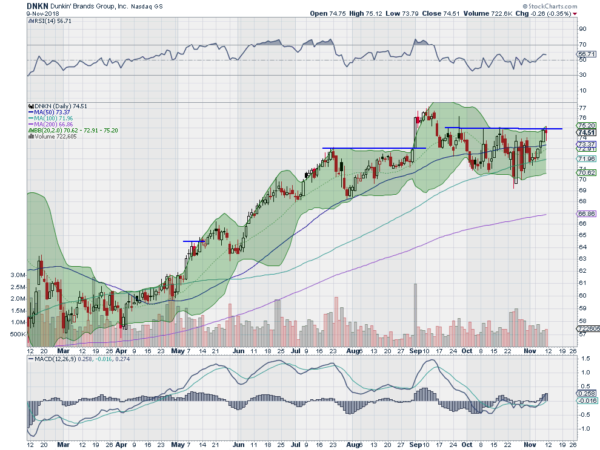

Dunkin Brands Group Inc (NASDAQ:DNKN)

Dunkin’, $DNKN, had a strong run to the upside from April low. It topped out in early September and started to pull back with the market. The pullback touched the 50 day SMA and found support. It has held there under resistance since. The RSI is on the edge of the bullish zone with the MACD rising and positive. Look for a push over resistance to participate higher…..

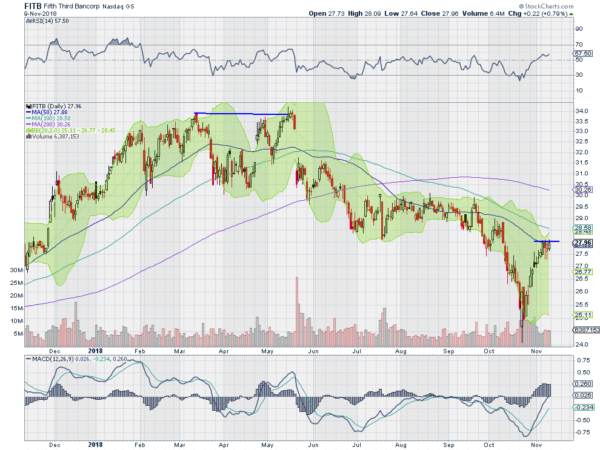

Fifth Third Bancorp (NASDAQ:FITB)

Fifth Third, $FITB, confirmed a double top when it dropped down to its 200 day SMA in May. After a quick bounce it fell back to the 200 day SMA and then through and continued to a bottom almost 30% lower in October. It has bounced in a ‘V’ since and is now consolidating. The RSI is on the edge of a move into the bullish zone with the MACD crossing to positive. Look for a push over resistance to participate higher…..

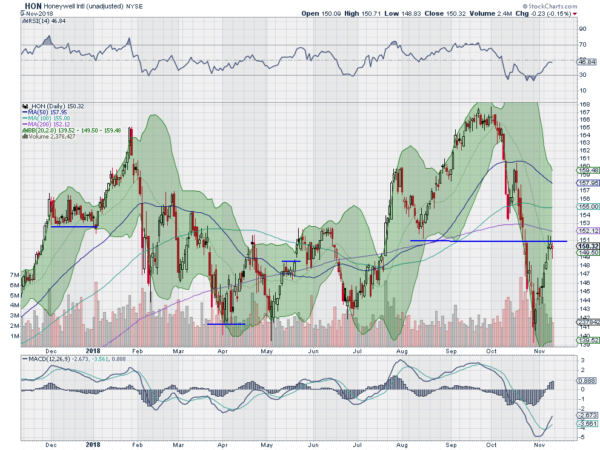

Honeywell (NYSE:HON)

Honeywell, $HON, made a high in January and then pulled back to an April low. It bounced over that in consolidation for 4 months before rising again to a higher high and consolidating. It pulled back fast in October in two steps to the prior consolidation zone. It managed to bounce back over that at the beginning of November and is holding over the 100 day SMA. The RSI is stalling shy of 60 with the MACD rising. Look of r a move out of consolidation higher to participate…..

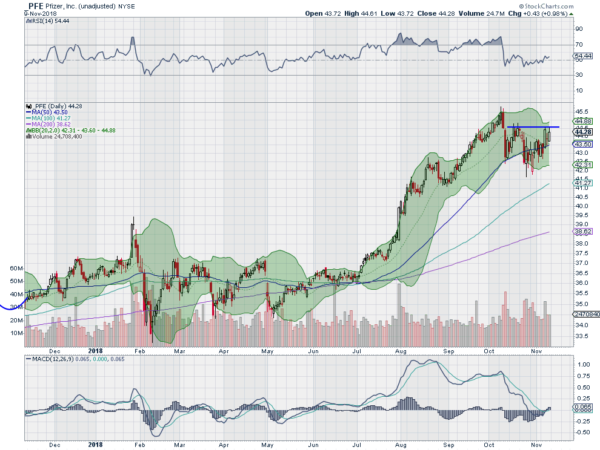

Pfizer (NYSE:PFE)

Pfizer, $PFE, rose out of consolidation in July and continued higher to a top in October. It pulled back from there, to the 50 day SMA at first, then below, where it bounced. It is now back at the initial bounce high. The RSI is drifting up and the MACD crossed up and positive. Look for a push over resistance to participate…..

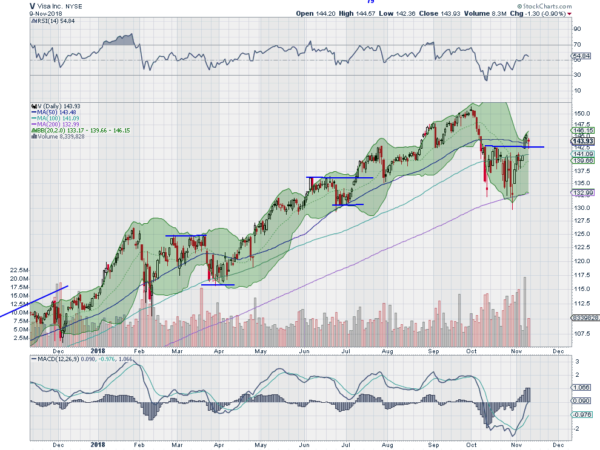

Visa (NYSE:V)

Visa, $V, started moving higher after the 2016 election. It topped at the end of September and pulled back eventually to touch its 200 day SMA 2 weeks ago. Since then it has moved higher and with the gap up Wednesday last week moved over short term resistance. The RSI is on the edge of the bullish zone with the MACD shifting to positive. Look for continued movement higher to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into November Options Expiration sees the equity markets showed a good bounce on the week but with a weak finish Friday.

Elsewhere look for Gold to consolidate its move higher while Crude Oil continues to move lower. The US Dollar Index is resuming its move higher while US Treasuries are pausing in their downtrend. The Shanghai Composite and Emerging Markets may be pausing in their downtrends.

Volatility continues to settle down in a slow fade, removing some downward pressure on equities, but it remains slightly elevated. The equities themselves are mixed with the SPY (NYSE:SPY) strongest and in a short term uptrend, while the IWM is pausing in its move higher and the QQQ is the weakest but broadly consolidating after the pullback. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.