Arena Pharmaceuticals (NASDAQ:ARNA)

Arena Pharmaceuticals (NASDAQ:ARNA) has bounced around in a very broad range for the past year. Since late December it has been rising and recently moved out of consolidation in a secondary move higher. The RSI is rising in the bullish zone and the MACD is positive and moving higher. Look for continuation to participate higher.

Biomarin Pharmaceutical (NASDAQ:BMRN)

Biomarin Pharmaceutical started higher from a low in April last year. It peaked in August and then had mild digestion before a retest of the high in October. The drop form there confirmed a Double Top and it pulled back, first to the 200-day SMA and then to the December low. It swiftly rose from there to retest the top of December consolidation and after a digestive pullback is back there again coming into the week. The RSI is bullish and rising with the MACD positive and rising. Look for a pushover resistance to participate.

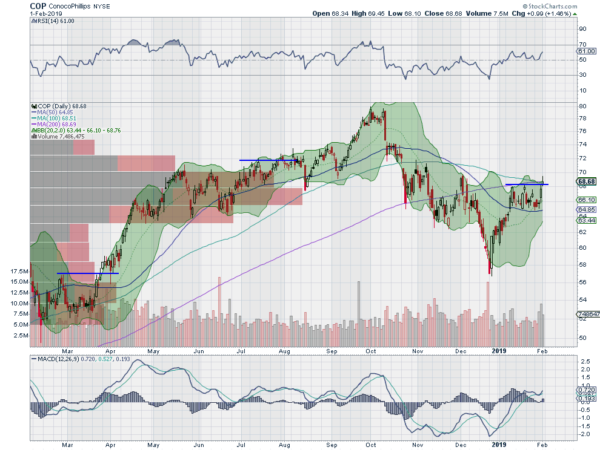

ConocoPhillips

ConocoPhillips (NYSE:COP) made a top in October and started pulling back. It paused at the 200-day SMA and then continued lower into December. It found a bottom on Christmas Eve and bounced. It has now stalled at the 200-day SMA. Friday saw it peek over the top but it could not hold. The RSI is rising in the bullish zone with the MACD positive and moving up. Look for continuation to participate.

JB Hunt Transport Services (NASDAQ:JBHT)

JB Hunt Transport broke below the 200-day SMA in October beginning a move to the downside. It paused through to mid-November and then resumed lower to a late December low. It reversed and started higher in January, stalling when it hit the prior consolidation top. A short pullback and it reversed again to the same resistance. The RSI is rising and bullish with the MACD positive and moving up. Look for a pushover resistance to participate.

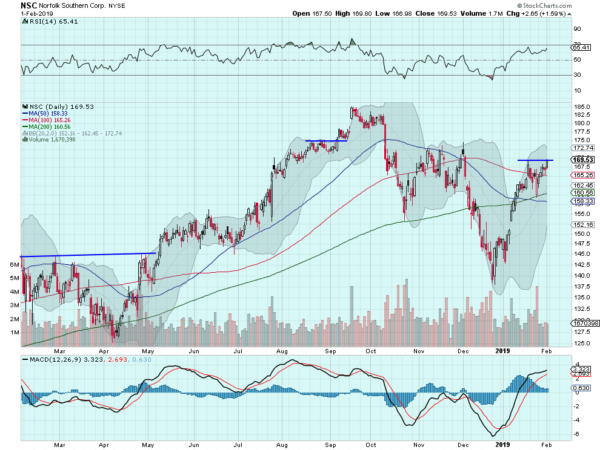

Norfolk Southern

Norfolk Southern (NYSE:NSC) reached a top in September and paused. It started lower in October and touched the 200-day SMA before bouncing to a lower high. A second leg down then made a low in December. It has moved higher since and is now consolidating the move the past 2 weeks. The RSI is strong in the bullish zone with the MACD flat but positive. Look for a push over resistance to participate.

Bonus Idea

Elsewhere, look for gold to continue in its uptrend while crude oil looks to break higher as well. The US Dollar Index continues to mark time moving sideways while US Treasuries are at resistance. The Shanghai Composite is building a reversal and Emerging Markets have confirmed a reversal higher.

Volatility looks to remain low and falling keeping the breeze at the backs of the equity index ETF’s SPY, IWM and QQQ. Their charts show a possible pause in the short term but the longer picture continues to look strong, as they close in on printing the first higher high since the drop. Use this information as you prepare for the coming week and trad’em well.