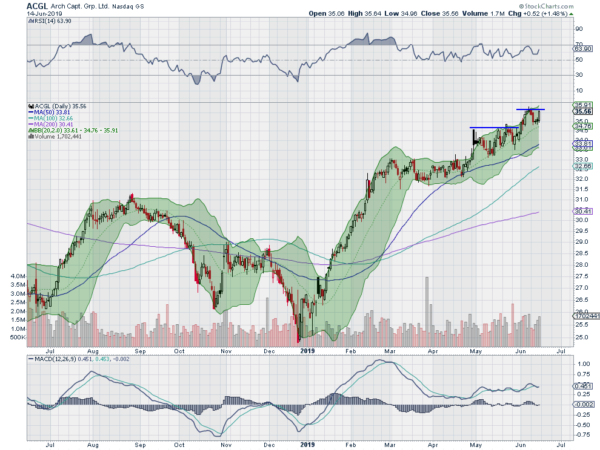

Arch Capital Group, Ticker: $ACGL

Arch Capital Group Ltd (NASDAQ:ACGL) ran from a December low to a plateau from March through April. It started higher again in May and is now consolidating that move. The RSI is rising and bullish with the MACD flat and positive. Look for a push over consolidation to participate.

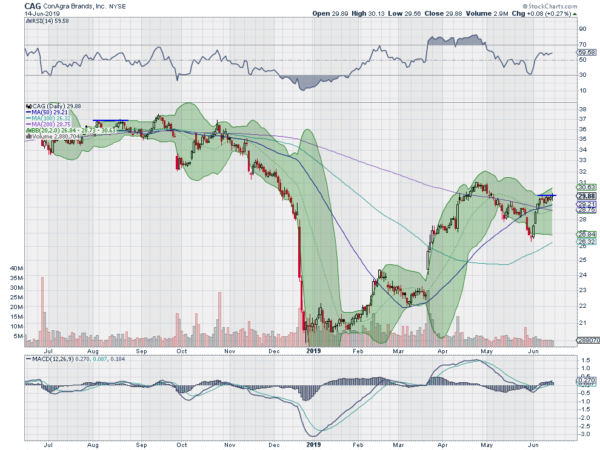

Conagra, Ticker: $CAG

ConAgra Foods Inc (NYSE:CAG) started higher in March and stalled as it hit the 200 day SMA in April. It pulled back through the end of May and then reversed. Now it is consolidating in that move. The RSI is stalling just under the bullish edge with the MACD rising and positive. Look for a pushover resistance to participate.

Service Corporation, Ticker: $SCI

Service Corporation International (NYSE:SCI) is pushing above February resistance to a higher high. The RSI is bullish and the MACD rising and positive. Look for continuation to participate.

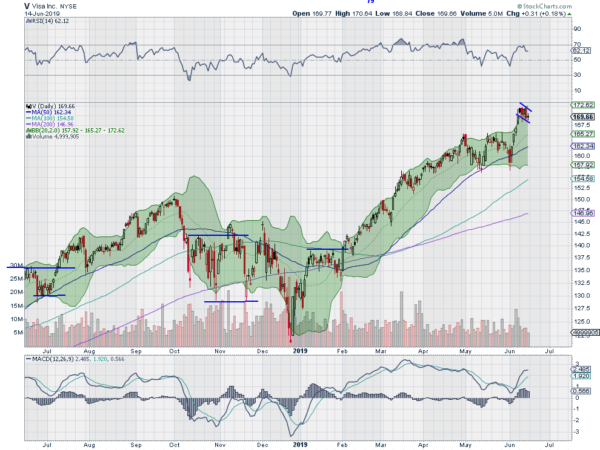

VISA, Ticker: $V

Visa Inc Class A (NYSE:V) ran from a low in December to a plateau in May. It broke higher to start June but comes into the week consolidating that move. The RSI is holding bullish with the MACD flat but positive. Look for a pushover resistance to participate.

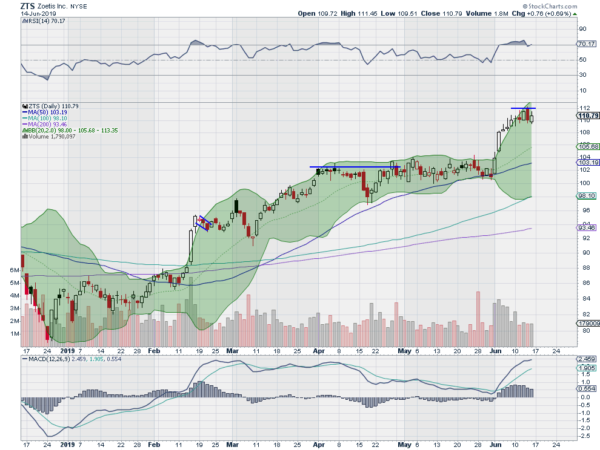

Zoetis, Ticker: $ZTS

Zoetis Inc (NYSE:ZTS) started higher out of consolidation at the beginning of June. Currently, it is pausing and consolidating that move. The RSI is reset out of overbought territory in the bullish zone with the MACD flat and positive. Look for a pushover resistance to participate.

Up Next: Bonus Idea

Elsewhere look for Gold to continue in its uptrend while Crude Oil continues to move lower. The US Dollar Index is now in a short term downtrend while US Treasuries continue to be biased higher. The Shanghai Composite and Emerging Markets are pulling back lower. Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show a loss of power and momentum in the short run but continued strength in the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.