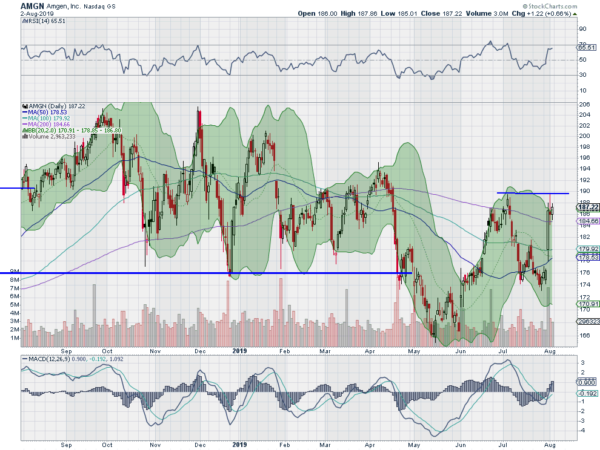

Amgen (NASDAQ:AMGN), Ticker: $AMGN

Amgen, $AMGN, bounced lower to a bottom in May. From there it started higher, stalling at another lower high. But it pulled back to a higher low and started up again. It ended last week at the prior bounce high. The RSI is in the bullish zone and the MACD rising and positive. Look for a push over resistance to participate…..

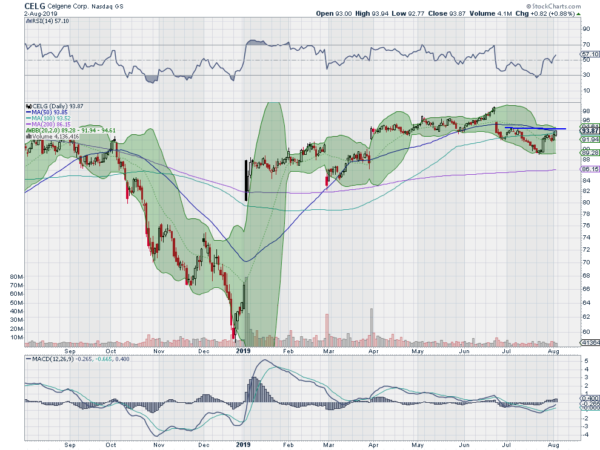

Celgene (NASDAQ:CELG), Ticker: $CELG

Celgene, $CELG, rose off of the bottom at the 200 day SMA in February. It continued to a top at the end of June before a gap down. That ran to a higher low 2 weeks ago and reversed. Now it is back at resistance. The RSI is rising into the bullish zone with the MACD about to cross zero as i moves higher. Look for a push over resistance to participate…..

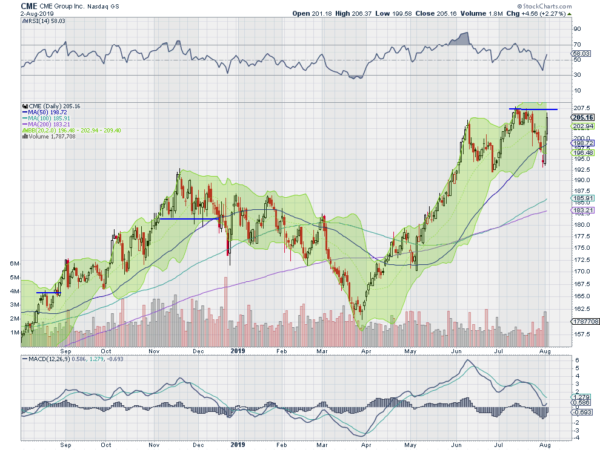

CME Group (NASDAQ:CME), Ticker: $CME

CME Group, Ticker: $CME, bottomed in May and reversed. It paused as it hit the 200 day SMA in April. then it resumes the path higher to a top in June. A pullback quickly found support and reversed to a higher high in July. Another pullback stopped at a higher low and it is now moving higher toward that prior top. The RSI is rising toward the bullish zone with the MACD turning back up and positive. Look for continuation to participate…..

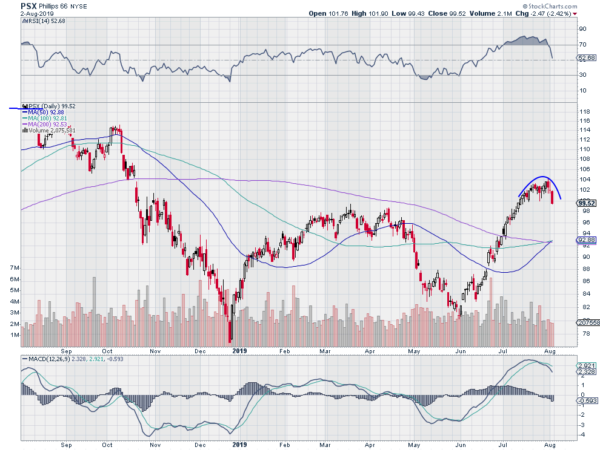

Phillips 66 (NYSE:PSX), Ticker: $PSX

Phillips 66, $PSX, moved off of a higher low to reach a higher high in July. But last week it turned over and started back lower. The RSI is also pulling back with the MACD crossed down and dropping. Look for continuation to participate…..

Skyline Corporation (NYSE:SKY), Ticker: $SKY

Skyline Champion, $SKY,started higher off of a bottom in December. It paused several times along the way, the latest at the end of June. That led to consolidation through July. Last week it pushed higher to resistance from September. The RSI is rising and bullish with the MACD moving higher and positive. Look for continuation to participate…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the dog days of August saw that equity markets had been dinged despite an accommodative FOMC.

Elsewhere look for Gold to move higher while Crude Oil continues to head lower. The US Dollar Index also looks to strengthen while US Treasuries are biased to continue higher. The Shanghai Composite looks to continue lower in the short term while Emerging Markets resume a downtrend.

Volatility looks to move higher putting a bias lower for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts also point to some short term weakness, especially in the SPY and QQQ. Long term the SPY and QQQ still remain strong with the IWM stuck in a range. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.