Acorda Therapeutics Inc (NASDAQ:ACOR)

Acorda Therapeutics Inc (NASDAQ:ACOR) fell hard from a high in December to what looked like a blow off low in March. But instead of a bounce it continued to drift lower over the next 6 months, and then resumes the steep drop to a low in November. The last 3 weeks have seen a reversal bringing the stock back over 21 and consolidate. The RSI is now on the edge of a move into the bullish zone and the MACD rising and positive. It has been here before, but look for a break through resistance to participate to the upside…..

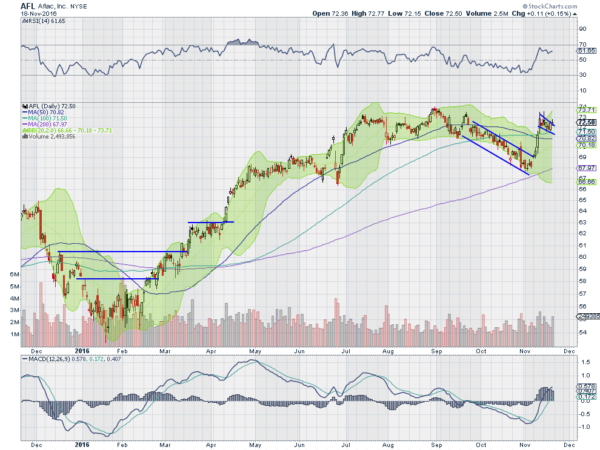

Aflac Incorporated (NYSE:AFL)

Aflac, started moving higher in January. The stock continued with some consolidation points along the way until a top at the end of August. From there it pulled back for 2 months. November started with a reversal back higher and now consolidation in a bull flag at the prior high. The RSI is in the bullish zone and the MACD is bullish and rising, supporting more upside. Look for a push up out of the flag to participate…..

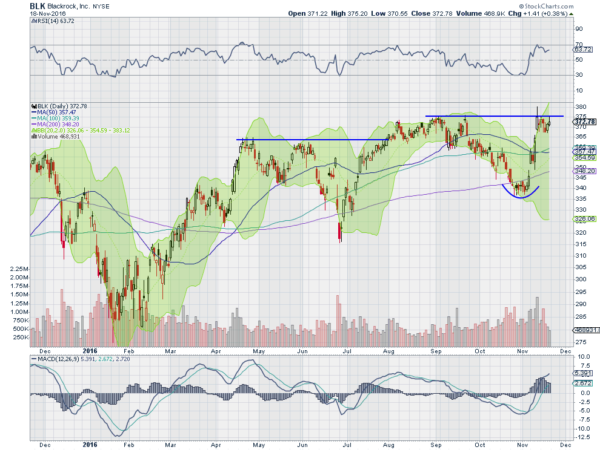

BlackRock Inc (NYSE:BLK)

BlackRock, started higher at the beginning of the year, finding resistance in April and pulling back. The pullback ended in June and then it moved to a higher high in August. After a month of consolidation it started pulling back again, finding support at a higher low in October. Since then it has moved back to the prior high and is consolidating. The RSI is ion the bullish zone and the MACD is rising. Look for a push over consolidation to participate to the upside….

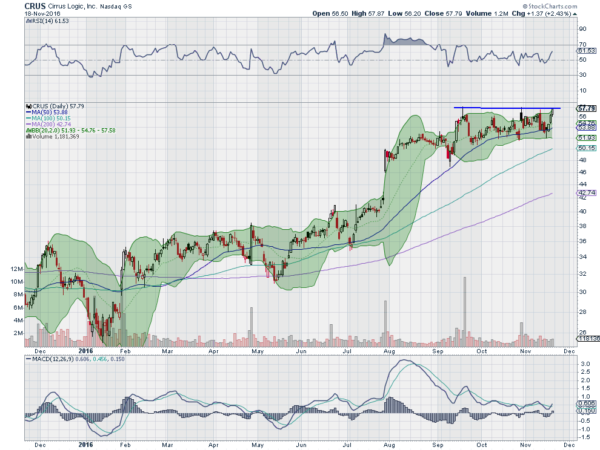

Cirrus Logic Inc (NASDAQ:CRUS)

Cirrus Logic, moved higher out of a base over the spring and early summer to a consolidation zone over 50. It has shown resistance now near 58 with tightening downside support. The RSI is in the bullish zone and rising with the MACD crossed up. Look for a push through resistance to participate to the upside…..

Foot Locker (NYSE:FL)

Foot Locker,, started higher off of a low in June following the Brexit vote. It took a couple of steps to move higher and then met resistance at 69 in August. A pullback in September found support and it reversed higher again to that same resistance before a shallower pullback. November saw a push to the upside and now consolidation. The RSI is in the bullish zone and the MACD rising. Look for a move over consolidation to participate to the upside…..

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with November Options Expiration behind and heading into the shortened Thanksgiving holiday week, sees equity markets looking strong.

Elsewhere look for Gold to continue lower while Crude Oil moves to the upside in the short run. The US Dollar Index remains strong as it moves higher while US Treasuries continue to be biased lower. The Shanghai Composite looks to continue to drift higher and Emerging Markets may have found support in their move lower.

Volatility looks to remain at unusually low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show strength in the IWM and SPY both short term and in the intermediate time frame. The QQQ however remains stuck in consolidation in the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.