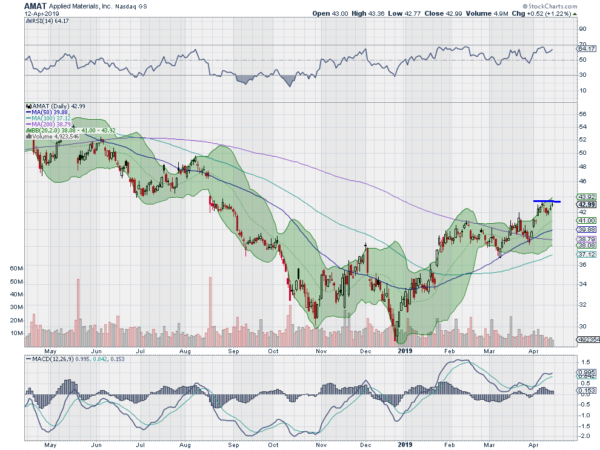

Applied Materials), Ticker: $AMAT

Applied Materials (NASDAQ:AMAT) started higher out of a bottom in December. It paused as it hit the 200-day SMA and then took another step higher as the 50-day SMA came up to meet the price. Coming into the week it is consolidating under resistance with the RSI rising in the bullish zone and the MACD rising and positive. Look for a pushover resistance to participate.

Eaton Vance, Ticker: $EV

Eaton Vance Corp (NYSE:EV) moved from a drift lower to a steep decline in October. It bottomed at the end of December and started to move back up. It stalled in that move at the end of February and has been consolidating since. The RSI is rising with the MACD turning up and positive. Look for a pushover resistance to participate.

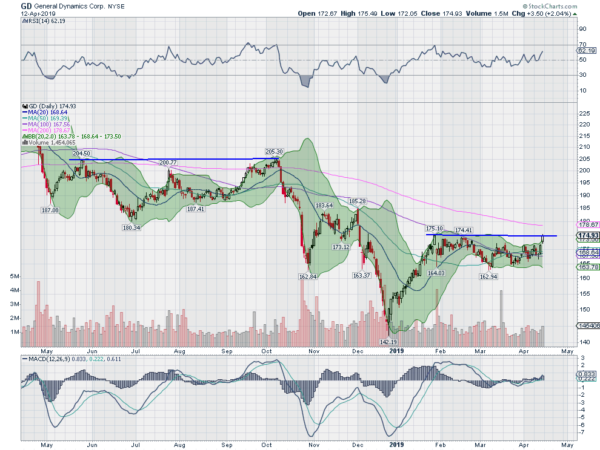

General Dynamics , Ticker: $GD

General Dynamics Corporation (NYSE:GD) fell from a high in April last year. It bounced to the 200-day SMA in May but could not hold over it. It consolidated there for the 5 months before starting lower again. It found support at the end of December and reversed higher into January. That move stalled at the end of the month and it has held in consolidation since. Friday saw a move to resistance with the RSI rising in the bullish zone and the MACD lifting off of zero. Look for a move higher to participate.

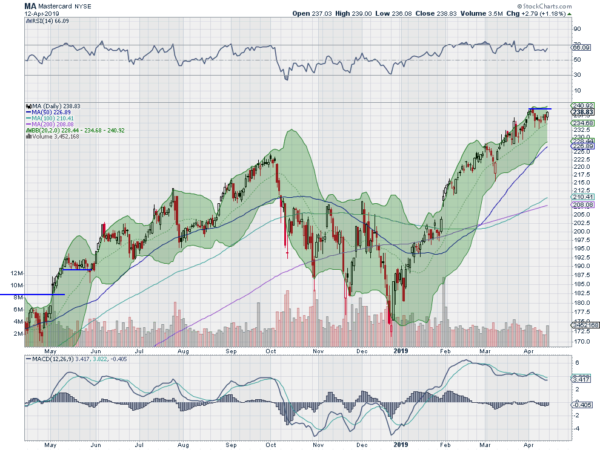

Mastercard), Ticker: $MA

Mastercard Inc (NYSE:MA) started to move higher in December. It slightly overshot the October high in February and then had a minor pullback. It then continued to the current plateau. The RSI is holding strong in the bullish zone with the MACD positive and drifting lower slowly. Look for a pushover resistance to participate.

Royal Caribbean, Ticker: $RCL

Royal Caribbean Cruises Ltd (NYSE:RCL) dropped in two steps to a low in December. Since then it has bounced and began to consolidate after making a higher high. Friday saw the price pushing up against resistance with the RSI rising in the bullish zone and the MACD lifting off of zero. Look for a pushover resistance to participate.

Up Next: Bonus Idea

Elsewhere look for Gold to consolidate in a tightening triangle while Crude Oil advances higher. The US Dollar Index continues to consolidate sideways while US Treasuries pull back retesting their break out. The Shanghai Composite looks to pause in its uptrend while Emerging Markets are biased to head higher.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, NYSE:IWM and QQQ. The SPY and QQQ seem ready to retest their all-time highs while the IWM has gotten caught up at resistance and continues to churn sideways. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.