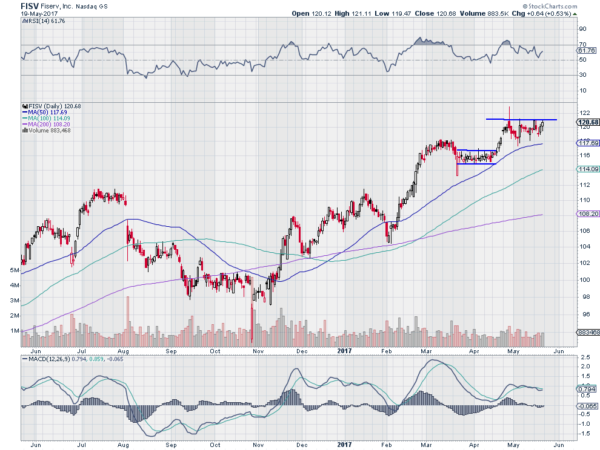

Fiserv (NASDAQ:FISV)

Fiserv, $FISV, has a long strong history of upward price action. The latest leg began in October. It crossed the 200 day SMA in November and retested it in February before the latest move up. That has found resistance and consolidated since the end of April. During the consolidation it has made marginally higher lows, a positive sign. The RSI is in the bullish range and the MACD flat but positive. Look for a push over resistance to participate higher…..

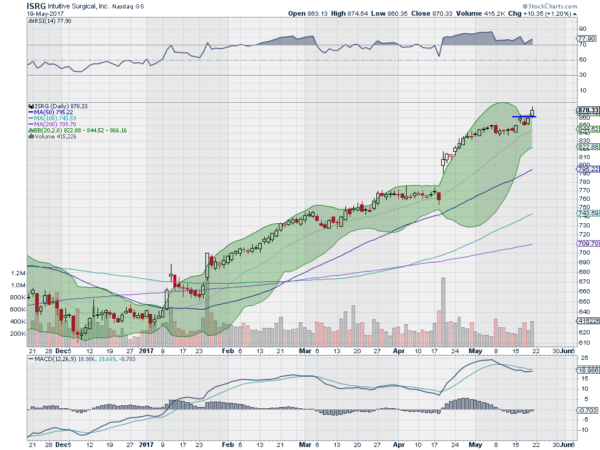

Intuitive Surgical (NASDAQ:ISRG)

Intuitive Surgical, $ISRG, started moving higher at the beginning of the year. It paused in April and then started a fresh move higher with a gap up following earnings. The stock slowed the move up the last two weeks and then took a step up Friday. The RSI is running a bit hot, but it seem that is often ok for this stock, and the MACD is trying to cross back up. Look for continuation to participate higher…..

Lam Research (NASDAQ:LRCX)

Lam Research, $LRCX, has had a steady trend higher for more than a year. That kind of move does not give many chances for a good entry. The current pause does. It has been consolidating since mid-April and as this has happened the RSI has worked off an overbought condition and the MACD is resetting lower. Look for a push over resistance to participate in the next (of many?) leg higher…..

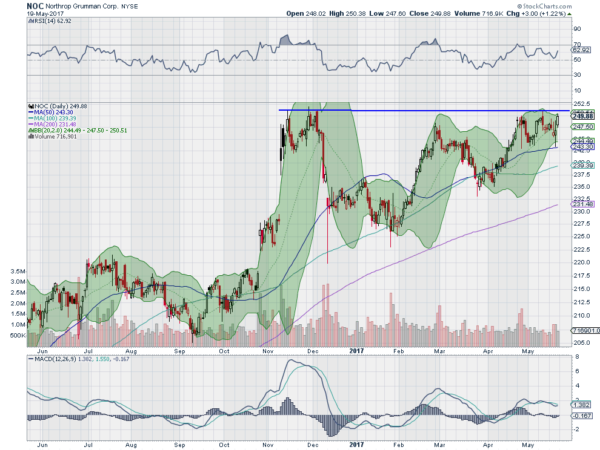

Northrop Grumman (NYSE:NOC)

Northrop Grumman, $NOC, soared higher with two gaps to the upside in October and November. It met resistance and then retraced about half of the move before turning back up. It paused again in February and pulled back, to a higher low. Another reversal has it back at resistance coming into the new week. The RSI is bullish and moving higher while the MACD is trying to cross up, and positive. Look for a push over resistance to participate higher…..

Starbucks (NASDAQ:SBUX)

Starbucks, $SBUX, moved higher out of a broad consolidation in April. That put it right back into a tighter consolidation now. Friday saw a push to the top of that consolidation with a strong candle. The Bollinger Bands® had squeezed and are now opening, while the RSI is bullish and moving back higher, and the MACD is turning back up as well. Look for a push over resistance to participate higher…..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with May Options Expiration in the rearview window allowing traders to look toward the Memorial Day Weekend and official kick off of the flight to the Hampton’s each Friday.

Equities head into the summer doldrums firm on the longer time frame but a little shaky short term. Elsewhere look for Gold to continue to trend higher while Crude Oil retains an upward bias in consolidation. The US Dollar Index is sick and looks to continue lower while US Treasuries continue their consolidation.

The Shanghai Composite is also in consolidation mode while Emerging Markets are biased to continue to the upside. Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all show consolidation in strength in the longer term, with the QQQ joining this week. In the shorter term there is some minor damage to repair that begun Thursday. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.