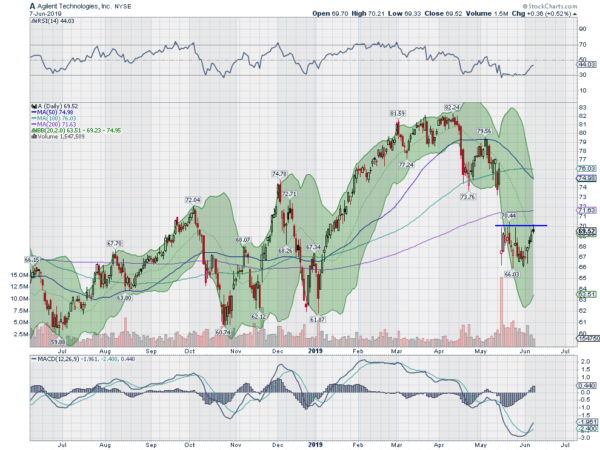

Agilent Technologies Inc, Ticker: $ALL

Agilent Technologies Inc (NYSE:A) rose to a top in March and then started moving lower. It paused in April and bounced then retested in May before a gap down. It found support at the end of May and held. Now it is moving back higher with an RSI rising and a MACD crossed up. Look for a pushover resistance to participate higher.

Allstate (ALL), Ticker: $ALL

Allstate (NYSE:ALL) rose from a bottom in December started to plateau in February. It has moved sideways since until a break to the upside Friday. The RSI is bullish and rising with the MACD rising off of the zero line. Look for continuation to participate higher.

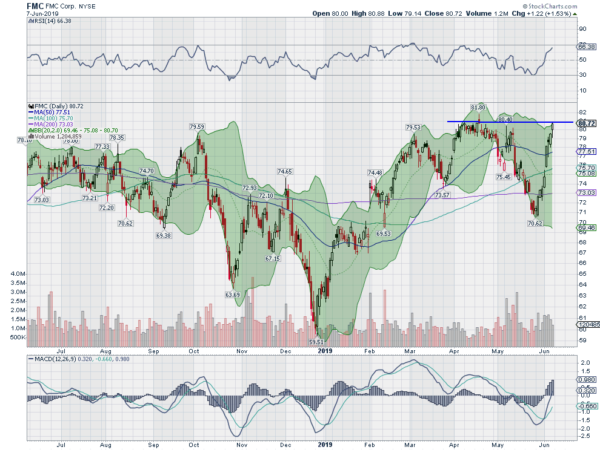

FMC, Ticker: $FMC

FMC Corporation (NYSE:FMC) rose from a December low and finally met resistance in April. It pulled back from there finding support in mid-May. Since then it has been moving back higher. It has a RSI rising in the bullish zone with the MACD rising and positive. Look for a push over resistance to participate.

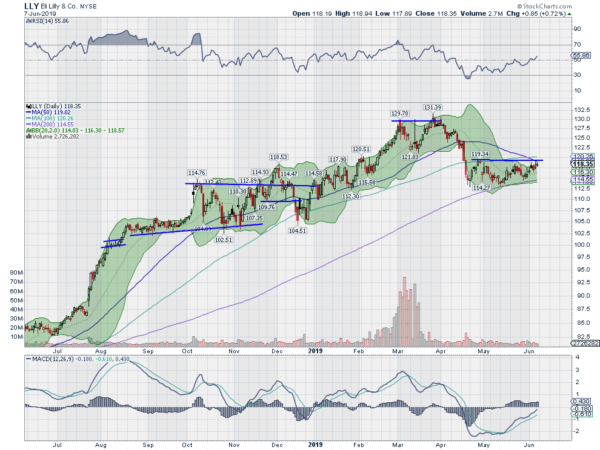

Eli Lilly (LLY), Ticker: $LLY

Eli Lilly (NYSE:LLY) paused in a move higher over last fall. It resumed in December and reached a top in March. It pulled back and found support into April. It held there and is now up against resistance. The RSI is rising toward the bullish zone with the MACD rising but still negative. Look for a move over resistance to participate.

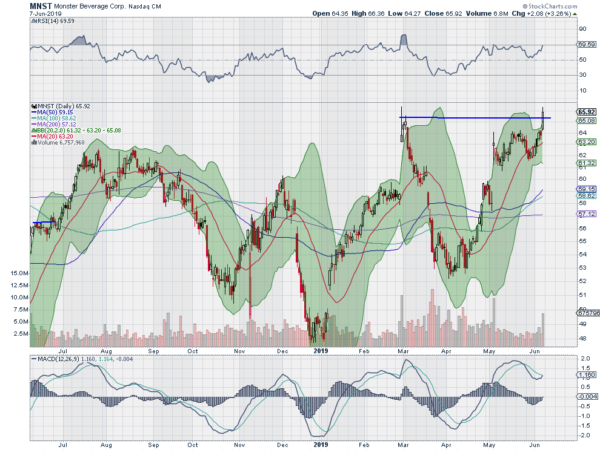

Monster Beverage (MNST), Ticker: $MNST

Monster Beverage (NASDAQ:MNST) made a top in February and then started to move lower. It found support in March and reversed higher. It consolidated in May and held in a range until Friday. The RSI is bullish and rising with the MACD crossing up and positive. Look for continuation to participate.

Up Next: Bonus Idea

Elsewhere look for Gold to continue higher while Crude Oil continues to move lower. The US Dollar Index looks to continue lower in the updrift while US Treasuries consolidate their move higher. The Shanghai Composite has renewed the downtrend while the bounce in Emerging Markets continues to move them higher.

Volatility looks to continue to ease making it easier for equity index ETF’s SPY (NYSE:SPY), IWM and QQQ, to move up. Their charts all show a strong move higher on the week, and firm reversals on the weekly chart. The daily charts show the SPY and QQQ with strong moves up all week, while the IWM stalled mid week and consolidated. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.