This week marks the beginning of the third quarter earnings season and expectations leave much to be desired. According to Estimize data, the S&P 500 is anticipated to post negative YoY EPS growth of 2.2%, with revenues pegged to come in at -1.7%. As always, it is still early and estimates will tend to rise as the season progresses and companies beat expectations. The S&P 500 constituents listed below are the ones to watch for this week.

-

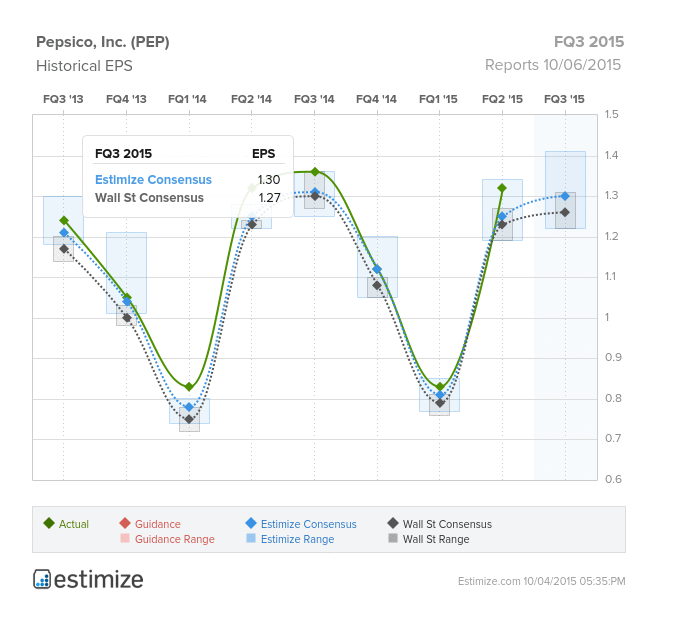

PepsiCo (NYSE:PEP)

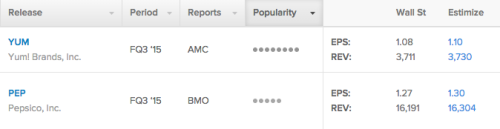

Consumer Staples - Beverages | Reports October 6, before the open

The Estimize consensus calls for EPS of $1.31 vs. Wall Street’s $1.27. The Estimize community is also expecting higher revenues of $16.4B as compared to the Street’s prediction of $16.2B

What to watch: Like many of its multinational peers, Pepsi has struggled with the strengthening US dollar this year. Pepsi gets nearly half of its sales from abroad, but has mostly been able to offset currency headwinds with a robust snacks segment and strategic price increases.

Last year PepsiCo delivered 4% organic revenue growth for the second year in a row, insisting this is a sign of a real comeback. Now in 2015, the 50th anniversary of the marriage of Pepsi-Cola and Frito-Lay, the company seems to be on track to do just as well. Strength in the first half of the year led PEP to raise full year EPS guidance last quarter. Like a lot of their food retail competitors, the wave of change in consumer preferences has prompted Pepsi to offer healthy alternatives. CEO Indra Nooyi said they are shifting resources from junk foods into the healthier alternatives and vowed to improve the healthiness of even the “fun” offerings.The carbonated drinks industry is also facing some headwinds as volumes continue to fall due changing demand patterns. The US consumer continues to become increasingly aware of the harmful effects associated with drinking carbonated soft drinks and therefore are beginning to turn to healthier products. It has been recently reported that U.S. per capita consumption of soda drinks has reached its lowest level since 1986.

-

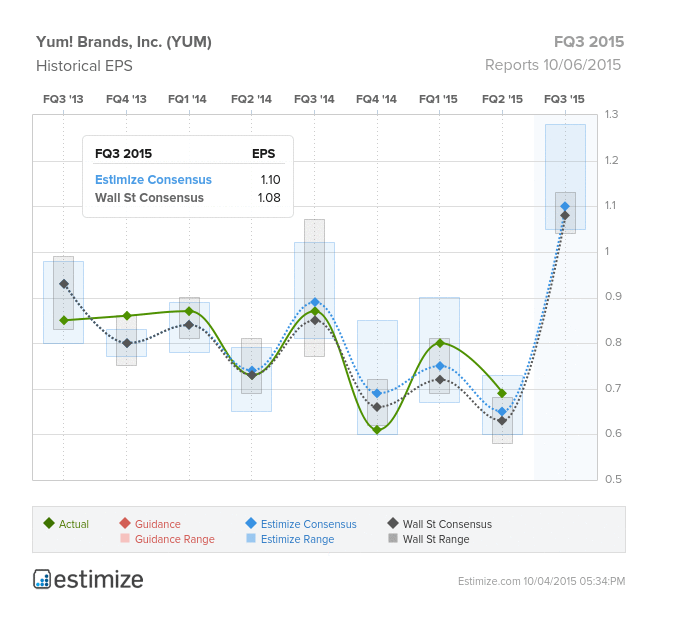

Yum! Brands (NYSE:YUM)

Consumer Discretionary - Hotels, Restaurants and Leisure | Reports October 6, after the close

The Estimize consensus calls for EPS of $1.10, two cents higher than Wall Street. The Estimize community is also expecting higher revenues of $3.75B vs. the Street’s expectation for $3.71B.

