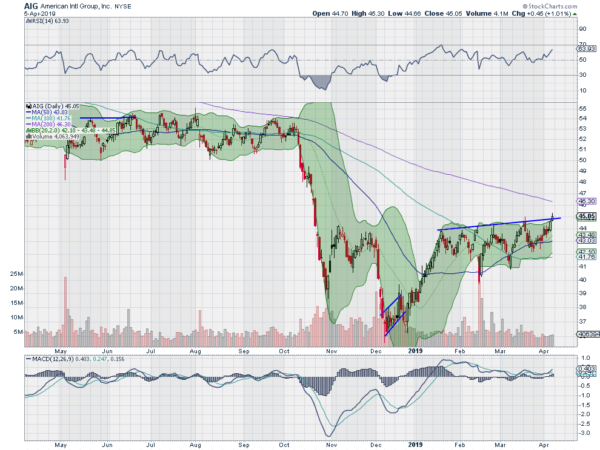

AIG (NYSE:AIG), Ticker: $AIG

AIG, $AIG, fell out of a long consolidation in October, bounced into the start of November and then dropped again to a bottom in December. Since then it has moved higher to that November bounce area where it shifted to a slow drift. It ended last week at resistance with the RSI rising into the bullish zone and the MACD lifting off zero. Look for a push over resistance to participate…..

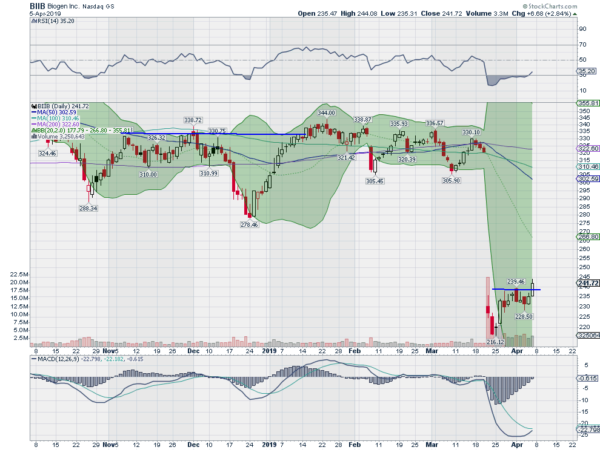

Biogen (NASDAQ:BIIB), Ticker: $BIIB

Biogen, $BIIB, was consolidating around the 200 day SMA for over 7 months until it dropped like a brick in March. Since then it has moved slightly higher. The RSI is lifting out of an oversold condition with the MACD about to cross up. Look for continuation to participate…..

Caterpillar (NYSE:CAT), Ticker: $CAT

Caterpillar, $CAT, fell hard and fast in October, losing over 25% of its market cap in just about 2 weeks. It bounced at the end of the month but to a lower high and then fell back again. A second touch at resistance also was rejected lower and now it is near a third touch. The RSI is flat in the bullish zone with the MACD rising and positive. Look for a push over resistance to participate…..

Micron (NASDAQ:MU), Ticker: $MU

Micron, $MU, started lower in June last year, finding support in December. It rose from there stalling at the end of February. A pullback to the 50 day SMA and it reversed back higher to the same resistance. That led to another trip to the 50 day SMA and reversal. It is now back at resistance for a third time. The RSI is holding in the bullish range with the MACD rising and positive. Look for a push over resistance to participate…..

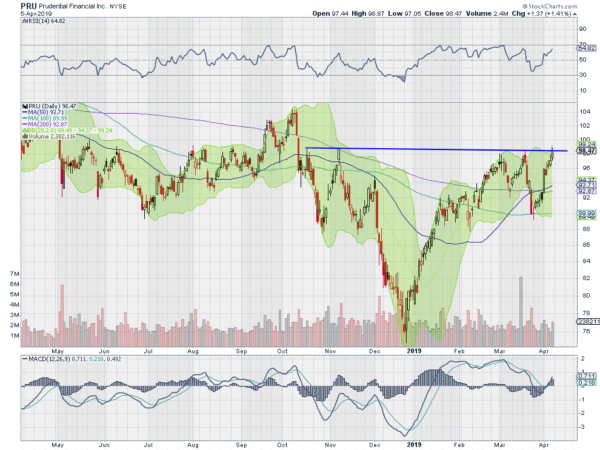

Prudential (LON:PRU), Ticker: $PRU

Prudential, $PRU, dropped from a top in October, to support at the end of December. Since then it snapped back fast in January and then slowed the pace. It paused as it hit the November bounce levels and has rejected lower twice. The third time at resistance it has a RSI rising in the bullish zone with the MACD crossed up and positive. Look for a push over resistance to participate…..

Up Next: Bonus Idea

If you like what you see sign up for more ideas and deeper analysis using the Get Premium button above.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as the 2nd Quarter begins saw there was no sell off in equities, rather a gap and go week showing strength.

Elsewhere look for Gold to continue to consolidate while Crude Oil remains in an uptrend. The US Dollar Index looks to mark time next week while US Treasuries pullback in their uptrend. The Shanghai Composite and Emerging Markets are back in their uptrends.

Volatility is very low and looks to continue there, keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts show the SPY and QQQ now looking like strong uptrends with the IWM turning up to join them. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.