Cboe Global Markets, Ticker: $CBOE

Cboe Global Markets, $CBOE, has been rounding out of a bottom, making a higher high in September and then a higher low on the pullback into October. Now it is back approaching the recent high. The RSI is rising into the bullish zone with the MACD crossed up and positive. Look for continuation to participate higher…..

Donaldson, $DCI, rose up out of a base in July. It quickly moved to a peak in early September before starting to pullback. It has consolidated the move lower the last week as it sits under the 50 day SMA. The RSI is turning back lower with the MACD falling and negative. Look for a break of consolidation or rise off support to participate…..

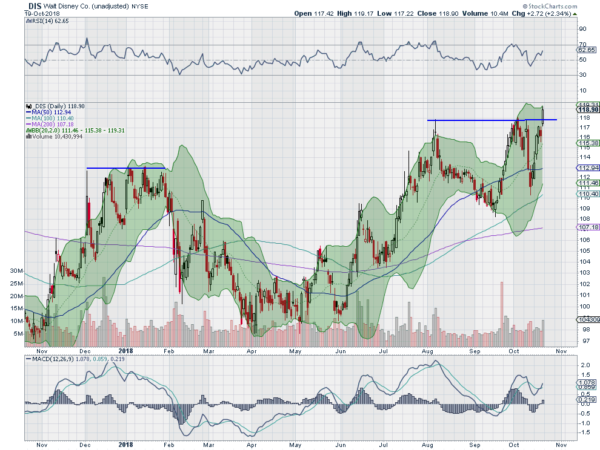

Walt Disney (NYSE:DIS), Ticker: $DIS

Walt Disney, $DIS, started higher in April and reached a peak in early August. From there it pulled back into a low in early September and then bounced. The bounce brought it back to the prior high and then it pulled back to a higher low before reversing again and ending the week at a new high. The RSI is rising and the MACD positive and moving up. Look for continuation to participate higher…..

Intercontinental Exchange, Ticker: $ICE

Intercontinental Exchange, $ICE, has been moving higher since May 2017. In February it pulled back to near the 200 day SMA and that has played a supporting role since. The RSI is rising and the MACD level. Look for a move off of support to participate higher…..

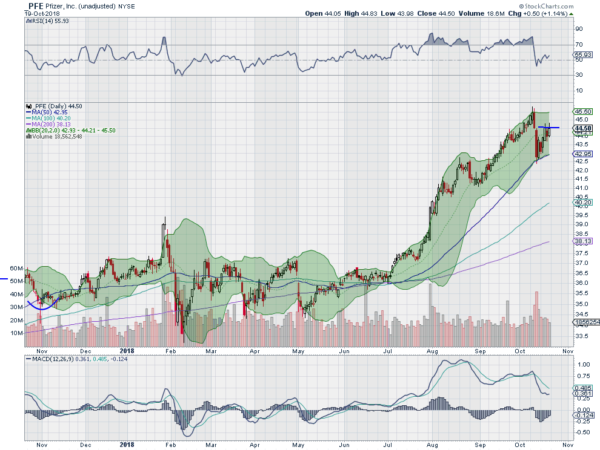

Pfizer (NYSE:PFE), Ticker: $PFE

Pfizer, $PFE, started higher off of the confluence of the SMA’s in July. It paused and pulled back to the 20 day SMA at the end of August and then continued up to the high in early October. Another pullback, this time to the 50 day SMA, saw a bounce and move higher. It ended the week consolidating that move. The RSI is rising and bullish with the MACD flat after a fall and positive. Look for a push higher to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as the October Options Expiry passes saw equities end a week of failed hopes as they rose off of the lows only to fall back by the end of the week.

Elsewhere look for Gold to move higher while Crude Oil continues lower in the short term. The US Dollar Index shows no signs of moving out of consolidation while US Treasuries are moving back lower. The Shanghai Composite continues to look awful as it makes new 4 year lows while Emerging Markets may be pausing in their downtrend.

Volatility pulled back slightly but remains above the longer term steady levels, keeping some pressure on the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts still show damage and little effort to get out of it. Short run reversals at the end of the week will likely bring on more bearish sentiment over the weekend. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.