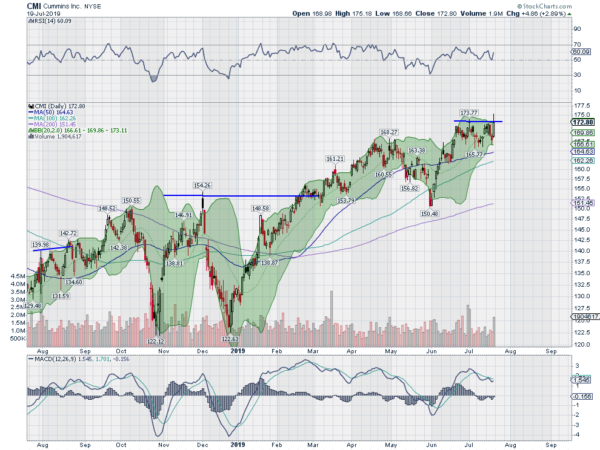

Cummins, Ticker: $CMI

Cummins Inc (NYSE:CMI) rose off of a December low and confirmed a break higher as it made a higher high in February. It continued to a top in April before a pullback that found support at the end of May. Another drive higher met resistance just after making a higher high and it has consolidated since. Friday saw it at the top of the consolidation with the RSI rising on the bullish zone and the MACD trying to cross up. Look for a pushover resistance to participate.

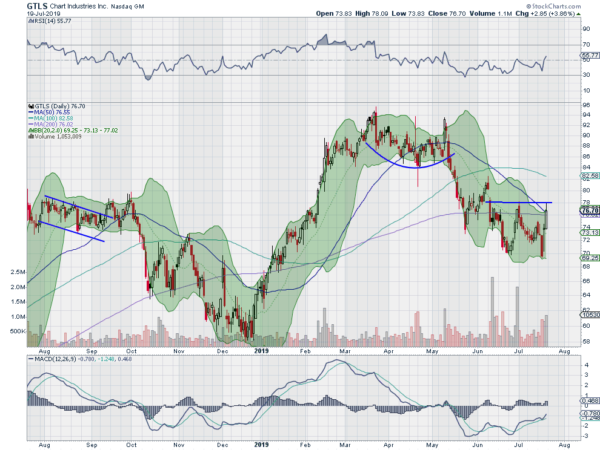

Chart Industries, Ticker: $GTLS

Chart Industries Inc (NASDAQ:GTLS) started higher in December, reaching a peak in March. From there it consolidated and then pulled back, first to the 200 day SMA and then further. It has been consolidating the past 6 weeks under resistance with the RSI rising towards the bullish zone and the MACD moving higher. Look for a pushover resistance to participate.

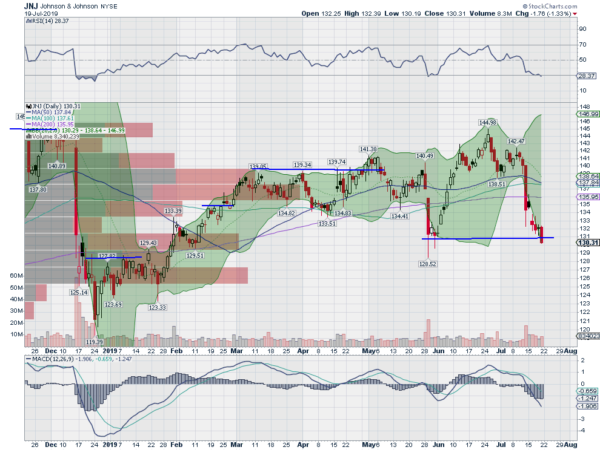

Johnson & Johnson, Ticker: $JNJ

Johnson & Johnson (NYSE:JNJ) bounced off of a bottom in December and moved higher for 4 months. It pulled back then and made another charge to the upside, stalling at the gap down from December. Now it is moving lower still. The RSI is falling in the bearish zone with the MACD dropping and negative. Look for continuation to participate.

Lam Research, Ticker: $LRCX

Lam Research (NASDAQ:LRCX), $LRCX, also rose from a December low, peaking at the end of April. It pulled back, finding support just above the 200 day SMA and consolidated until Thursday. That is when it broke consolidation to the upside. The RSI is rising and bullish with the MACD rising and positive. Look for continuation to participate…..

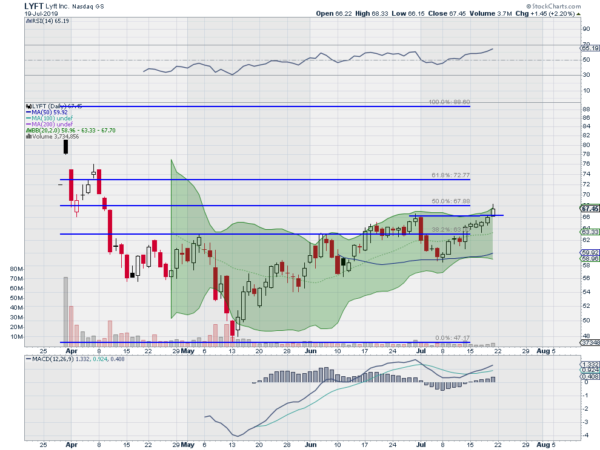

Lyft, Ticker: $LYFT

LYFT Inc (NASDAQ:LYFT) started bleeding right after the first trade following its IPO. It finally bottomed in May 6 weeks later. Since then it has been recovering and closed last week having retraced 50% of the drop. The RSI is rising and bullish with the MACD positive and moving higher. Look for continuation to participate.

Elsewhere look for Gold to pause in its uptrend while Crude Oil drives lower. The US Dollar Index remains stuck in a sideways consolidation while US Treasuries are pausing in their uptrend. The Shanghai Composite and Emerging Markets look to be consolidating sideways, the Shanghai Composite after a pullback and Emerging Markets in an uptrend.

Volatility looks too low but drifting up keeping the bias slightly lower for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts all show consolidative pullbacks in the shorter time frame, with the SPY and QQQ showing no real damage, while the IWM continues to tread water. The SPY and QQQ look strong on the longer timeframe with the IWM continuing to sideways on this timeframe also. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.