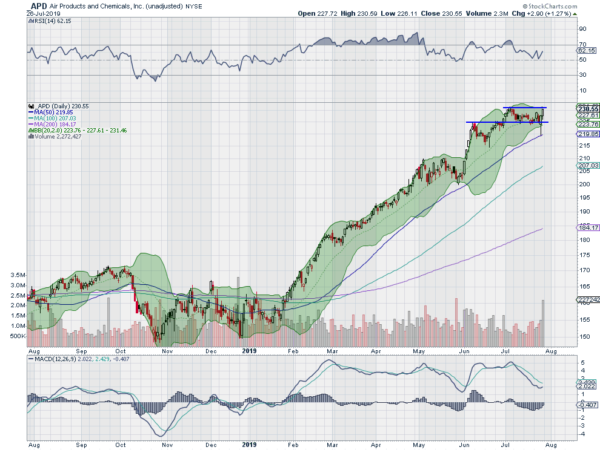

Air Products, Ticker: $APD

Air Products and Chemicals Inc (NYSE:APD) has been trending higher since January. It paused to consolidate in May and then again at the start of July. Friday saw it move back to the top of the consolidation zone with the RSI rising in the bullish zone and the MACD turning to cross up. Look for a pushover resistance to participate.

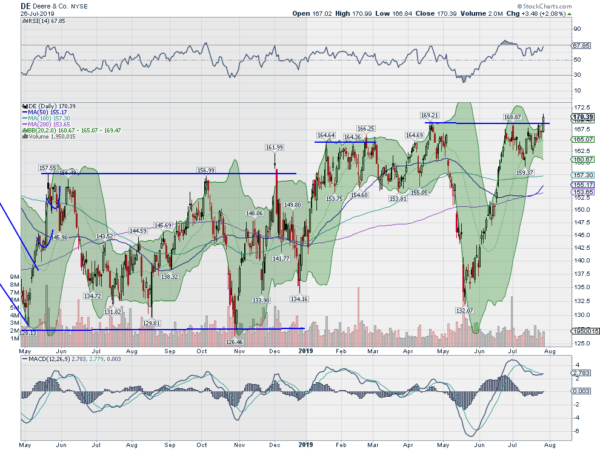

Deere, Ticker: $DE

Deere & Company (NYSE:DE) made a peak in April and then rapidly imploded, dropping to a low in May 20% lower. Since then it has moved back up to that prior high and consolidated. Friday it pushed over resistance with a RSI strong in the bullish zone and the MACD level but crossing up and positive. Look for continuation to participate.

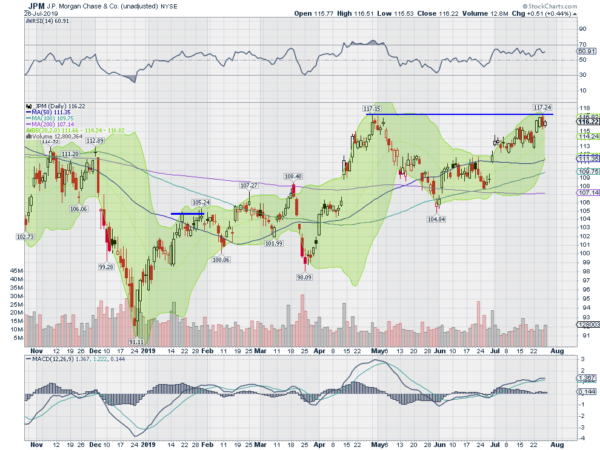

JP Morgan, Ticker: $JPM

JPMorgan (NYSE:JPM) started moving lower from a top at the beginning of May. It found support at a higher low at the end of the month and reversed. Last week it was back at that May high. The RSI is holding in the bullish zone with the MACD rising and positive. Look for a pushover resistance to participate…..

McCormick, Ticker: $MKC

McCormick (NYSE:MKC), $MKC, started higher off of a January low and met resistance in April. It has run mainly sideways since with a slight upward bias the past month. It has a RSI rising in the bullish zone with the MACD crossing up and positive. Look for a push over resistance to participate…..

Walmart (WMT)), Ticker: $WMT

Walmart (NYSE:WMT), $WMT, started higher off of a December low and then quickly settled into a slower path higher. In June it accelerated again and continued to a peak 2 weeks ago. It pulled back last week and found support just under the 20 day SMA. Friday saw a push back to the upside with the RSI turning back up in the bullish zone and the MACD resetting lower. Look for continuation to participate.

Elsewhere look for Gold to continue to mark time in its uptrend while Crude Oil pauses in the move lower. The US Dollar Index seems looks to move higher in consolidation while US Treasuries pause and consolidate their move up. The Shanghai Composite and Emerging Markets are both in consolidation mode with no indication that will change.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts all agree with this on the shorter timeframe and are moving higher. But with the SPY and QQQ making all-time highs and driving to the upside on the longer timeframe, the IWM continues to lag and remains in a range. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.