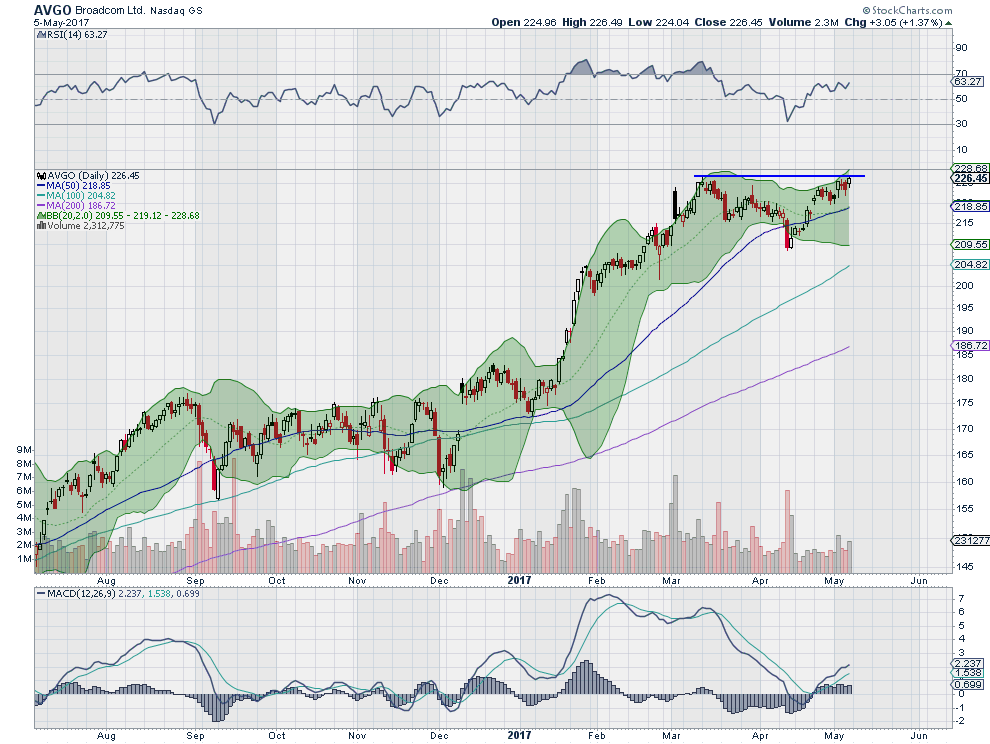

Broadcom (NASDAQ:AVGO)

Broadcom, rose out of consolidation at the beginning of the year making a high in early March. It pulled back from there in two steps before finding a bottom as it dropped below the Bollinger Bands®. The bounce from there has the price back at the March high coming into the new week. The RSI is in the bullish zone and rising with the MACD moving up and bullish. Look for a new high to participate in the upside…..

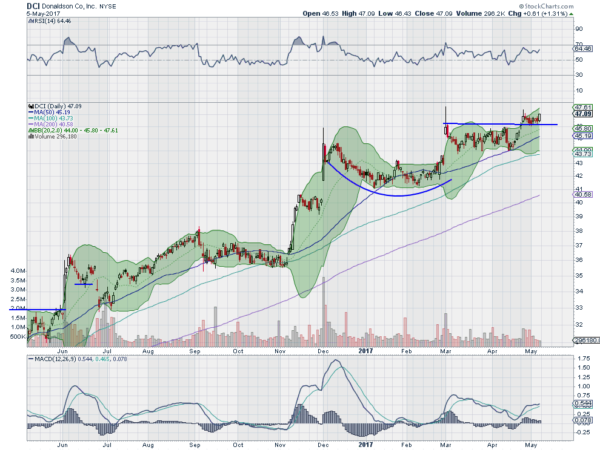

Donaldson Company Inc (NYSE:DCI)

Donaldson, has been stair stepping higher for more than a year. It moved above the last stair two weeks ago and stalled, consolidating. Friday it started higher again though. The RSI is bullish and rising with the MACD moving higher. Look for continuation to participate higher…..

FedEx (NYSE:FDX)

FedEx, ran higher after the election in November, peaking in early December. It pulled back from there and has traded in a range ever since. The last move off of support stalled at the SMA’s and pulled back to a higher low and now that has reversed higher. The RSI is on the edge of a move into the bullish zone and the MACD is rising and about to cross zero. Look for a higher high to participate in the upside…..

Kansas City Southern (NYSE:KSU)

Kansas City Southern, pulled back from a high in August finding support in early November. The initial bounce failed and it retested the low in January. Since then it has made a series of higher lows and higher highs. Friday saw the price push over short term resistance and it has support for more upside from a rising and bullish RSI and a MACD turning back higher. Look for continuation to participate higher…..

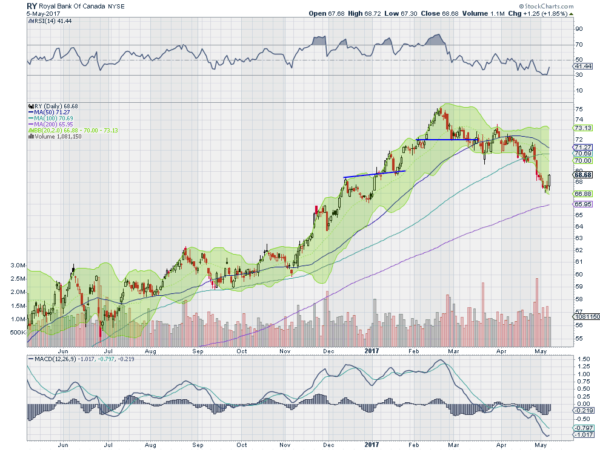

Royal Bank Of Canada (NYSE:RY)

Royal Bank of Canada, started moving higher out of consolidation in November. It peaked in February 25% higher and started to pull back. That pullback found support last week and consolidated before a strong move higher Friday. The RSI also turned back higher and the MACD curled up. A reversal brewing. Look for continuation Monday to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which deep into the earnings season and with the May FOMC meeting and non-farm payrolls in the books, sees equities looking strong again.

Elsewhere look for Gold to continue in its downtrend while Crude Oil also is biased lower, but with caution for a reversal. The US Dollar Index is weak and moving lower while US Treasuries are also biased to the downside. The Shanghai Composite rounds out the markets looking weak as it moves lower while Emerging Markets are biased to continue to the upside.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts all look stronger in the short term with the SPY and QQQ leading the way. In the longer timeframe the IWM is at resistance while the SPY and QQQ look set for a series of new highs. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.