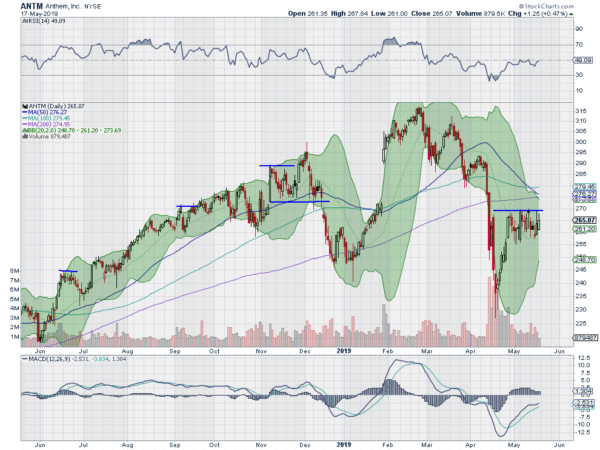

Anthem (NYSE:ANTM), Ticker: $ANTM

Anthem, $ANTM, took a nose dive in April, dropping over 20% in just 4 days before finding footing. The bounce from there reached the 20 day SMA at the end of the month and it has been consolidating there ever since. The RSI is holding at the mid line with the MACD level but negative. Look for a push over resistance to participate….

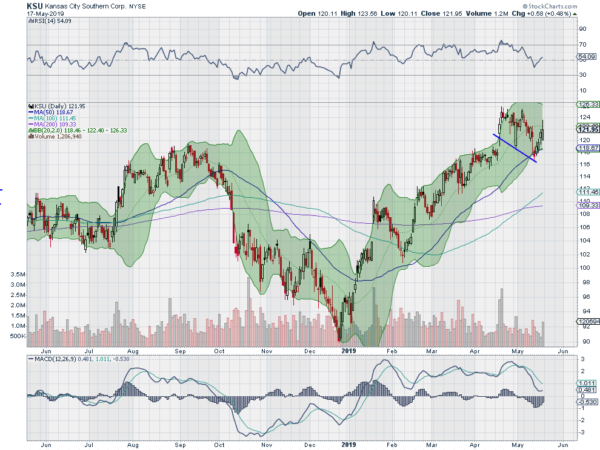

Kansas City Southern (NYSE:KSU), Ticker: $KSU

Kansas City Southern (NYSE:SO), $KSU, had a strong run higher off of a low in December reaching a top in mid-April. It pulled back from that, retesting the 50 day SMA 2 weeks ago. It is now moving higher again. The RSI is rising in the bullish zone with the MACD turning to cross up. Look for a push over Friday’s high to participate…..

Pfizer (NYSE:PFE), Ticker: $PFE

Pfizer, $PFE, pulled back to a low in April and then bounced. It stalled as it touched the 50 day SMA in early May and dropped back to a higher low. Now it is back at the bounce high with the RSI on the edge of a move into the bullish zone and the MACD about to cross to positive. Look for a higher high to participate…..

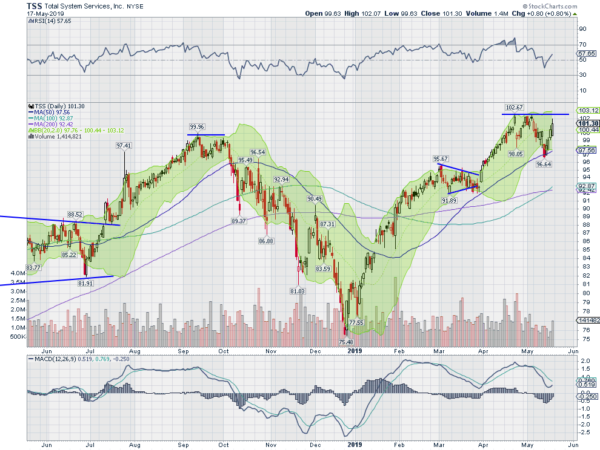

Total System Services (NYSE:TSS), Ticker: $TSS

Total System Services, $TSS, had a strong move higher off of a December low to consolidate in March. A second move from there ran to a top in mid-April before the current consolidation. The RSI is rising in the bullish zone with the MACD turning to cross up and positive. Look for a push over resistance to participate…..

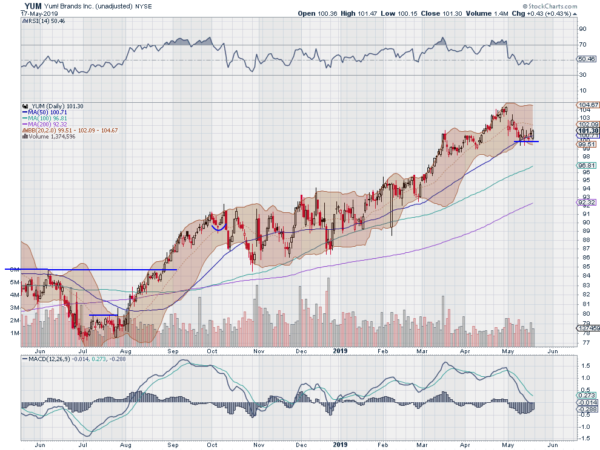

Yum Brands, Ticker: $YUM

Yum Brands, $YUM, met resistance at the start of May after a long run higher. It has since pulled back to the 50 day SMA and consolidated. Friday saw a turn to the upside. It has a RSI turning back higher at the mid line with the MACD leveling as it reset to zero. Look for a lift out of consolidation to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which saw equities continued to experience some setbacks as the markets closed out May options expiration.

Elsewhere look for Gold to continue its pullback while Crude Oil resumes the uptrend. The US Dollar Index looks to drift higher while US Treasuries are also biased to the upside. The Shanghai Composite remains stuck in its pullback while Emerging Markets continue the downtrend.

Volatility looks to continue to moderate easing the pressure on the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts show intra-week strength in the pullbacks of the SPY and QQQ with the IWM stuck in a range. All 3 look weaker on the daily charts. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.