Arconic Inc (NYSE:ARNC)

Arconic, $ARNC, made a top in January and then pulled back in two steps. It consolidated at the bottom for nearly 3 months before a reversal higher began. That move stalled as it reached the 1st step down and then pulled back into the end of October. Now it is at resistance with the RSI rising and the MACD about to turn positive. Look for a push over resistance to participate…..

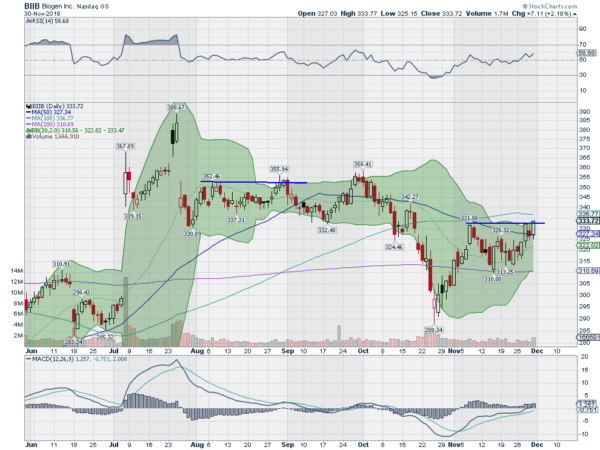

Biogen (NASDAQ:BIIB)

Biogen, $BIIB, gapped higher in July and ran. It gapped again two weeks later to a blow off top and then gapped down. After all that activity it then held steady in a range for two and a half months before dropping to fill the first gap. It bounced and recovered to test the bottom of the prior range and then pulled back. A touch at the 200 day SMA and it is now moving back over the prior high. The RSI is on the edge of a move into the bullish zone and the MACD is rising and now positive. Look for continuation to participate…..

Graco Inc (NYSE:GGG)

Graco, $GGG, fell from a third tap at resistance in September and accelerated to the downside. It found a bottom 1 month later in October over 20% lower. The bounce from there was strong and reached the 50 day SMA before receding in a digestive move. Now it is back at that resistance. The RSI is rising and bullish with the MACD turning positive. Look for continuation to participate…..

Johnson & Johnson (NYSE:JNJ)

Johnson & Johnson, $JNJ, rose from a pullback in October making a higher high as it moved into November. It topped out shortly after and retraced back to the prior high and the 50 day SMA before the latest move higher. Now it is at resistance with a RSI strong in the bullish zone and the MACD trying to cross up. Look for a push over resistance to participate higher…..

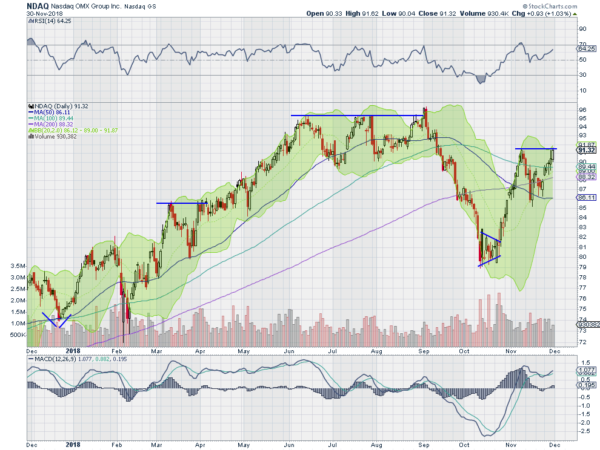

Nasdaq Inc (NASDAQ:NDAQ)

Nasdaq, $NDAQ, had a strong run higher to a plateau over the summer. It started to pullback in September finding support and consolidating in October. It moved back higher and stalled at a lower high. A shallow pullback to the 50 day SMA was followed by a reversal and it is now back at that latest peak. The RSI is rising and bullish and the MACD is positive and moving up. Look for a push over resistance to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with 1 month left in the year sees equities have given up most or all of their gains for the year, but are looking to start December moving higher. Perhaps a Santa Claus rally can repair some of the damage.

Elsewhere look for Gold to consolidate in the short term while Crude Oil pauses in its downtrend. The US Dollar Index is resuming the path higher while US Treasuries bounce in their downtrend. The Shanghai Composite is resuming its path lower while Emerging Markets pause in their downtrend.

Volatility looks to remain elevated but stable, putting light pressure on equities. The equity index ETF’s SPY (NYSE:SPY), IWM and QQQ, all showed great strength on the week and look to continue that into December. On the longer scale the QQQ has the most work to do to reverse the downtrend, while the IWM and SPY have stopped the bleeding for now. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.