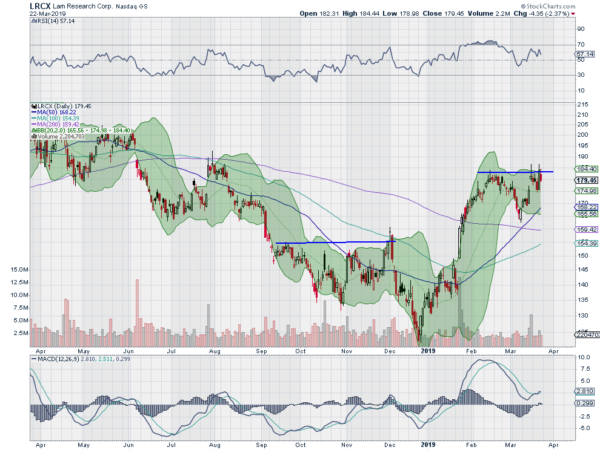

Lam Research, Ticker: $LRCX

Lam Research (NASDAQ:LRCX) started higher Boxing Day. It continued to a top in February and then pulled back to a higher low over the 200-day SMA. It has since returned to the prior high and is consolidating. The RSI is holding in the bullish zone with the MACD crossed up, rising and positive. Look for a pushover resistance to participate.

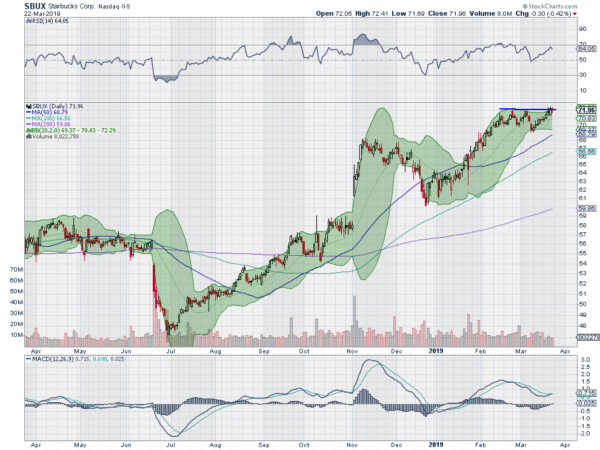

Starbucks, Ticker: $SBUX

Starbucks (NASDAQ:SBUX) pulled back to a December low and held short of closing the November gap. It reversed then and drove higher to a February top. Since then it has butted up against that top 3 time, the latest being Friday. The RSI is rising and bullish while the MACD is crossing up and positive. Look for a pushover resistance to participate.

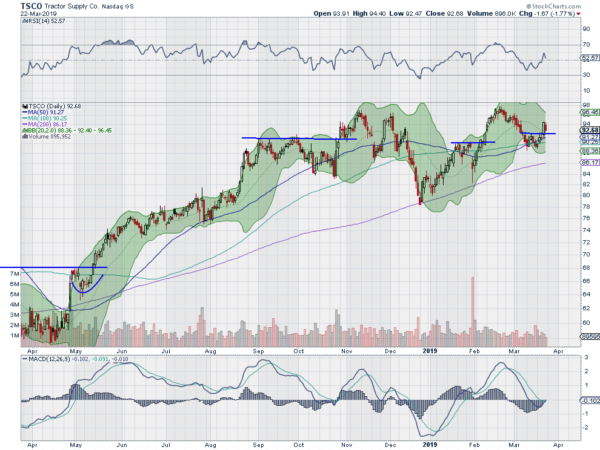

Tractor Supply, Ticker: $TSCO

Tractor Supply Company (NASDAQ:TSCO) started higher in December. It paused at prior highs and pulled back to the 200-day SMA before a second move higher. That also stalled at the all-time high and pulled back. Last week ended with it pushing back higher. The RSI is back over the midline with the MACD about to cross up and turn positive. Look for continuation to participate…..

Total System Services, Ticker: $TSS

Total System Services (NYSE:TSS) started higher at the end of December and continued to a top at the end of February. It has consolidated in a symmetrical triangle since. The RSI is pulling back to the mid line with the MACD falling but positive. Look for a break higher to participate…..

Weyerhaeuser, Ticker: $WY

Weyerhaeuser Company (NYSE:WY) started lower in June and continued to a bottom Christmas Eve. Since then it bounced and ran to a congestion zone that held it in November and has stalled. The RSI is holding up in the bullish zone with the MACD lifting off of zero. Look for a pushover resistance to participate.

Up Next: Bonus Idea

Elsewhere look for Gold to resume its uptrend while Crude Oil continues higher. The US Dollar Index despite all the noise remains in a broad consolidation while US Treasuries are breaking higher. The Shanghai Composite continues in the uptrend while Emerging Markets fall back into consolidation.

Volatility looks to remain low but building putting some pressure on the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts are showing some divergence with the IWM pulling back in a short term trend reversal while the SPY holds and consolidates and the QQQ continues to higher highs. Use this information as you prepare for the coming week and trad’em well.

Discalimer:

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.