American Express (NYSE:AXP), Ticker: $AXP

American Express (NYSE:AXP) started higher in December and has had a strong trend higher since. The reversal at the end of last week points to another leg higher with the RSI rising into the bullish zone and the MACD crossing up and positive. Look for continuation to participate.

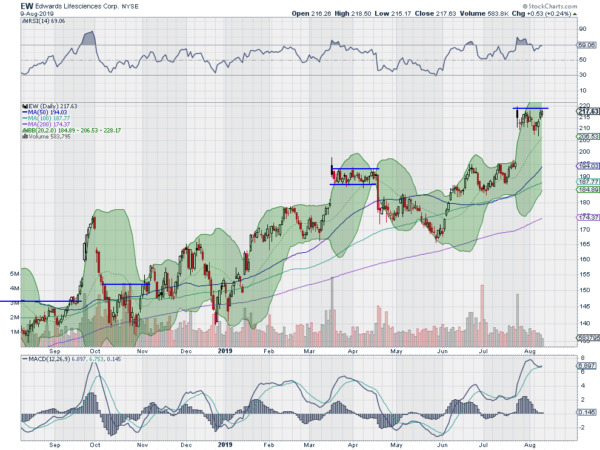

Edwards Lifesciences (NYSE:EW), Ticker: $EW

Edwards Lifesciences (NYSE:EW) pulled back from a gap up in March, finding a bottom in May. It rose back to that top in June and held until a gap up in July. It has consolidated that gap up since. The RSI is in the bullish zone with the MACD avoiding a cross down. Look for a pushover resistance to participate.

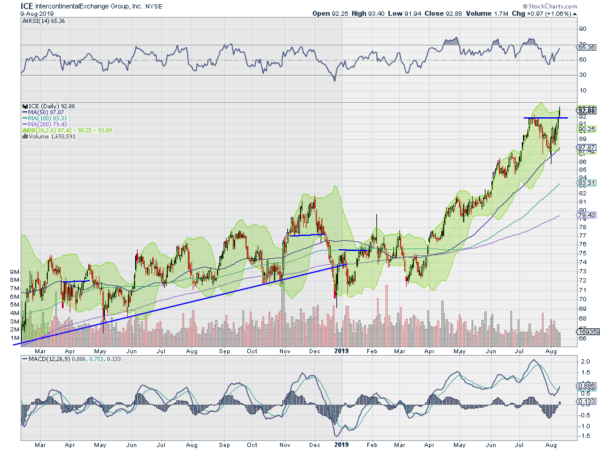

Intercontinental Exchange, Ticker: $ICE

Intercontinental Exchange (NYSE:ICE) started higher out of consolidation in April. It continued to move higher, reaching a peak in the beginning of July. It pulled back from there to the 50 day SMA and reversed 2 weeks ago. It ended last week back at the prior top and pushing through. The RSI is rising and bullish with the MACD crossed up and positive. Look for continuation to participate.

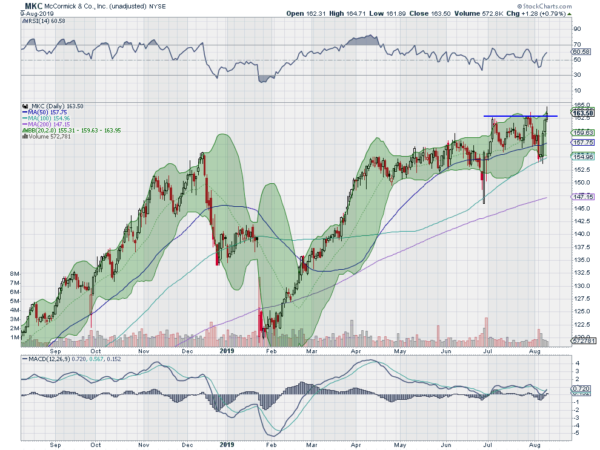

McCormick (NYSE:MKC), Ticker: $MKC

McCormick & Company (NYSE:MKC) rose off of a bottom in January. It ran fast to an interim peak in April and then shifted to a slower climb. After a pullback at the end of June it made a higher high and has struggled since. Friday it made a new high as it pressed through resistance. The RSI is rising and bullish with the MACD crossed up and positive. Look for continuation to participate…..

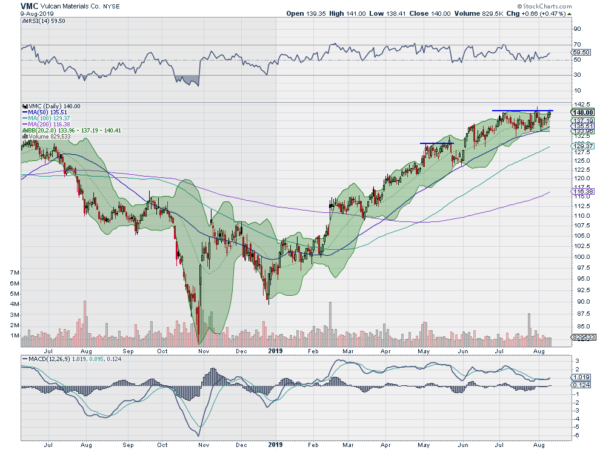

Vulcan Materials, Ticker: $VMC

Vulcan Materials (NYSE:VMC) has trended higher since February. The move slowed as it hit resistance at the beginning of July. It has consolidated under resistance since. The RSI is rising and bullish with the MACD crossing up. Look for a pushover resistance to participate.

Elsewhere look for Gold to continue in its uptrend while Crude Oil may be ready to pause in its pullback. The US Dollar Index continues the slow grind higher in a wide channel while US Treasuries may be ready to pause in their uptrend. The Shanghai Composite and Emerging Markets have resumed their path lower.

Volatility has picked up slightly making the path higher a bit tougher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts show good recoveries from a shock in the short run, with continued strength in the SPY and QQQ in the long term chart, while the IWM consolidates in a range. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.