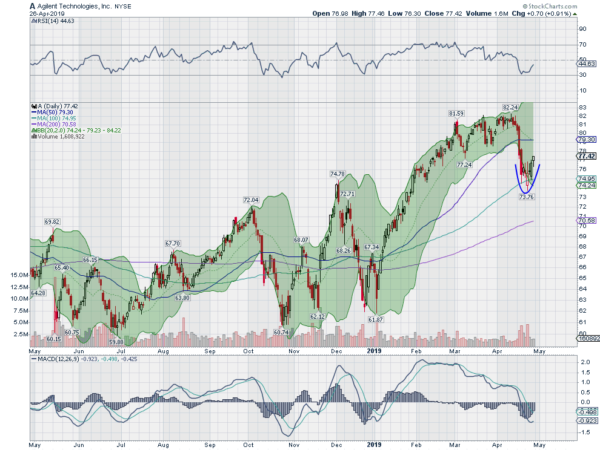

Agilent Technologies, Ticker: $A

Agilent Technologies (NYSE:A), rose off of a bottom in January. It continued to move higher, to a top from late March through early April. It pulled back from there to a low late in April before the recent turn back higher. The RSI is running higher as well with the MACD turning to cross up. Look for continuation to participate.

Allegiant Travel, Ticker: $ALGT

Allegiant Travel Company (NASDAQ:ALGT) started higher off of a bottom in December and topped after two steps in February. It pulled back to the 200-day SMA from there and found support into March. From there it reversed back to prior resistance where it sits. The RSI is rising in the bullish zone with the MACD moving higher and positive. Look for a pushover resistance to participate.

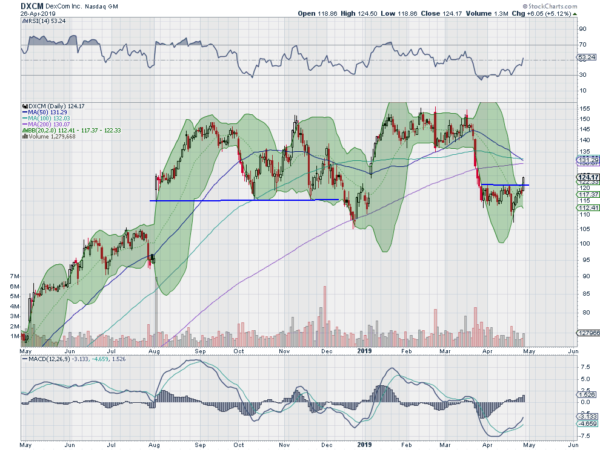

DexCom, Ticker: $DXCM

DexCom Inc (NASDAQ:DXCM) pulled back from a plateau in the first quarter and consolidated. It broke that consolidation Friday to the upside. The RSI is rising through the mid line with the MACD crossing up and rising. Look for continuation to participate.

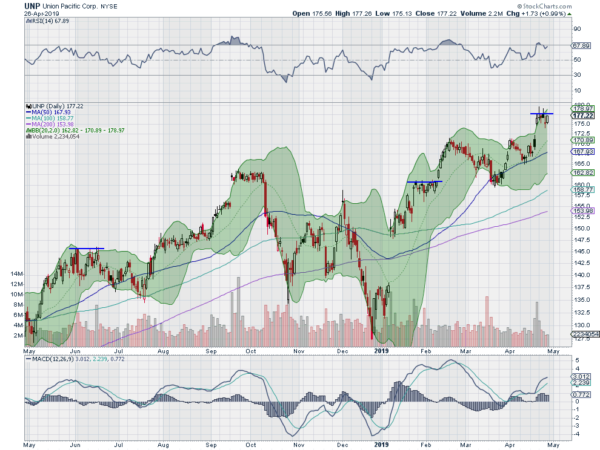

Union Pacific, Ticker: $UNP

Union Pacific (NYSE:UNP) gapped up in January and has trended higher since. Last week it gapped higher again and consolidated. The RSI is strong in the bullish zone with the MACD rising and positive. Look for a pushover consolidation to participate.

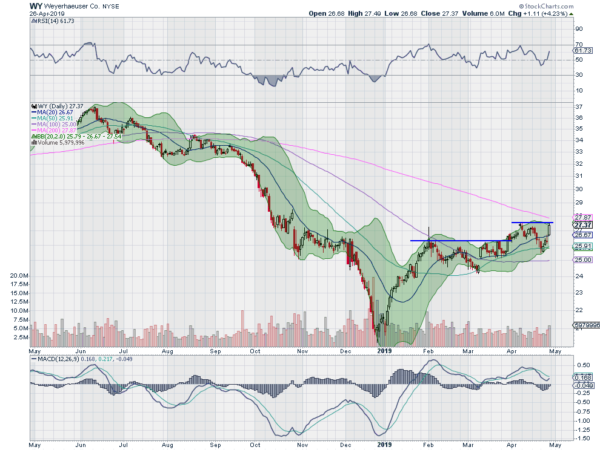

Weyerhaeuser, Ticker: $WY

Weyerhaeuser Company (NYSE:WY) made a bottom in December and then quickly rose in January. The price action leveled from there for 2 months before a push up to resistance. After a shallow pullback, it is at resistance again. The RSI is rising and bullish with the MACD positive and crossing up. Look for a pushover resistance to participate.

Up Next: Bonus Idea

Elsewhere look for Gold to possibly reverse high out of a pullback while Crude Oil pauses in its uptrend. The US Dollar Index has changed to a short term uptrend while US Treasuries are biased higher. The Shanghai Composite and Emerging Markets are both pulling back in their uptrends.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are strong in the weekly timeframe with the QQQ leading the way at all-time highs and the SPY right behind with the IWM improving. On the daily timeframe, the QQQ may be ready for a pause and it might be time for it to pass the baton to the IWM which is back at resistance. The SPY meanwhile remains strong and a fraction from new all-time highs. Use this information as you prepare for the coming week and trad’em well.

Disclaimer:

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.