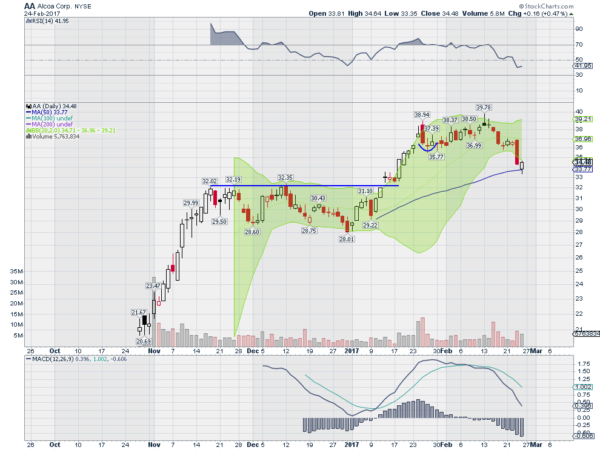

Alcoa (NYSE:AA)

Alcoa has been moving higher since the split of the company in October. It went through a consolidation for 6 weeks along the way but then broke out the other side to a February high. It has pulled back over the past 2 weeks, ending last week at the 50 day SMA and holding there with a possible reversal candle. The RSI is still in bullish territory with the MACD falling, but still positive. Look for an up day Monday to confirm a reversal…..

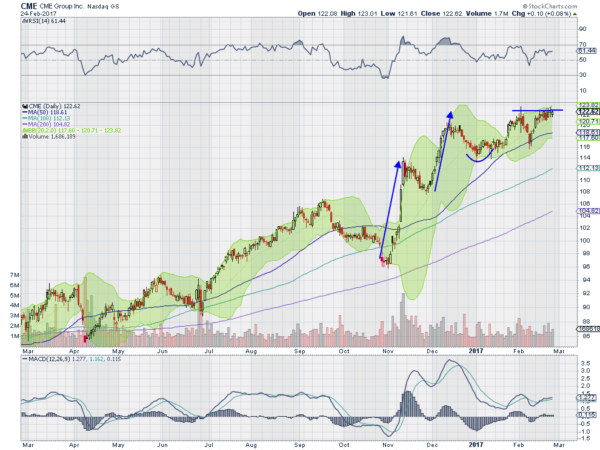

CME (NASDAQ:CME)

CME had two sharp legs higher from the end of October to a December peak. Since then it has consolidated against that high as resistance with a couple of higher lows. The RSI is bullish and the MACD rising slowly. Both support more upside. Look for a push to a new high to participate to the upside…..

Humana (NYSE:HUM)

Humana ran 30% higher following the election. After a small pullback though it has done nothing since. Consolidation for 3 months saw it work off an overbought condition on the RSI and reset the MACD near zero. The movement since mid-February has it pinned to resistance with momentum turning up. Look for a push over resistance to participate higher…..

Molson Coors (NYSE:TAP)

Molson Coors ran from a February 2016 low to a high in mid-October. Since then it has pulled back and found support in mid-November. It traded in a range from 94 to 100 for nearly 4 months, before pushing above it last week. This also put the price over the 100 and 200 day SMA’s. A quick retest of the break out held and it moved higher Friday. The RSI is bullish and rising and the MACD is moving higher. Look for continuation to participate to the upside…..

Whole Foods (NASDAQ:WFM)

Whole Foods has basically done nothing for more than a year. Back and forth in a range, wider at first and narrower recently. But the range has been large enough to trade. Coming into the new week the price is breaking above short term resistance and offering a trade opportunity. The RSI is in the bullish zone and rising while the MACD is also pushing higher. Look for continuation to participate to the upside…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into March sees the Equity markets still looking strong on the longer time frame but showing more signs of short term weakness taking hold.

Elsewhere look for gold (NYSE:GLD) to continue higher in its uptrend while crude oil (NYSE:USO) churns with a bias for a break to the upside. The US dollar Index still looks better to the upside while US Treasuries (NASDAQ:TLT) consolidate further. The Shanghai Composite continues to drift higher while Emerging Markets (NYSE:EEM) are showing some weakness in their uptrend.

Volatility looks to remain at abnormally low levels keeping the wind at the back of the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their long term charts all continue to look strong while the short term charts hit a set back and may continue a drift lower short term. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.