Alexion Pharmaceuticals (NASDAQ:ALXN)

Alexion Pharmaceuticals, ALXN, pulled back from a top in October finding support in November. It bounced from there to just over the 200 day SMA and then retreated again. The range then held with a brief trip over the 200 day SMA in March. In May the consolidation tightened to a symmetrical triangle and it broke that to the upside in June. A retest last week and Friday’s reversal make it interesting. The RSI is moving up in the bullish zone with the MACD avoiding a cross down. Look for continuation to participate higher…..

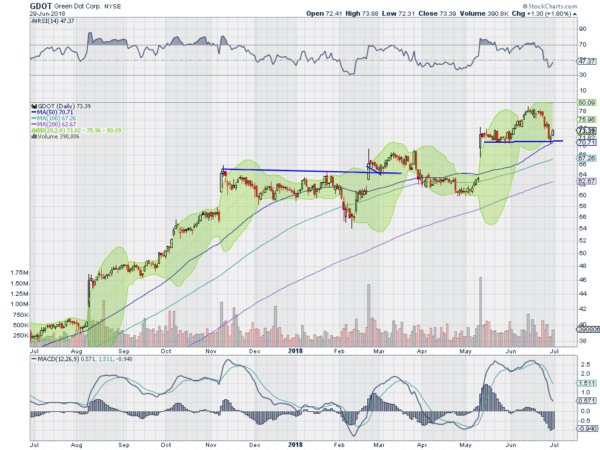

Green Dot Corporation (NYSE:GDOT)

Green Dot, GDOT, gapped higher in May and then consolidated the move. It then pushed higher again into June but fell back at the end of the month. The drop brought it back to the 50 day SMA and it prior support. Friday it confirmed a reversal off of support. It has a RSI that is also turning back higher after holding in the bullish zone during the pullback but the MACD is still falling. Look for continuation to participate…..

Generac Holdlings Inc (NYSE:GNRC)

Generac Holdings, GNRC, ran higher fast to a top at the beginning of November. It pulled back in a shallow arc at first and then to the 200 day SMA in March. It consolidated in a range then for 2 months before moving higher. Three weeks ago it retested the January high and pulled back to a higher low. Last week it started higher again. The RSI is rising in the bullish zone and the MACD is turning to cross up and positive. Look for continuation to participate higher…..

Meet Group Inc (NASDAQ:MEET)

Meet Group, MEET, started moving higher in April. It crossed the 200 day SMA in May and continued to a top in June. This is at the gap down level from August last year. The RSI is holding after pulling back from an overbought condition and the MACD is leveling. Look for a push over resistance to participate…..

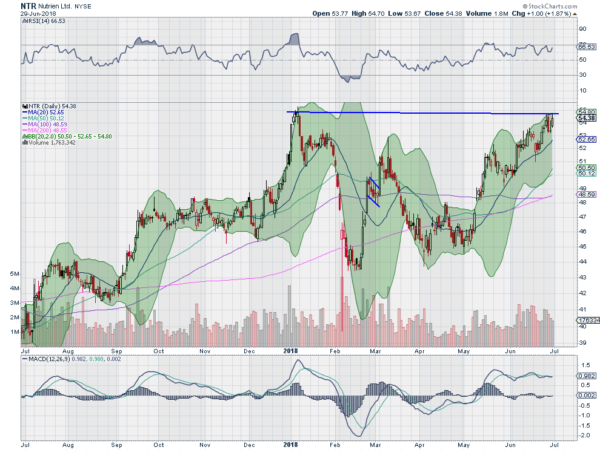

Nutrien Ltd (NYSE:NTR)

Nutrien, NTR, started to pullback from a top in January, finding a bottom in February. It bounced to a lower high and then fell back. It consolidated and confirmed a double bottom on a move over the April high with a gap up in May. It stalled at the March bounce high and retreated to a higher low. Since then it has pushed through resistance and is approaching the January high. The RSI is bullish and rising with the MACD flat and positive. Look for continuation to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as we close the books on the 2nd Quarter and prepare for a holiday shortened 4th of July week, sees that the equity markets look to have run out of gas. Maybe the short week will re-energize them. All the indexes had a positive quarter with the IWM just out pacing the QQQ, 7.9% to 6.5% and the SPY gaining 3.1%. The QQQ won the month up 0.9% to the 0.6% for the IWM and the SPY eked out a 0.1% gain. The monthly candles all look toppy with long upper shadows, while the quarterly candles are all looking strong.

Elsewhere Gold looks as it may pause in its downtrend while Crude Oil continues to race higher. The US Dollar Index is pausing in its uptrend while US Treasuries are on the edge of a break out to the upside. The Shanghai Composite may be ready to pause in its downtrend while Emerging Markets are setting up for a possible reversal higher. Volatility looks to remain low but above recent levels keeping the wind at the backs of the equity markets but the breeze blowing softer.

The equity index ETFs SPY, IWM and QQQ, all had a mixed week with early signs of strength Friday fading into the close, leaving questions about the short term. The longer weekly timeframe was much less troublesome showing consolidation for the SPY continuing and the IWM and QQQ digesting recent moves higher. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.