ACADIA Pharmaceuticals, Ticker: $ACAD

ACAD stared higher off of the December bottom, pausing when it had returned to the Fall highs. Then two weeks ago it jumped to a higher high before the digestive pullback last week. The strong move Friday, along with the RSI turning back up and MACD avoiding a cross down support another leg higher. Look for continuation to participate.

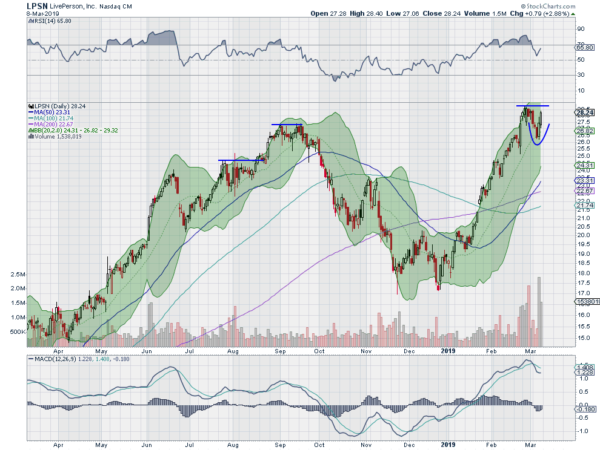

LivePerson, Ticker: $LPSN

LPSN topped out in September and then started to move lower. It found support in December and started to move higher into the New Year. Two weeks ago it made a higher high and then pulled back. It ended last week moving back up toward that high. The RSI is also moving back higher in the bullish zone with the MACD flat and positive. Look for continuation to participate higher.

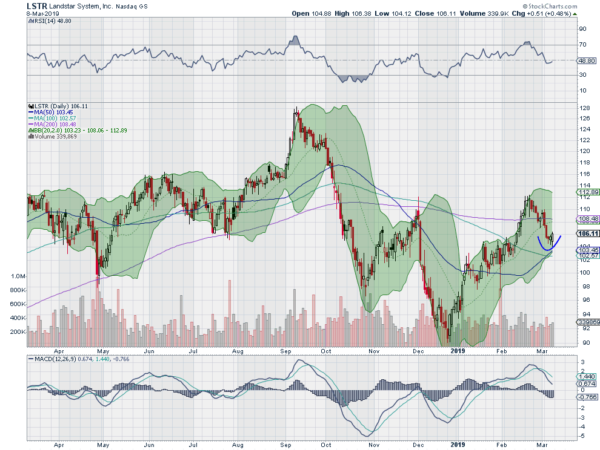

Landstar, Ticker: $LSTR

LSTR started lower in early September. It found support at the end of October and reversed only to be stopped at the 200 day SMA at the end of November. It fell back from there to a lower low at the end of the month. Since then it rose back through the 200-day SMA to a higher high in February and has pulled back. Friday saw a strong move that may mark the bottom with the RSI turning back up but the MACD still falling. Look for continuation to participate…..

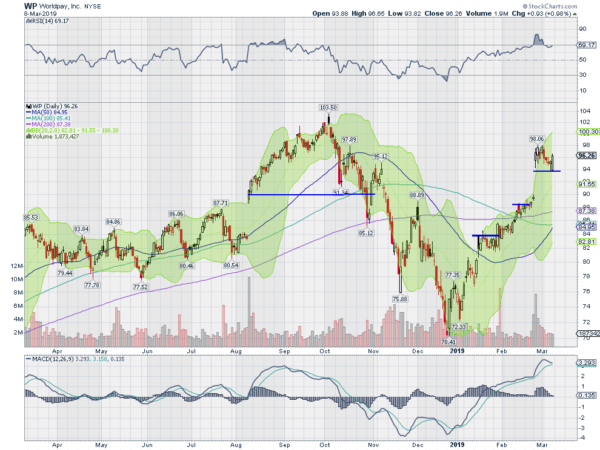

Worldpay, Ticker: $WP

WP topped in October and then began a drop that found support in late December. It has stepped higher since, adding a gap up 2 weeks ago. It has been digesting that gap and ended last week with a strong move that may indicate another leg beginning. The RSI is turning back up after retracting from an overbought condition while the MACD may be crossing down. Look for continuation to participate higher.

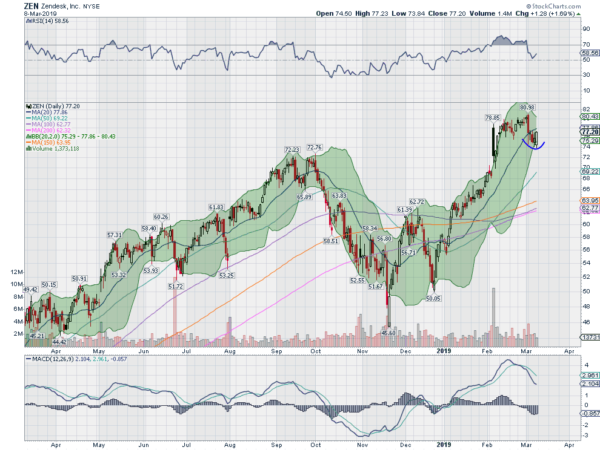

Zendesk, Ticker: $ZEN

ZEN pulled back from a high in September, finding support in November. It confirmed a double bottom as it rose into 2019 and kept moving higher. It hit resistance last week and pulled back. By the end of the week, it was showing strength again. The RSI is turning back up but the MACD is falling. Look for continuation in the price to participate.

Up Next: Bonus Idea

Elsewhere look for Gold to pullback in its uptrend while Crude Oil marks time moving sideways. The U.S. Dollar Index continues in broad consolidation but with a possible bullish reversal building while US Treasuries move higher in broad consolidation. The Shanghai Composite is making a digestive move in its uptrend while Emerging Markets are pulling back and possibly reversing lower.

Volatility looks to remain low but rising from extremes shifting the bias to lower for the equity index ETF’s SPY, IWM and QQQ. Their charts all confirmed reversal patterns on the weekly timeframe and their first 5 day moves lower on the daily timeframe. No major damage to the uptrend has been done at this point. Use this information as you prepare for the coming week and trad’em well.

Disclaimer:

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.