Fiserv (FISV)

Fiserv (NASDAQ:FISV) ended a strong trend higher in October as it pulled back with the market. It crossed the 200 day SMA on its third touch in December and made a low at the end of the month. In early January it retested that low and then exploded to the upside. As it made a new all-time high it paused and it has been consolidating that move for the past two weeks. Friday saw it push over the consolidation late in the day. The RSI is strong in the bullish zone with the MACD flat but positive. Look for continuation to participate higher.

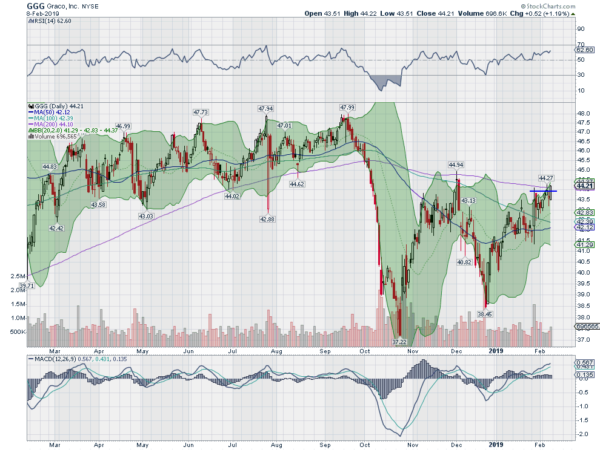

Graco (GGG)

Graco Inc (NYSE:GGG), made a top in January last year and then pulled back to its 200 day SMA. It bounced from there and ran mostly sideways under resistance until September. Then it dropped to a lower low into October. A bounce brought it to the 200 day SMA where it reversed lower, this time to a higher low in December. Since then it has moved back higher and is consolidating at the 200-day SMA. The RSI is in the bullish zone with the MACD rising and positive. Look for a push up out of consolidation to participate.

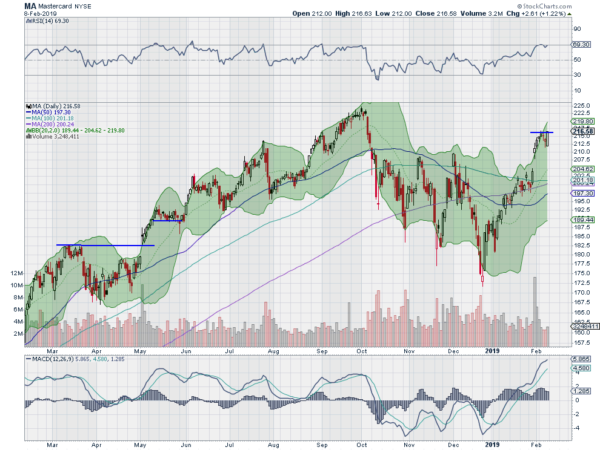

Mastercard (MA)

Mastercard (NYSE:MA) ended a bull run higher in October when it reversed lower. It found a bottom after 3 bounces in December. Since then it has been moving higher. The RSI is bullish and rising with the MACD positive and moving higher. Look for a push over recent consolidation to participate higher.

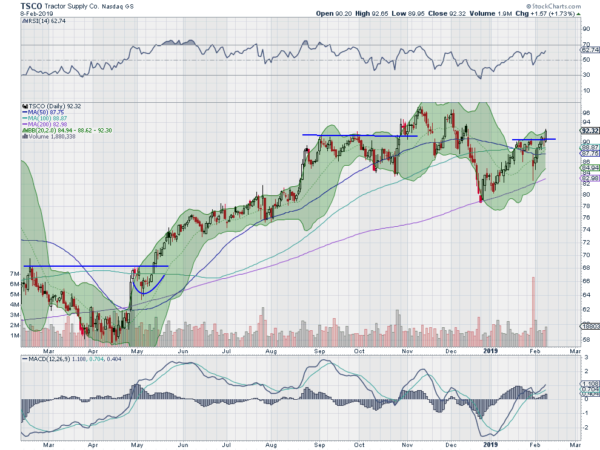

Tractor Supply (TSCO)

Tractor Supply Company (NASDAQ:TSCO) started higher in April. It continued to move up until it reached a peak in November. From there it pulled back to the 200-day SMA and bounced. The bounce halted at a lower high and reversed to a higher low again at the 200-day SMA. Now it is breaking prior resistance with a RSI moving into the bullish zone and the MACD rising and positive. Look for continuation to participate.

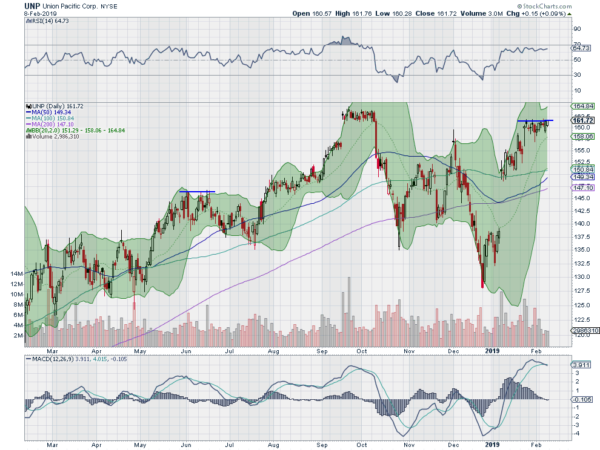

Union Pacific (UNP)

Union Pacific Corporation (NYSE:UNP), pulled back from a top in October to a low later that month and bounced. The bounce failed to make a higher high and fell back to a lower low into December. Since then it moved higher, gapping up in January. Now it is consolidating that move. The RSI is strong and bullish with the MACD about to cross down but positive. Look for a pushover consolidation to participate higher.

Elsewhere look for Gold to resume its uptrend while Crude Oil may be reversing lower. The U.S. Dollar Index continues to mark time moving sideways in broad consolidation while US Treasuries are at resistance as they move higher. The Shanghai Composite reopens with a positive outlook and Emerging Markets are pausing in their move higher.

Volatility looks to remain at low levels making it easier for equities to advance. Their charts show digestion of the 6-week move higher in the shorter timeframe as the SPY), IWM and QQQ) all held over their 20-day SMA’s. The longer timeframe sees the uptrend intact but with some indecision in the short run. Use this information as you prepare for the coming week and trade them well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.