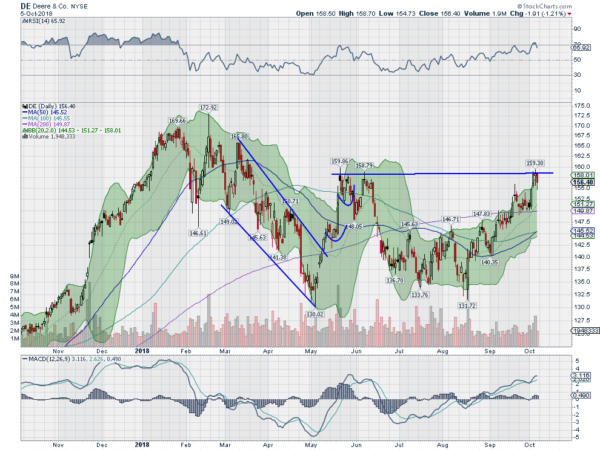

Deere, Ticker: $DE

Deere, $DE, pulled back from a January high running lower in a channel to a bottom at the beginning of May. It bounced from there to a lower high into June and then fell back again to the May low. It held there until a move higher started in August and it now finds the price back at the June bounce resistance. The RSI is pulling back from a touch at overbought with the MACD rising. Look for a push over resistance to participate higher…..

Fiserv (NASDAQ:FISV), Ticker: $FISV

Fiserv, $FISV, seems to do nothing but go up. Thursday it pulled back to rising trend support and Friday held. The RSI is turning back up in the bullish zone with the MACD drifting. Look for a move up off of support to participate…..

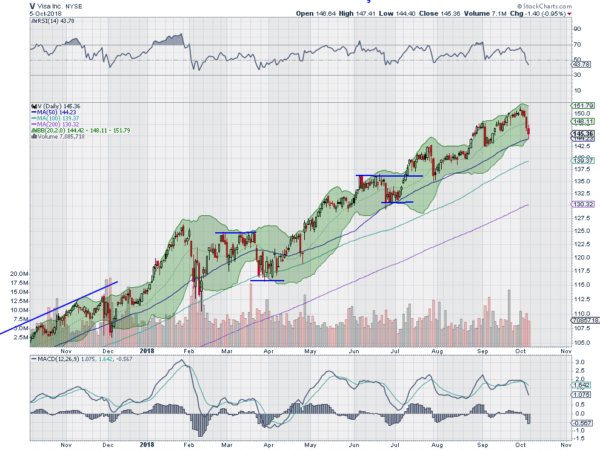

Visa (NYSE:V), Ticker: $V

Visa, $V, started moving higher off of consolidation at the 100 day SMA in April. Since then it has continued higher with a few pullbacks to the 50 day SMA along the way. It is there again now. The RSI has reset lower in the bullish zone and the MACD is falling. Look for a reversal higher to participate…..

Verizon (NYSE:VZ), Ticker: $VZ

Verizon, $VZ, started moving higher out of consolidation around the 200 day SMA in June. That continued to a top in August and it has consolidated there since. The RSI is rising in the bullish zone with the MACD crossed up and rising. Look for a push over resistance to participate…..

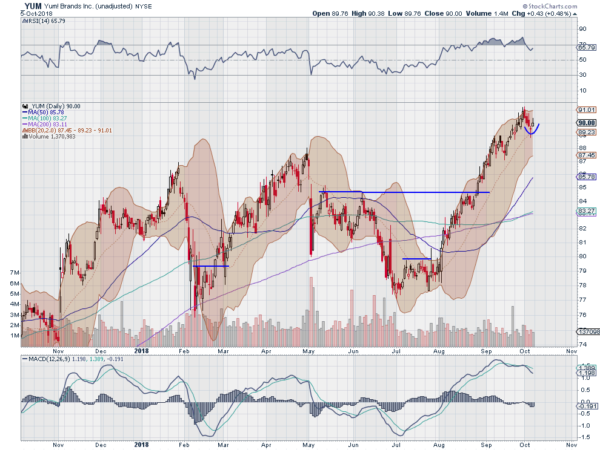

Yum Brands, Ticker: $YUM

Yum Brands, $YUM, started higher in August and continued to a top last week. It pulled back last week and found support at the 20 day SMA, printing a Hammer reversal candle. That confirmed Friday with a move higher. The RSI is turning back up in the bullish zone with the MACD drifting lower. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which after one week of October sees the equity markets have given up strength with some sectors bleeding red in the shorter frame while holding key levels on the longer timeframe.

Elsewhere look for Gold to consolidate in the downtrend while Crude Oil pauses in its move higher. The US Dollar Index is moving higher in consolidation while US Treasuries are trending lower. The Shanghai Composite comes back from vacation looking like a possible reversal to the upside but Emerging Markets resumed their downtrend.

Volatility perked up and may continue, making it more difficult for the equity index ETF’s SPY, IWM and QQQ. The IWM is in full blow short term downtrend but at support on the longer timeframe. The QQQ are consolidating on the longer timeframe but also leaking in the shorter view. The SPY looks the strongest on that longer timeframe but is also dipping to retest the January highs in the short run. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.