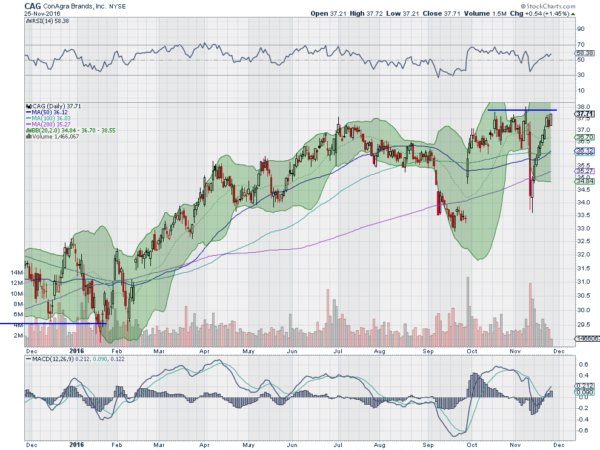

ConAgra (NYSE:CAG)

Conagra started higher at the beginning of 2016. That stalled at a peak of just under $38 in July. It pulled back from there, breaking down below the 200 day SMA before a gap higher started it back to the upside. That also stalled just under $38 and led to another pullback below the 200 day SMA. It started back up again in November, from a higher low, and is now approaching resistance a third time. The RSI is rising and bullish while the MACD is crossed up and rising. Look for a push over resistance to participate to the long side…..

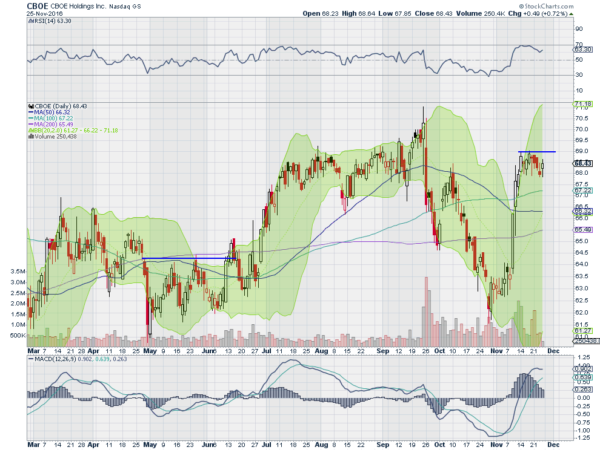

CBOE (NASDAQ:CBOE)

CBOE made a high in September, and then pulled back fast on heavy volume. It made a small bounce before continuing lower, finally finding support in October. Since then it has been nothing but sunny days for the stock. It rose over 2 weeks back to a resistance area and has consolidated since. The RSI is bouncing in the bullish zone while the MACD holds. Look for a push over resistance to participate to the upside…..

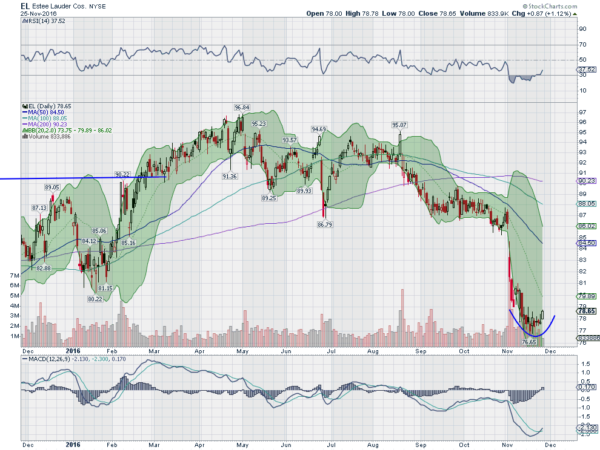

Estee Lauder (NYSE:EL)

Estee Lauder started a slow roll lower in May. That saw the bottom drop out at the start of November and now it seems to be settling. The RSI is moving up out of oversold territory while the MACD is crossed and rising. Look for a move over Friday’s high to participate to the upside…..

Interactive Brokers (NASDAQ:IBKR)

Interactive Brokers rose up off of a low in February and started to stall as it hit the 200 day SMA in April. It hung around there for some time mostly below the 200 day SMA until a push higher in October. That quickly failed and moved lower but a ‘V’ bottom ensued and now the price is back at a 5 month high and consolidating in a bull flag. The RSI is in the bullish zone and pulling back from an overbought condition while the MACD is flat and holding in bullish territory. Look for a move up out of the flag to participate…..

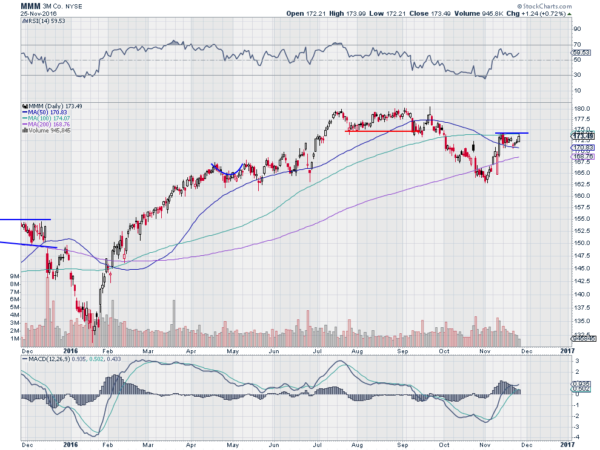

3M (NYSE:MMM)

3M rose from a bottom in January with a strong run higher into mid July. It met resistance there just over 180 and consolidated for 2 and a half months until it started to pullback, It broke down below the 200 day SMA in October and found support before a reversal higher. That move stalled 2 weeks ago and has consolidated between the 50 and 100 day SMA’s. The RSI is holding in the bullish zone and the MACD is flat after rising, but also in the bullish zone. Look for a push above resistance to participate to the upside…..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which stuffed with turkey and shopped out from Black Friday, had traders and investors seeing the equity markets looking strong heading into December.

Elsewhere look for gold to continue lower while crude oil consolidates with a short term bias higher. The US dollar Index continues to look strong as while US Treasuries are biased lower but may be finding support. The Shanghai Composite continues to look strong and Emerging Markets (NYSE:EEM) continue to consolidate in their downtrend.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). The SPY looks strong and ready for more while the IWM may be getting overheated and should garner close attention for a possible short term pullback. The QQQ is sitting just under highs and could be the beneficiary of any short term rotation. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.