Akamai Technologies, Ticker: $AKAM

Akamai Technologies Inc (NASDAQ:AKAM), started moving lower in June. It made a series of lower highs and lower lows to a bottom at the beginning of the year. Since then it has been moving higher. Two weeks ago it started to consolidate, digesting the move up. The RSI is in the bullish zone with the MACD flat but positive. Look for a pushover consolidation to participate.

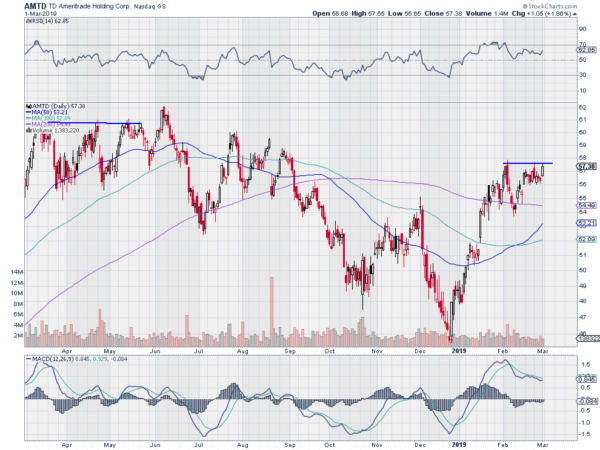

TD Ameritrade, Ticker: $AMTD

TD Ameritrade Holding Corporation (NASDAQ:AMTD) made a bottom with the market at the end of December. Since then it has moved higher, over the 200-day SMA and met resistance at the beginning of February. It pulled back to the 200-day SMA, found support and rebounded. Now it is back at resistance with the RSI in the bullish zone and the MACD flat and positive. Look for a pushover resistance to participate.

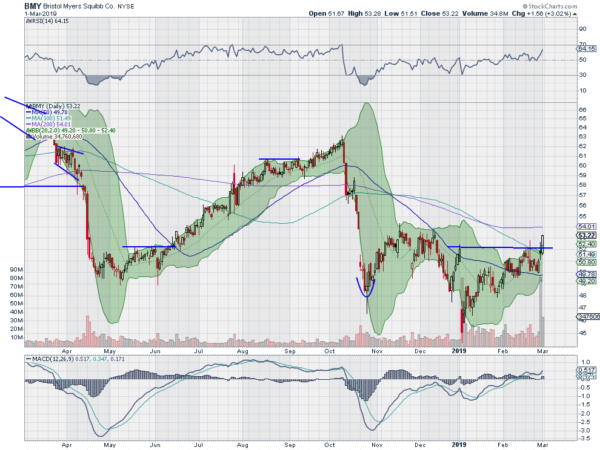

Bristol-Myers Squibb,Ticker: $BMY

Bristol-Myers Squibb (NYSE:BMY) dropped from an October high in 2 steps to a low in the beginning of the year. It has recovered from there, closing the open gap and moving over short term resistance to end last week. The RSI is rising in the bullish zone with the MACD turning up and positive. Look for continuation to participate higher.

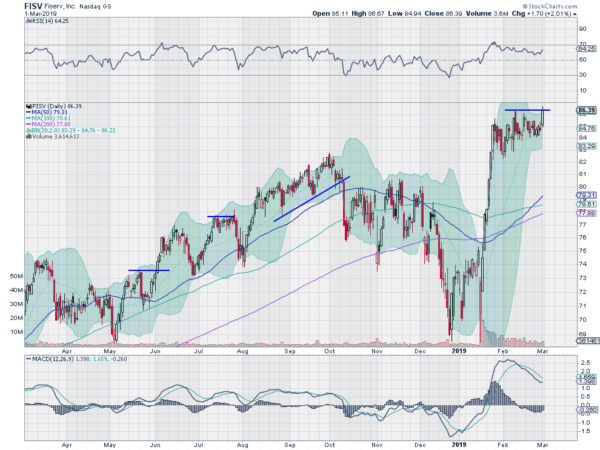

Fiserv, Ticker: $FISV

Fiserv (NASDAQ:FISV) announced a merger with First Data Corp in January and the stock dropped to retest the December low. But in less than 2 weeks it had not only rebounded but was at a new all-time high. It has consolidated that move since but showed signs of a breakout Friday. The RSI is in the bullish zone with the MACD turning back up and positive. Look for continuation to participate…..

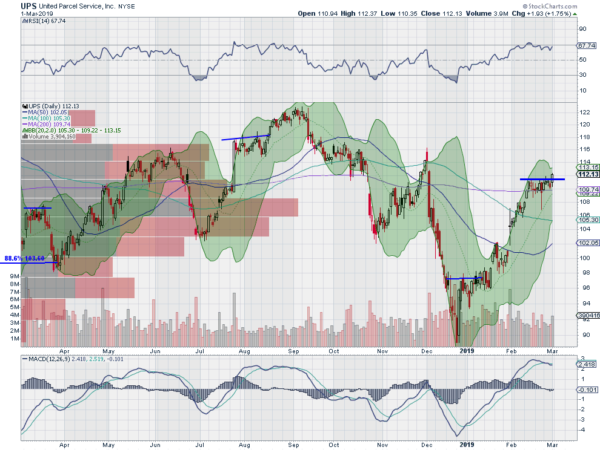

UPS, Ticker: $UPS

United Parcel Service Inc (NYSE:UPS) started moving lower in September. it bounced in October, to a lower high at the start of December, before a bigger leg down to the Christmas Eve low. Since then it has moved higher. The past 3 weeks it has been consolidating that move just over the 200-day SMA. The RSI is holding in the bullish zone with the MACD flat and positive. Look for a pushover resistance to participate.

Elsewhere

Look for Gold to continue its recent pullback while Crude Oil stalls in its uptrend. The U.S. Dollar Index remains in broad consolidation while US Treasuries are trending lower in the short term. The Shanghai Composite and Emerging Markets remain in uptrends, but with Emerging Markets consolidating the move.

Volatility looks to remain very low keeping the bias higher for the equity index SPY, IWM and QQQ. Their charts all experienced consolidation this week at key levels on the short time frame, a healthy pause. On the longer timeframe possible reversal candles will look to next week to see if confirmation of long term uptrends is given or reversal confirmation at a lower high. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.