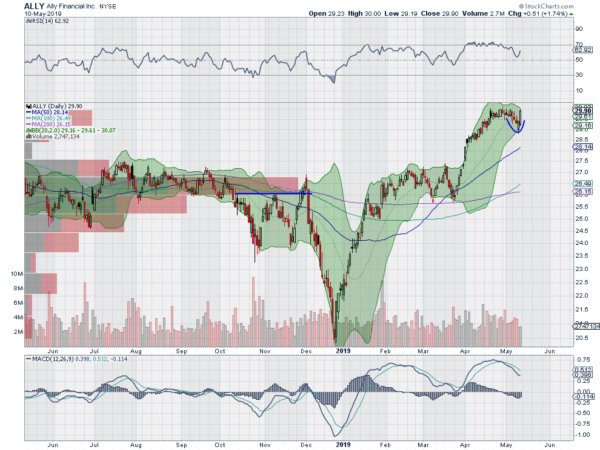

Ally Financial, Ticker: $ALLY

Ally Financial Inc (NYSE:ALLY) started higher in December and met resistance when it rose over its 200-day SMA. It held there for 2 months before a second move higher that topped in April. It digested that move and pulled back to the lower Bollinger Band® before a reversal higher Friday. The RSI is rising in the bullish zone with the MACD flat and positive. Look for a push to new highs to participate.

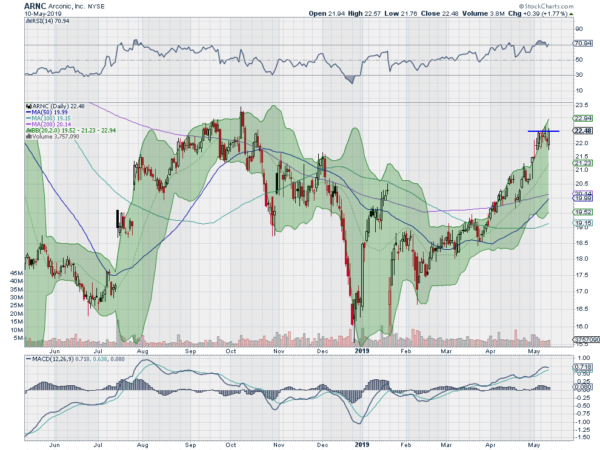

Arconic, Ticker: $ARNC

Arconic Inc (NYSE:ARNC) started moving higher in February. It crossed the 200 day SMA in April and paused momentarily then advanced again. Coming into the week it is consolidating again with the RSI slightly overbought and the MACD flat and positive. Look for a push up out of consolidation to participate.

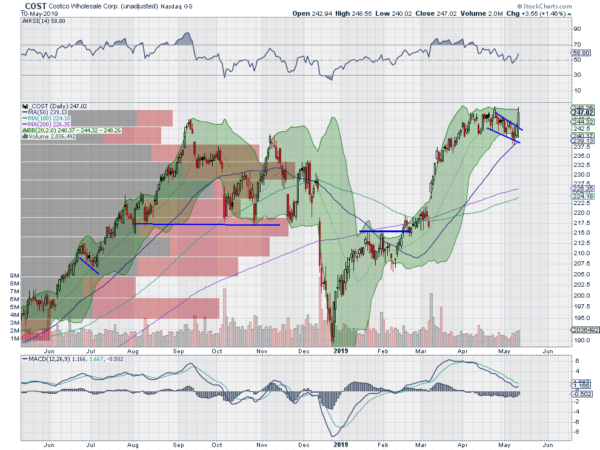

Costco, Ticker: $COST

Costco (NASDAQ:COST) started higher in December, pausing to consolidate over prior support into March. It then moved higher again, continuing to a new all-time high. It pulled back from there to touch the 50-day SMA and then reversed Friday. It has a RSI rising again in the bullish zone with the MACD curling back up and positive. Look for continuation to participate.

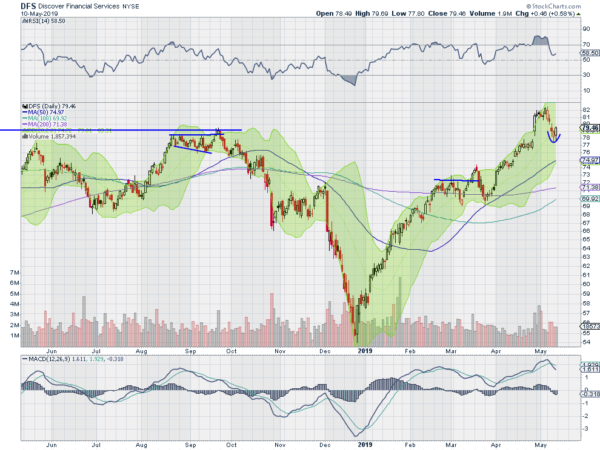

Discover Financial, Ticker: $DFS

Discover Financial Services (NYSE:DFS) started higher in December. It paused and consolidated when it reached the November consolidation zone over the 200-day SMA. It then continued higher and made a new all-time high at the beginning of the month. Since then it has been pulling back and it filled the gap from April Thursday. Friday saw it move back higher. The RSI is turning up in the bullish zone with the MACD flat and positive. Look for continuation to participate higher.

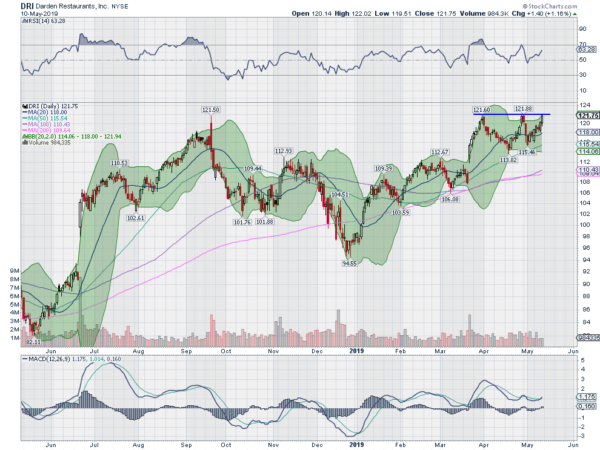

Darden Restaurants, Ticker: $DRI

Darden Restaurants (NYSE:DRI) also started higher in December. I consolidated at the zone where it previously churned through November and then continued to the September high. It has been consolidating there since. The RSI is rising in the bullish zone with the MACD crossing up and positive. Look for a push higher to participate.

Up Next: Bonus Idea

Elsewhere look for Gold to pause in its downtrend while Crude Oil continues to pullback in the uptrend. The US Dollar Index looks to continue to move sideways while US Treasuries are biased to continue higher. The Shanghai Composite may be ending its pullback while Emerging Markets are biased to the downside in the short run.

Volatility looks to settle back after a pop higher, easing the pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts show decent resets lower in the SPY and QQQ with the IWM back in its range. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.