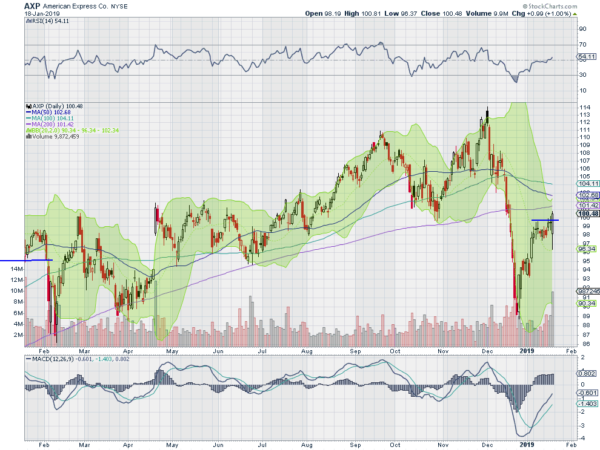

American Express Ticker: $AXP

American Express Company (NYSE:AXP) had a horrendous December falling from an all-time high at 114 to a low at 89, a 20% drop, in 3 weeks. It has been moving higher since with a couple of steps so far. Friday saw the price push over short term resistance and retest the October low. The RSI is rising toward the bullish zone with the MACD moving up. Look for continuation to participate.

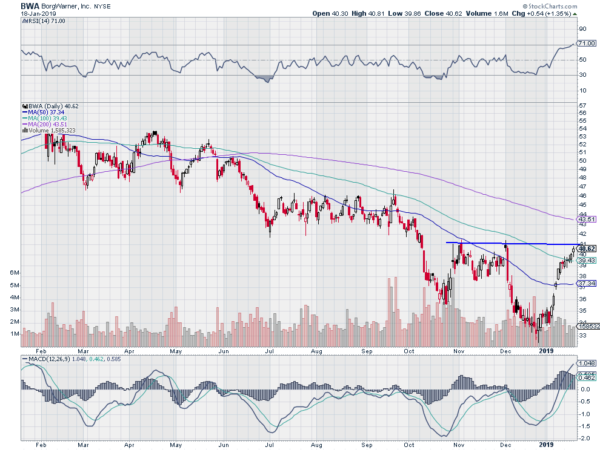

BorgWarner, Ticker: $BWA

BorgWarner (NYSE:BWA) has been moving lower since topping in January last year. The move off of the December low has put the price back at the November highs, a third touch there. It has an RSI that is rising and bullish, near overbought, with the MACD moving up and positive. Look for a pushover resistance to participate.

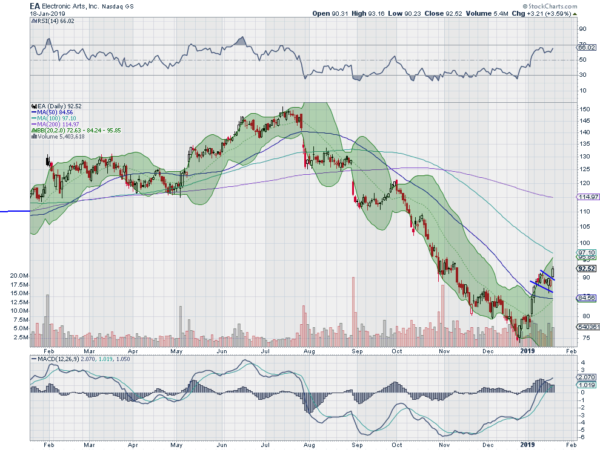

Electronic Arts), Ticker: $EA

Electronic Arts (NASDAQ:EA) started higher off of its 200 day SMA in December 2016. It topped in July last year and started moving lower. At the Christmas Eve low it had retraced that entire move and lost 50% of its value. Since then it has been moving back higher and closed last week breaking a bull flag to the upside. The RSI is rising and bullish with the MACD positive and moving higher. Look for continuation to participate.

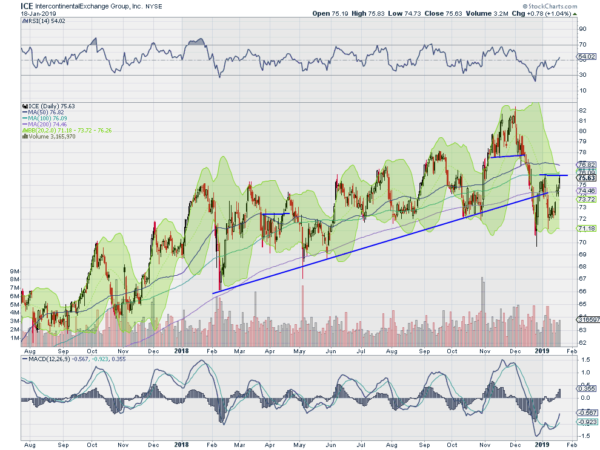

Intercontinental Exchange, Ticker: $ICE

Intercontinental Exchange Inc (NYSE:ICE) had trended higher until it broke down in December. It bounced back quickly to its 20 day SMA and then dropped again, this time to a higher low. A second bounce has it back at the early January high coming into the week. The RSI is rising through the midline with the MACD crossed up and moving higher. Look for a pushover resistance to participate.

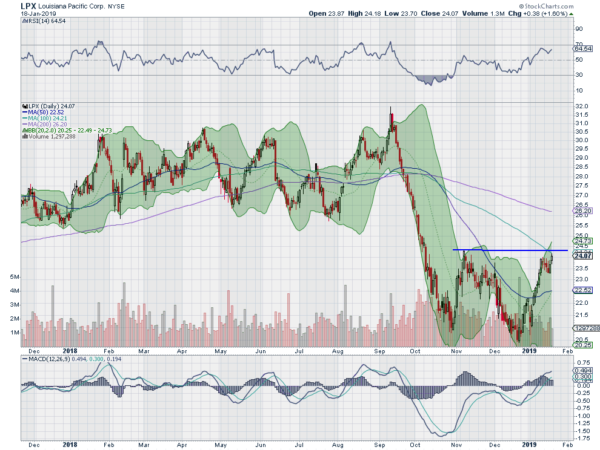

Louisiana-Pacific, Ticker: $LPX

Louisiana-Pacific Corporation (NYSE:LPX) fell fast from a top in September. It found support in October and bounced but quickly ran out of steam. A second trip down made lower low and it bounced again. It paused at a retest of the first bounce and is now moving higher again. The RSI is rising and bullish with the MACD positive and moving up. Look for a pushover resistance to participate.

Bonus Idea

Elsewhere look for Gold to pause in its uptrend while Crude Oil resumes the move higher. The U.S. Dollar Index is showing short term strength, while U.S. Treasuries are biased to continue lower. The Shanghai Composite is also exhibiting short term strength and may be reversing higher while Emerging Markets (NYSE:EEM) continue to move up.

Volatility is back down to the lows since equities started to drop in October making the path higher the easier one for equities. The equity index ETF’s SPY (NYSE:SPY), IWM and QQQ, are all responding well in both the short and intermediate term charts. But they all remain short of confirming reversals with a higher high and below their 200-day SMA’s. More work to be done. Use this information as you prepare for the coming week and trade them well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.