Bluebird Bio, Ticker: $BLUE

Bluebird Bio (NASDAQ:BLUE), $BLUE, started moving lower in March. In June it dropped under the 200 day SMA and since then it has spent most of its life living under the 50 day SMA. Two weeks ago that changed as it pushed above and held on a shallow pullback last week. The RSI is rising in the bullish zone and the MACD positive and moving higher. Look for a push over resistance to participate higher.

Halliburton, Ticker: $HAL

Halliburton (NYSE:HAL), $HAL, started a move lower in May that continued to a bottom in December. Since then it has been moving higher. It took a pause last week and then closed the week moving back to resistance. The RSI is rising in the bullish zone with the MACD positive and moving up. Look for a push over resistance to participate higher.

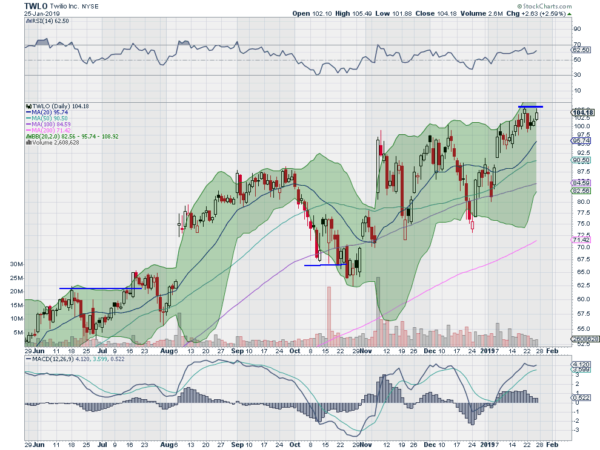

Twilio, Ticker: $TWLO

Twilio (NYSE:TWLO), $TWLO, had a very different 4th quarter than most stocks, as it was up 3.50% on the period. It paused as it came back to the all-time high levels in early January and then continued, ending last week in consolidation pennies from its high. The RSI is turning back up and the MACD is doing the same. Look for a new high to participate to the upside.

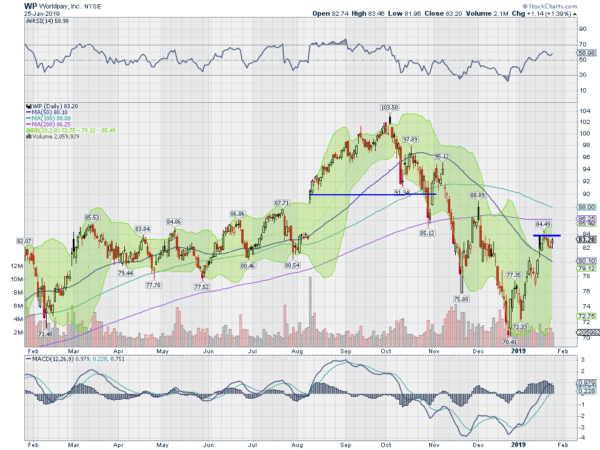

Worldpay, Ticker: $WP

Worldpay (NYSE:WP), $WP, pulled back from a top in October. It bounced off of its 200 day SMA, then took a second leg lower into November. Another bounce and it fell back to the December low. Since then it has moved higher. It crossed the 50 day SMA 2 weeks ago and then paused. Friday it saw a start higher again. The RSI is on the edge of the bullish zone with the MACD rising and positive. Look for a push over resistance to participate.

Zumiez, Ticker: $ZUMZ

Zumiez (NASDAQ:ZUMZ), $ZUMZ, started to pullback from a high in September. It made a weak bounce in October, and then continued to a bottom in December. It consolidated there for most of the month and then started to move back higher. Last week it paused as it touched the 200 day SMA. Friday saw it resume a push higher to resistance. The RSI is rising in the bullish zone with the MACD flat but positive. Look for a push over resistance to participate.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the last week of January, sees equities have taken a pause but remain in their uptrends. But they also remain short declaring that the correction is over.

Elsewhere look for gold to pause in its uptrend while oil pauses in its move higher. The US Dollar Index is back in broad consolidation while US Treasuries pause in their uptrend. The Shanghai Composite is building the case for a possible reversal higher while the MSCI Emerging Markets is building a reversal itself.

Volatility looks to remain muted keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and (NASDAQ:QQQ). Their charts remain strong in the short timeframe and just short of full bullish on the longer timeframe. Use this information as you prepare for the coming week and trade them well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.