What to watch: Expect to see continued fallout from food quality concerns in China. Business in China makes up about half of it’s sales and has been performing poorly since it was revealed earlier in the year that a supplier re-labeled meat that was past its expiration date. Last quarter Yum’s same store sales in China fell 10%, a sharper decline than was expected. Despite that, CEO Greg Creed said that the company is still on track to open at least 700 new restaurants in China by the end of the year. They also reiterated guidance for 10% EPS growth for FY 2015. Yum subsidiary Taco Bell has been performing well in what has become a very popular fast food breakfast space, continually adding to their menu. However, unlike competitor McDonald's (NYSE:MCD) which does all day breakfast, Taco Bell only offers the menu from 5am - 11am. Due to success of the breakfast offering, YUM is adding Taco Bell restaurants at a fast clip. On the other hand, Pizza Hut has been lagging for sometime now. The pizza chain is working on improving online ordering, increasing digital marketing, and offering deep discounts to lure value-focused customers.

-

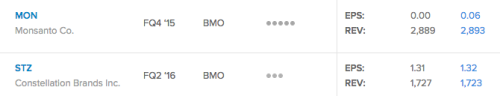

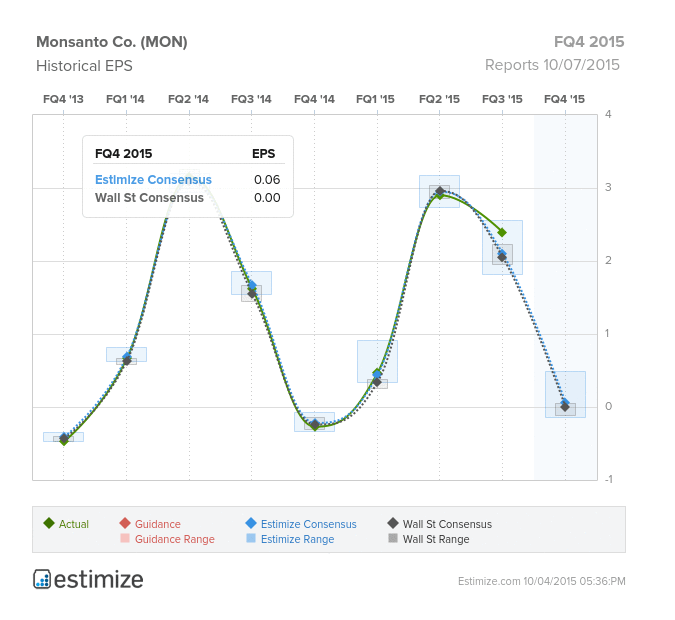

Monsanto Company (NYSE:MON)

Materials - Chemicals | Reports October 7, before the open

The Estimize consensus for MON currently stands at $0.06, much higher than Wall Street’s flat expectation. Revenue estimates are in-line at $2.89B.

What to watch: Monsanto has struggled this year due to the current agricultural environment, especially for corn. Corn is Monsanto’s biggest revenue producer, but prices have dropped significantly during the first half of the year, prices then recovered over the summer, but are still off 2.5% YTD. Reigniting worries over prices is the swelling corn supply due to record crops last year, and favorable weather in 2015 that will likely lead to big crops once again. Now industry watchers are concerned that these large stockpiles will reduce demand for the crop. The agriculture company is hoping soybeans can become a driver of growth in the meantime. Sales of the crop were up 48% in the first quarter, making the tech-enhanced seeds its second-biggest revenue producer behind corn. However, ideal weather has also lead to massive supplies of soybeans for the last year and half. To make matters worse, the agribusiness giant is contending with allegations that its best selling weed killer, Roundup, is a potential carcinogen. The World Health Organization classified glyphosate, a component of the Roundup product, as “likely having the potential to cause cancer in humans.”

