On Nov 7, yields on several U.S. sovereign bonds spiked following positive news that the United States and China are likely to roll back existing tariffs that were imposed in phases on each other's goods.

Strong economic data and better-than-expected performance by U.S. corporates in the third quarter of 2019 are the other catalysts. Investors dumped safe-haven government bonds and opted for risky assets like equities, which resulted in a Wall Street rally.

As a result of these developments, stock prices of several banks surged. A hike in government bond yield will raise the cost of funds, which in turn will enable the financial sector, especially banks, to widen the spread between longer-term assets, such as loans, with shorter-term liabilities, thus boosting the sector’s profits.

Yield Curve Steepens

On Nov 7, the yield on benchmark 10-year U.S. Treasury Note increased 11 basis points to 1.924%, marking the highest closing in three months. Notably, the yield climbed intraday to 1.97% — its biggest single-day move since the 2016 presidential election.

The yield on long-term 30-year U.S. Treasury Note gained 10.3 basis points to 2.4%, the highest gain since Sep 13. Moreover, the yield on short-term 2-year U.S. Treasury Note was up 7 basis points to 1.677%, reflecting its largest daily climb since Oct 11. Meanwhile, yield on 3-month U.S. Treasury Bill stayed as low as 1.569.

Following the hike in sovereign bond yields, S&P Financials Select Sector SPDR (XLF) rose 0.7%. Year to date, XLF is up 25.3%, surpassing the S&P 500 Index's gain of 23.1%. Moreover, the SPDR S&P Regional Banking ETF (NYSE:KRE), the SPDR S&P Bank ETF (NYSE:KBE) and the KBW Nasdaq Bank Index (BKX) gained 0.7%, 0.7% and 0.8%, respectively, on Nov 7.

Positive Development on Trade Dispute

On Nov 7, Reuters reported that Gao Feng, a spokesperson for China’s Commerce Ministry said that both the United States and China have agreed to get rid of existing trade tariffs that were imposed in phases. Per Gao, both sides will eliminate some of the existing tariffs in order to reach the phase one of the broader trade deal.

On Oct 11, President Donald Trump met with Chinese vice premier Liu He and said in the Oval Office that the United States has reached a “very substantial phase one deal” with China in a move to end the lingering tariff war. Since then, investors are eagerly waiting for at least a partial trade deal between the two countries.

Strong Economic Data

The Department of Labor reported that the non-farm payroll in October came in at 128,000, surpassing the consensus estimate of 88,000. Average hourly wage rate in October grew 0.2% compared with 0% in September. Year over year, wage rate increased 3%, faster than household inflation, which grew 1.8%.

The ISM reported that its service index came in at 54.7% for the month of October, beating the consensus estimate of 53.6% and previous month’s reading of 52.6%.A strong bunch of 13 industries out of 18, expanded in October.

Our Top Picks

At this stage, it will be prudent to invest in banking stocks with a Zacks Rank #1 (Strong Buy) and strong growth potential. We have narrowed down our search to five stocks, which have popped in the past three months and still have upside left. You can see the complete list of today’s Zacks #1 Rank stocks here.

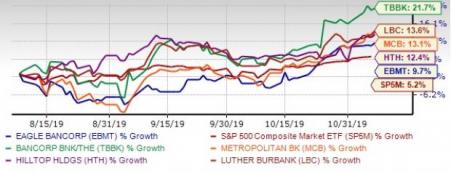

The chart below shows price performance of our five picks in the past three months.

The Bancorp Inc. (NASDAQ:TBBK) provides banking products and services in the United States. It offers a range of deposit products and services, including checking, savings, money market, commercial, and retirement accounts.

The company has an expected earnings growth rate of 58% for the current year. The Zacks Consensus Estimate for the current year improved by 14.7% over the last 30 days. The stock has jumped 21.7% in the past three months.

Luther Burbank Corp. (NASDAQ:LBC) offers commercial banking products and services to real estate investors, entrepreneurs, high net worth individuals and commercial businesses.

The company has an expected earnings growth rate of 12.7% for the current year. The Zacks Consensus Estimate for the current year improved by 8.5% over the last 30 days. The stock has soared 13.6% in the past three months.

Metropolitan Bank Holding Corp. (NYSE:MCB) provides a range of business, commercial, and retail banking products and services to small businesses, middle-market enterprises, public entities, and individuals in the New York metropolitan area..

The company has an expected earnings growth rate of 16.3% for the current year. The Zacks Consensus Estimate for the current year improved by 6.6% over the last 30 days. The stock has soared 13.1% in the past three months.

Hilltop Holdings Inc. (NYSE:HTH) offers a wide range of financial products and services in the United States. It operates in four segments: Banking, Broker-Dealer, Mortgage Origination, and Insurance.

The company has an expected earnings growth rate of 68% for the current year. The Zacks Consensus Estimate for the current year improved by 11.4% over the last 30 days. The stock has surged 12.4% in the past three months.

Eagle Bancorp Montana Inc. (NASDAQ:EBMT) operates as the bank holding company for Opportunity Bank of Montana offering various retail banking products and services in Montana. It serves checking, savings, money market, and individual retirement accounts, as well as certificates of deposit accounts.

The company has an expected earnings growth rate of 71% for the current year. The Zacks Consensus Estimate for the current year improved by 8.9% over the last 30 days. The stock has climbed 9.7% in the past three months.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Eagle Bancorp Montana, Inc. (EBMT): Free Stock Analysis Report

The Bancorp, Inc. (TBBK): Free Stock Analysis Report

Hilltop Holdings Inc. (HTH): Free Stock Analysis Report

Luther Burbank Corporation (LBC): Free Stock Analysis Report

Metropolitan Bank Holding Corp. (MCB): Free Stock Analysis Report

Original post

Zacks Investment Research