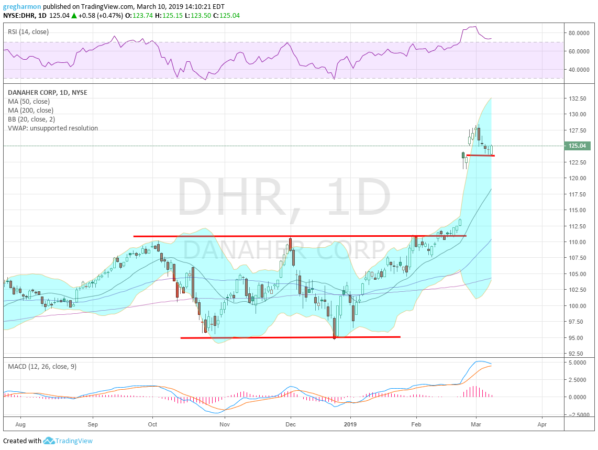

Danaher (NYSE:DHR) bounced around in a broad channel until breaking it to the upside in February. It drifted up at first and then gapped higher to a new all-time high. Last week saw it digesting that move with a pullback that filled one gap. The RSI has pulled back from an overbought condition and the MACD is now rolling down and about to cross.

Friday saw some strength and a solid candle to the upside. A Measured Move higher would give a target to 140. But a breakdown following the MACD would see a gap fill as a possibility. Short interest is low under 1%. There is no resistance above 128.40. Support lower comes at 123.50 and 121.50 then 113.63 and 110.85. The company is expected to report earnings next on April 17th. The stock pays a dividend of only 0.5% but the ex-date is March 28th.

The March options chain shows open interest spread from 92.50 to 125 with the biggest from 105 to 110 on the put side. The March calls see the biggest open interest at 125. In April the puts show biggest open interest at 120 and 110 with the calls from 125 to 130.

Danaher, Ticker: $DHR

Trade Ideas

- Buy the stock on a move over 126 with a stop at 122.

- Buy the April 125 Calls for $3.40.

- Buy the April 115/130 bull Risk Reversal for $1.10.

- Buy the April 120/115-110 1×2 Put Spread for $0.50.

- Buy the April 125 Straddle for $6.80.

Elsewhere

Look for Gold to the pullback in its uptrend while Crude Oil marks time moving sideways. The US Dollar Index continues in broad consolidation but with a possible bullish reversal building while US Treasuries move higher in broad consolidation. The Shanghai Composite is making a digestive move in its uptrend while Emerging Markets are pulling back and possibly reversing lower.

Volatility looks to remain low but rising from extremes shifting the bias to lower for the equity index ETF’s SPY, IWM and QQQ. Their charts all confirmed reversal patterns on the weekly timeframe and their first 5 day moves lower on the daily timeframe. No major damage to the uptrend has been done at this point. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.