-

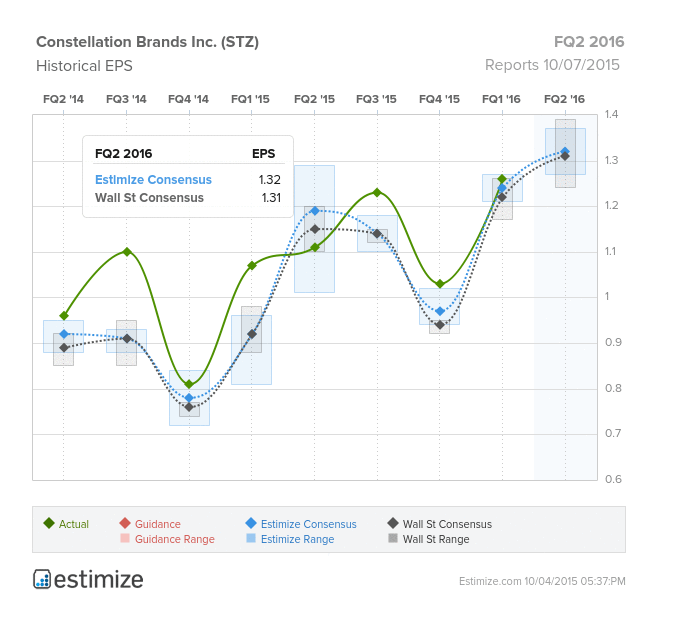

Constellation Brands (NYSE:STZ)

Consumer Staples - Beverages | Reports October 7, before the open

The Estimize community expects EPS of $1.32, a penny higher than Wall Street’s estimate. Revenues are expected to come in at $1.72B, slightly below the Street’s estimate of $1.73B.

What to watch: Constellation Brands is expected to further benefit from its imported beer brands as demand continues to grow. Imported beer volumes rose by a staggering 13.0% in the first quarter of 2015 year-on-year (YoY) in the United States. About 60% of the imported beer value came from Mexico. The beverage company’s Mexican beer profile continues to perform best, with total revenues receiving a nice boost due to the popularity of Corona and Modelo. The wine business has also been growing rapidly (STZ is the largest premium wine company in the world), with brands like Robert Mondavi, Black Box and Dreaming Tree, all great categories seeing a lot of growth and high margins. The stock is currently trading in close range to its 52-week high and is up 29% this year alone.

-

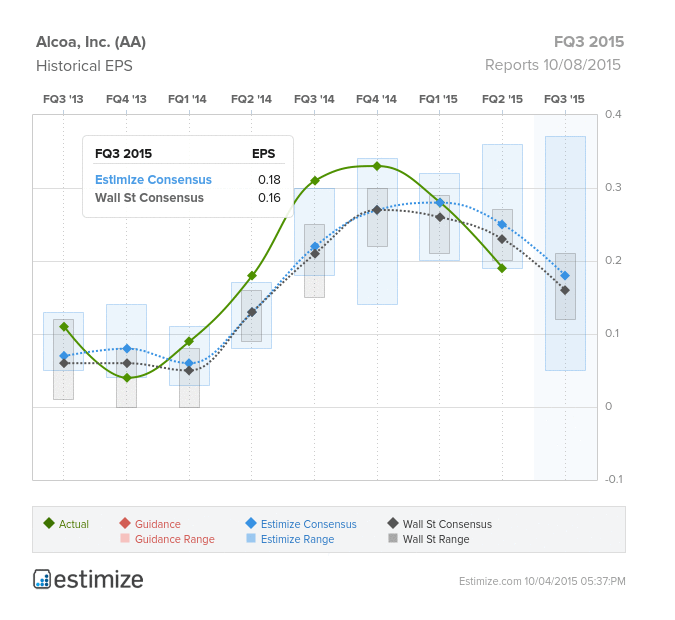

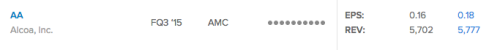

Alcoa (NYSE:AA)

Materials - Metals & Mining | Reports October 8, after the close

The Estimize consensus calls for EPS of $0.18, two cents above Wall Street. Revenue estimates of $5.78B are also higher than the Street’s $5.70B.

What to watch: Aluminum producer, Alcoa, has been rather bullish on the aluminum industry over the past couple of years, but investors should have taken their downtrodden guidance during the Q2 report very seriously. Last quarter the company cut EPS estimates by $0.09 and reduced full year 2015 and 2016 projections by approximately 20%. Since the beginning of the the year aluminum prices are down 14%, as are all other base metals. Declining global demand and China’s collapse are taking their toll. While China is the largest exporter of aluminum and competes against Alcoa’s business, a drop in demand for many products that are created using Alcoa’s alumina is impacting demand for the base metal. For example, the company is expecting a 4 - 6% decline in the heavy duty truck and trailer market in 2015 due to weakness in China, worse than prior guidance of negative 2 - 4%. The aerospace and automotive segments are expected to offset some of this weakness however, anticipated to grow 8 - 9% and 2 - 4%, respectively. However, last quarter the company cut EPS estimates by $0.09 and reduced full year 2015 and 2016 projections by approximately 20%. The stock has followed suit, down 40% YTD.