Cboe, Ticker: $CBOE

Cboe, $CBOE, started moving lower in January with the market. Fast move at first and then an bounce followed by a steady 5 month decline. That made a bottom in August. It has been rising since then and is now near the point of making a higher high. The RSI is rising and bullish with a MACD that is rising and positive. Look for that higher high to participate…..

Cigna, Ticker: $CI

Cigna, $CI, gapped down below its 200 day SMA in March and then had a slow 5 month consolidation. It started back higher in July and gathered pace as August started. As it crossed the 200 day SMA it stalled and it has consolidated ever since. The RSI is rising in the bullish zone with the MACD flattening and positive after a pullback. Look for a push over resistance to participate…..

General Mills, Ticker: $GIS

General Mills, $GIS, started lower with the market in January and continued with a couple of gaps to a low in May. Since then it has drifted slightly higher, but has yet to fill the first gap. The RSI is now bullish and rising with the MACD crossing up and positive as the price consolidated under resistance. Look for a push over it to participate higher…..

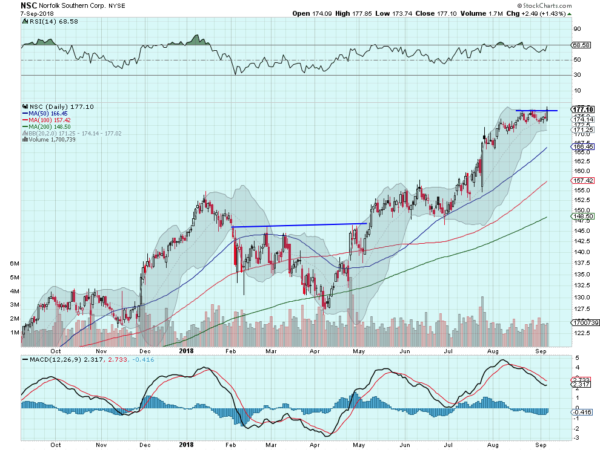

Norfolk Southern, Ticker: $NSC

Norfolk Southern, $NSC, started higher off of a low in April. It paused through May and June and then made a second leg higher. That met resistance in mid-August and it has consolidated since. Friday saw a strong push higher to resistance. The RSI is rising in the bullish zone and the MACD is turning back up. Look for a push over resistance to participate higher…..

Rapid7, Ticker: $RPD

Rapid7, $RPD, was a Top 10 idea a month ago, and went on to a failed break out. Since then it broke out again and held, continuing higher to the present consolidation. It has a RSI that is rising and bullish with the MACD turning back up. Look for a new high to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which after closing the books on summer vacations with the short week, saw some profit taking in the equity markets, but they all remained with strong long term charts.

Elsewhere look for Gold to possibly pause in its downtrend while Crude Oil slowly drifts higher long term. The US Dollar Index is marking time sideways while US Treasuries are biased to continue lower. The Shanghai Composite and Emerging Markets did nothing to change their downside trends.

Volatility has crept higher and set up to slowly continue, keeping pressure on equity markets. The equity index ETF’s SPY, IWM and QQQ, all reacted with moves lower on the week. The QQQ was the hardest hit and then the small caps with the SPY down less than 1%. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.