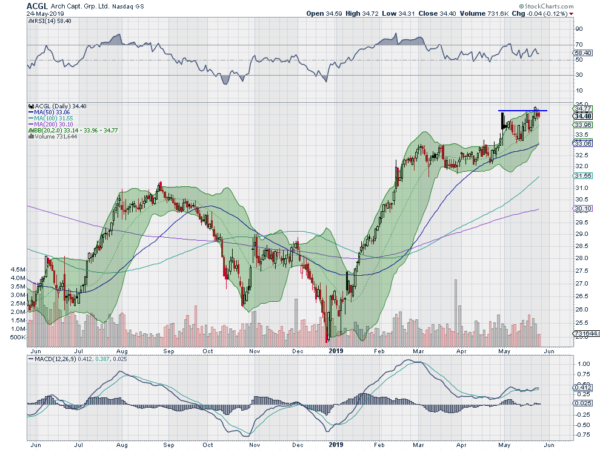

Arch Capital Group, Ticker: $ACGL

Arch Capital Group Ltd (NASDAQ:ACGL) started higher in December and kept running to a top in March. It paused there and then started up again at the end of April. After a pullback to retest the break out it is now back at the high. The RSI is bullish and the MACD is flat but positive. Look for a push to a new high to participate.

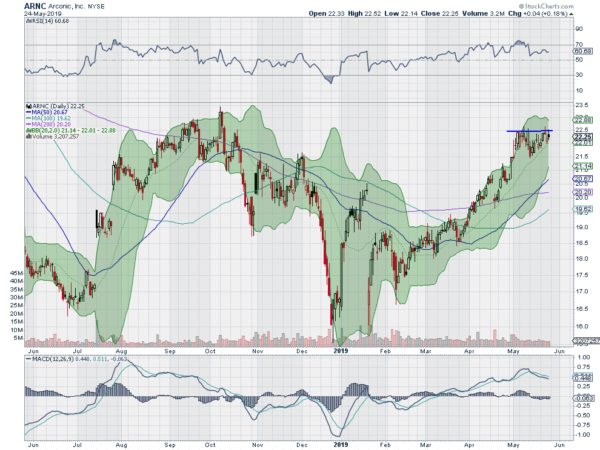

Arconic, Ticker: $ARNC

Arconic Inc (NYSE:ARNC) started higher for good in February. It continued to a recent top earlier this month before a shallow pullback. Now it is back at resistance with a RSI strong in the bullish zone and the MACD flat. Look for a pushover resistance to participate.

Ashland Global, Ticker: $ASH

Ashland Global Holdings Inc (NYSE:ASH) started higher in December and plateaued into mid-February. It moved sideways there for 3 months before starting lower at the beginning of May. It found support last week and Friday started back higher. The RSI is also moving back higher with the MACD turning toward a cross up. Look for continuation to participate.

BioMarin Pharmaceuticals, Ticker: $BMRN

Biomarin Pharmaceutical Inc (NASDAQ:BMRN) rose from a December low to retest the November consolidation area. It failed to push through and started moving back lower in February. Since then it has made a series of lower highs. Last week it made a higher low and is back approaching trend resistance. The RSI is rising and almost in the bullish zone with the MACD rising and positive. Look for a push over resistance to participate.

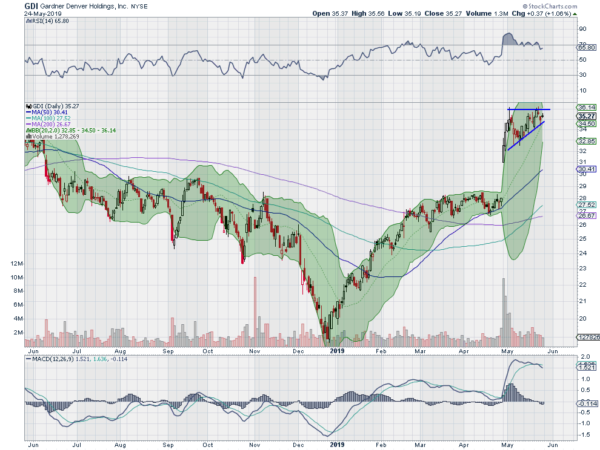

Gardner Denver, Ticker: $GDI

Gardner Denver Holdings Inc (NYSE:GDI) started higher in December and leveled as it moved over the 200 day SMA in February. It continued sideways until a gap up at the end of April. It has been consolidating that move since. The RSI is bullish and the MACD is starting to pull back. Look for a break of consolidation to participate.

Up Next: Bonus Idea

Elsewhere look for Gold to consolidate in the downtrend while Crude Oil pulls back. The US Dollar Index is changing to a short term downtrend while US Treasuries continue to march higher. The Shanghai Composite and Emerging Markets look to continue to move lower.

Volatility looks to remain stable at moderate levels keeping the pressure off of for the equity index ETF’s SPY, IWM and QQQ. This has allowed sentiment driven by headlines to play a bigger roll. In response, the QQQ is looking the weakest with the SPY and IWM finding support at prior levels. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.