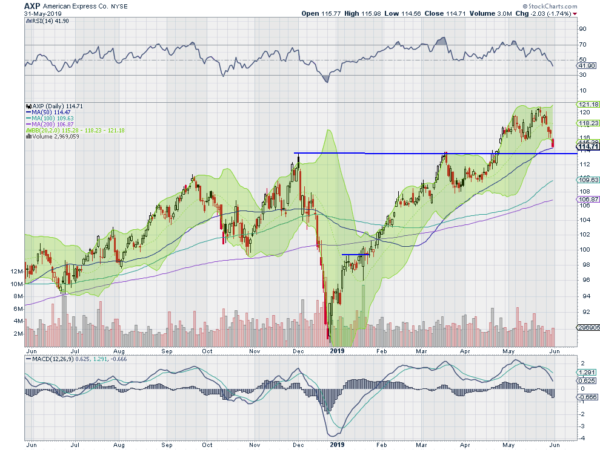

American Express (AXPZ), Ticker: $AXP

American Express (NYSE:AXP) made a top 2 weeks ago after a long run higher from a December low. Friday it closed on the 50 day SMA and at a lower low. The RSI is at the lower edge of the bullish zone with the MACD falling but positive. Look for a push under prior resistance to participate.

Exact Sciences, Ticker: $EXAS

EXACT Sciences Corporation (NASDAQ:EXAS) started moving higher at the end of last week out of consolidation. The RSI is rising in the bullish zone with the MACD crossed up and positive. Look for a push over resistance to participate.

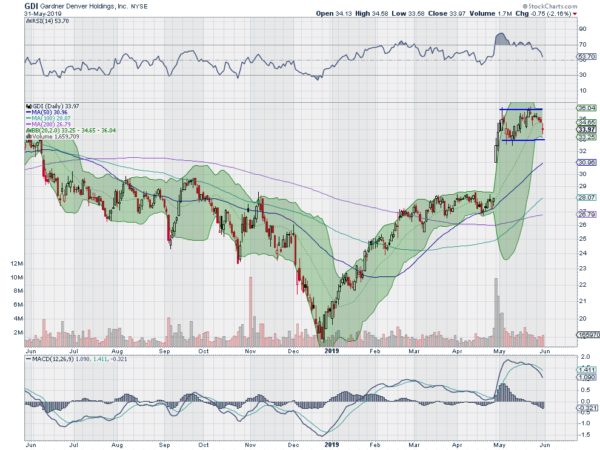

Gardner Denver, Ticker: $GDI

Gardner Denver Holdings Inc (NYSE:GDI) was a Top 10 last week and failed to break higher. Instead, it fell out of an ascending triangle. Now it is near support to the downside. The RSI is pulling back with the MACD crossed down and dropping. Look for a drop through support to participate.

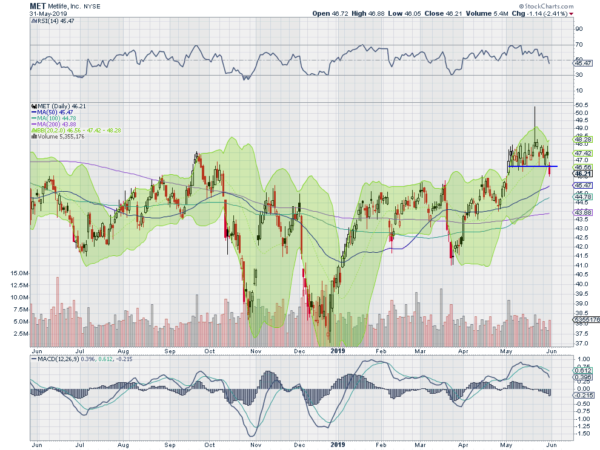

MetLife (MET)), Ticker: $MET

MetLife Inc (NYSE:MET) made a move higher from a March low. That topped with a blow off candle May 21st while in consolidation. It ended last week breaking down through support. The RSI is falling in the bullish zone with the MACD crossed down and dropping. Look for continuation to participate.

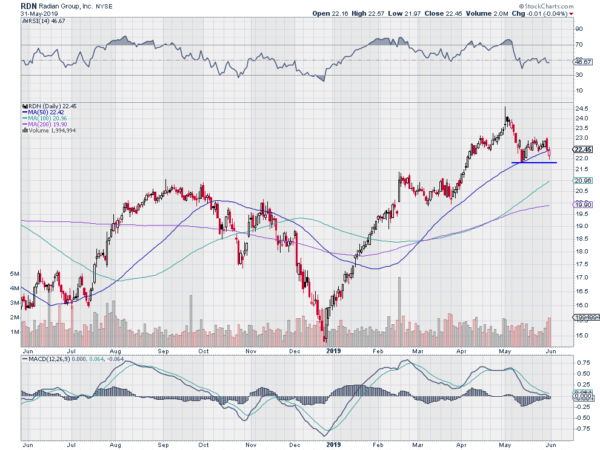

Radian Group, Ticker: $RDN

Radian Group Inc (NYSE:RDN) started higher in December, paused in February and then continued to a top at the beginning of May. It pulled back to the 50 day SMA from there and found support. A small bounce met quick resistance and it held until it lost ground at the end of last week. The RSI is holding in the low end of the bullish zone with the MACD flat at zero. Look for a drop through support to participate…..

Elsewhere look for Gold to continue in its uptrend while Crude Oil continues lower. The US Dollar Index continues to drift higher while US Treasuries are very strong but overbought. The Shanghai Composite continues to consolidate in its downtrend while Emerging Markets may be reversing back higher.

Volatility looks to drift up putting downward pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts are showing the pain in the short run and that is now moving into the weekly timeframe as well. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.