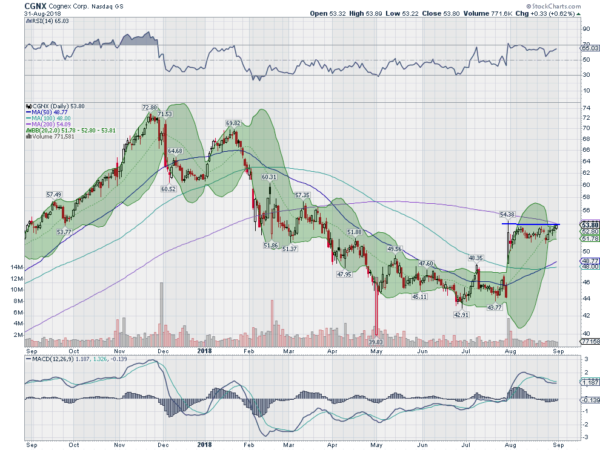

Cognex Corporation (NASDAQ:CGNX)

Cognex, $CGNX, dropped from a double top in January, ending the downtrend with a gap down blow off at the beginning of May. It consolidated for 3 months after that before a gap up at the end of July. It has held there in consolidation since. The RSI is strong in the bullish zone with the MACD flat but positive. Look for a push over consolidation to participate…..

L3 Technologies Inc (NYSE:LLL)

L3 Technologies, $LLL, peaked in January with the market then dropped back. It found support at the 100 day SMA in February and bounced, rising back to the prior high. A second drop in April was much more severe blowing through the 200 day SMA and finding support more than 15% lower. It started higher immediately and after two steps was back near the top at the end of July. It has held there consolidating in a tight range since. The RSI is in the bullish zone with the MACD trying to cross up and positive. Look for a push over resistance to participate…..

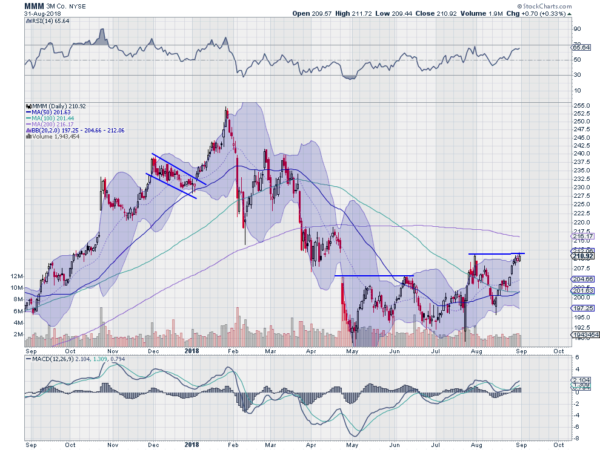

3M (NYSE:MMM)

3M, $MMM, pulled back from a top in January, after a 2 year move higher. The first drop touched the 200 day SMA and bounced fast. It fell back again into March and the 200 day SMA could not hold it this time. A gap down in April and it found a bottom at the beginning of May. It has consolidated from there and then made a higher high into the end of July, with a move over the 100 day SMA. One move pullback to a higher low and it is now rising and back at the July high. The RSI is also rising and bullish with the MACD rising. Look for a push through resistance to participate…..

Tractor Supply Company (NASDAQ:TSCO)

Tractor Supply, $TSCO, started higher in April off of a consolidation period, and continued higher to a retest of the January high. It ran sideways for a while before then turning back higher 2 weeks ago. It executed an Evening Star reversal to start last week which resulted in a shallow pullback. Now it is rising again and about to reach the August high. The RSI is rising and bullish with the MACD moving up out of a flat run. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with eight months in the books and the long Labor Day Weekend upon us sees the equity markets are waking up tanned and rested from their summer vacation.

Elsewhere look for Gold to possibly pause in its downtrend while Crude Oil resumes the path higher. The US Dollar Index is searching for support in a pullback while US Treasuries are in broad consolidation. The Shanghai Composite and Emerging Markets are biased to the downside with the former on the cusp of new 4 year lows.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s. Their charts are now showing strength on both the daily and weekly timeframes as all end august at monthly all-time highs. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.