5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

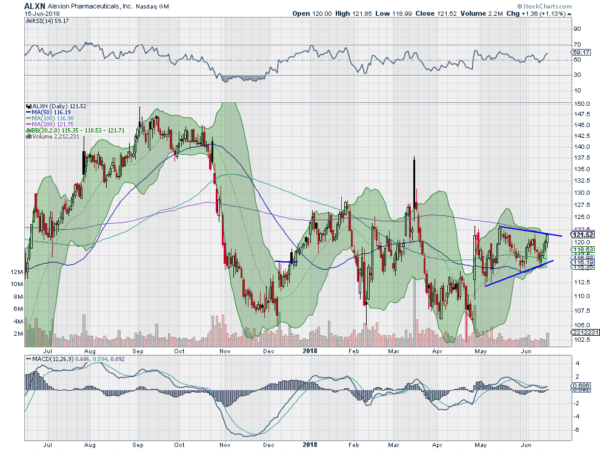

Alexion Pharmaceuticals, Ticker: $(NASDAQ:ALXN)

Alexion Pharmaceuticals, $ALXN, fell from an October peak, making a low in December. The bounce from there retraced 50% of the fall and then fell back to the December low. Another push spiked to a higher high before also failing and retreating to the prior low. Since May it has moved up and then consolidated in a symmetrical triangle. The RSI is knocking on the edge of the bullish zone and the MACD is crossing up. Look for break of the triangle to the upside to participate…..

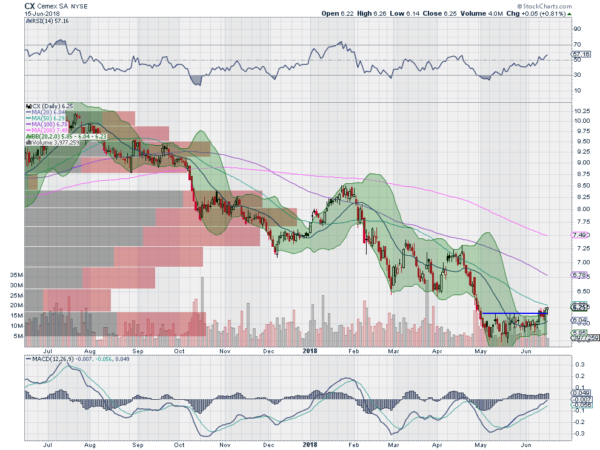

CEMEX, Ticker: $(NYSE:CX)

CEMEX, $CX, started moving lower in July last year. A couple of false bonces along the way, none over the 200 day SMA, and it made a low in May. Since then it has consolidated sideways until starting a move higher last week. The RSI is rising toward the bullish zone with the MACD now positive and moving up. Look for continuation to participate higher…..

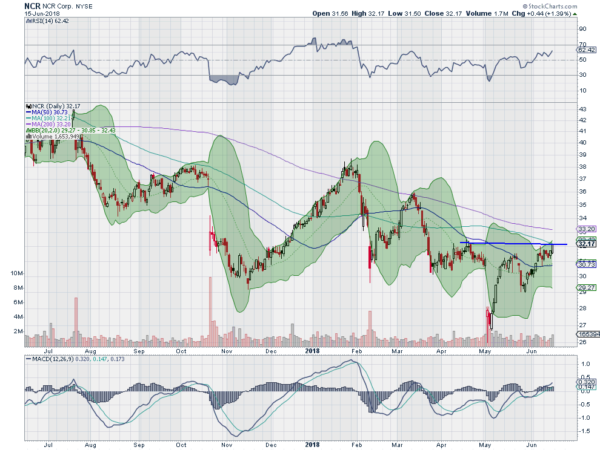

NCR, Ticker: $(NYSE:NCR)

NCR, $NCR, stair stepped lower, finding a bottom in May after gapping down from a consolidation. Since then it has pushed up and then retraced to a higher low. Now it is making a higher high at resistance. The RSI is rising in the bullish zone with the MACD rising and positive. Look for a push over resistance to participate…..

Northwest Bancshares, Ticker: $(NASDAQ:NWBI)

Northwest Bancshares, $NWBI, marched higher from a September low until finding resistance at the end of the month. That resistance would hold for the next 8 months, when it broke it to the upside at the end of May. It continued higher into June and then stalled upon making a higher high. It pulled back in a bull flag and Friday looks to have started a move out of the flag. The RSI is in the bullish zone and the MACD is kissing the signal line. Look for continuation higher to participate…..

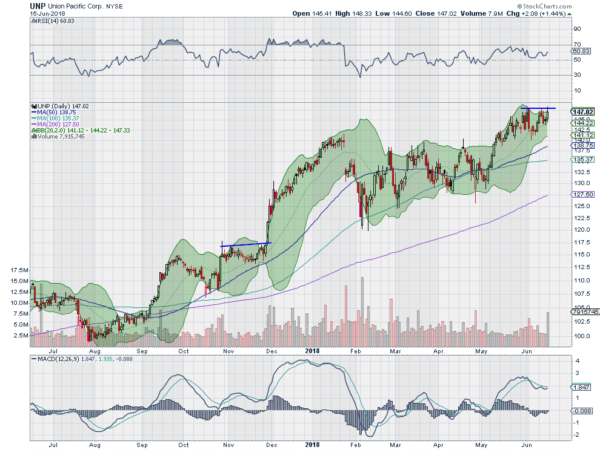

Union Pacific, Ticker: $(NYSE:UNP)

Union Pacific, $UNP, gapped down in January and ran lower to the 100 day SMA. It loosely followed that higher, bouncing off of resistance at the gap fill, until showing continuation in May. After making a higher high at the start of June it has been consolidating. The RSI is in the bullish zone and the MACD is about to cross up. Look for a push over resistance to participate…..

Up Next: Bonus Idea

If you like what you see sign up for more ideas and deeper analysis using the Get Premium button above.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with June options expiration and the June FOMC meeting behind allowing the market to look forward to slow summer trading and the next quarter’s earnings season. As it does, equity markets continue to look strong.

Elsewhere look for Gold to resume its move lower while Crude Oil turns lower as well. The US Dollar Index continues to strengthen while US Treasuries consolidate in the channel that has held then all year. The Shanghai Composite is making multi year lows and looking weak with Emerging Markets on the verge of turning a digestive bull flag into a bearish reversal.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are a bit mixed with the IWM and then the QQQ leading in the shorter timeframe as the SPY continues to struggle at the March highs. But on the longer timeframe all look strong, still the IWM leading with the QQQ close behind and the SPY dragging up the rear. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.