5 Trade ideas for Monday

Alcoa (NYSE:AA)

Alcoa, AA, gapped down after reporting earnings two weeks ago. It was already in a downtrend, moving counter-trend at the time. The move found support and then started back higher last week. The RSI is moving back up and the MACD is flat after a pullback, turning to the upside. Look for a continuation over resistance to participate higher.

Rockwell Collins (NYSE:COL)

Rockwell Collins, COL, dropped back to retest its 200 day SMA in May. That energized the stock and it quickly moved back up, retesting the high in June. It could not push through though and reversed again, back to the 200 day SMA, but at a higher low. It is rising again and near that top. The RSI is rising in the bullish zone with the MACD rising and positive. Look for a new high to participate to the upside.

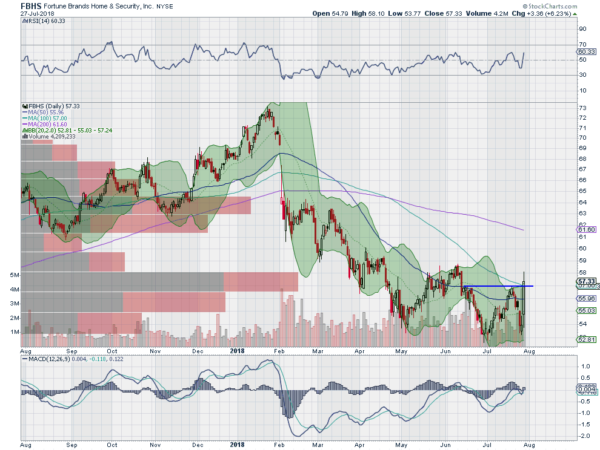

Fortune Brands Home & Security Inc (NYSE:FBHS)

Fortune Brands Home & Security, FBHS, gapped down in February and then rode a trend lower. It morphed into a bottoming consolidation in May and Friday looks to be trying to break to the upside. The RSI is rising and bullish with the MACD turning up and positive. Look for continuation to participate higher.

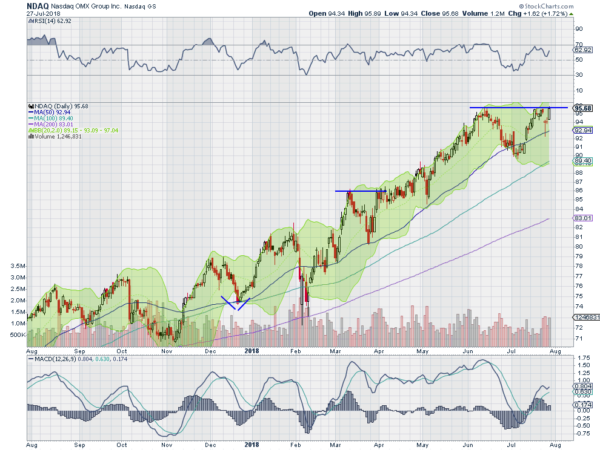

Nasdaq Inc (NASDAQ:NDAQ)

Nasdaq, NDAQ, started a move higher in February. It paused in March and then resumed to a top in June. It pulled back to the 50 day SMA into July and then reversed. Now it is back at that top to start the week. The RSI is bullish and rising with the MACD turning up. Look for a push over resistance to participate higher.

Northrop Grumman (NYSE:NOC)

Northrop Grumman, NOC, was trending lower from a top in April when a bounce fell below the 200 day SMA last week. It continued lower through Thursday before finding support and bouncing. The RSI is rising off of an oversold signal and the MACD is slowing its descent. Look for continuation to participate higher.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as the last full week of July ended saw the equity markets looking tired on the shorter time frame but remained solid on the longer one.

Elsewhere look for Gold to consolidate in the downtrend while Crude Oil shows signs of reversing higher at support. The US Dollar Index continues to mark time moving sideways while US Treasuries pullback in consolidation. The Shanghai Composite may be stalling in its bounce in the downtrend while MSCI Emerging Markets are building strength for a possible reversal higher.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts are showing a lack of energy or maybe even some weakness in the short term, especially in the QQQ and IWM. All look stronger and remain in the uptrends on the longer timescale. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.