If you’re like most dividend investors, you’re probably keeping one eye on bond yields right now.

And, well, you should be … but only if you own low-yielding (or slow-growing) “bond proxies” like, say, PepsiCo (NASDAQ:PEP).

But if you buy (or already own) the 5 “undercover” high yielders I’ll show you at the end of this article, I have great news for you: you can ignore inflation, bond yields and the Fed and simply keep on collecting your fat dividend checks.

Bond Yields: 1, PepsiCo: 0

Before we get to that, back to PepsiCo.

As you probably know, the yield on the 10-year Treasury note has risen from 2.3% in early December to more than 2.9% today.

PepsiCo’s payout? 3.1%—pretty much the same as the yield on the 10-Year.

So the question becomes: why would you even consider buying PEP, a company whose sugary drinks are on the wrong side of the landslide toward healthier eating?

Because even though PEP beat expectations in the first quarter, its North American beverage business, home to a third of its sales, is still a lead weight, posting yet another quarter of declining revenue—a slide that likely won’t stop anytime soon!

Bond Yields Bury Old-School Dividend Aristocrats

An often-ignored problem with sputtering sales at PepsiCo and other consumer staples—I’m looking at you Kraft Heinz Co (NASDAQ:KHC)—is that sales are the fuel of earnings and, by extension, dividend growth. So unless revenue takes a turn for the better, their dividends will stagnate, making other income options more attractive over time.

Result: income-hungry first-level investors will dump these paupers in droves, practically guaranteeing they’ll underperform.

It’s already happening.

Check out how PepsiCo (blue line below), ConAgra Foods Inc (NYSE:CAG), in red, Mondelez International Inc (NASDAQ:MDLZ), in purple and General Mills (NYSE:GIS), in green, have performed vs. the broader market (orange) since the Federal Reserve kicked off the latest rate-hike cycle on December 17, 2015:

“Safe” Stocks Are Anything But!

Funny thing is, history is repeating itself.

Let’s go back to July 2004 through June 2006, when the Federal Reserve hiked rates from 1.25% to 5.25% and 10-year Treasury yields spiked to 5.14%.

What happened? None of these household names could squeak past the S&P 500.

A Depressing Pattern

But don’t worry, because there is one sector that crushed the market then and is woefully undervalued now: real estate investment trusts (REITs).

And when I say “crushed,” I mean it.

If you held the iShares US Real Estate (NYSE:IYR) back then, you pocketed a gain more than 3 times that of the S&P 500! (Note: I’m using IYR instead of the more popular REIT benchmark, the Vanguard REIT (NYSE:VNQ), here as VNQ didn’t launch until September 2004.)

REITs Lap the Market When Rates Rise

I know what you’re thinking: “Sure, Brett, but unlike back then, REITs have gotten hammered in the current rate-hike cycle.”

You’d be right.

VNQ has been badly roughed up since the latest rate-tightening cycle kicked off more than two years ago:

Our Cue to Buy

First-level investors would take this as a sign that now is the time to sell REITs and look for safer income plays.

But the right move is the exact opposite.

Here’s why:

- REITs boast fat dividend yields: Many REITs, like 3 of the 5 I’ll reveal below, yield 5% and up. Let’s be honest: it will be many years, if ever, before the yield on the 10-year rivals payouts like those!

- The best REITs—including all 5 below—are seeing a nice uptick in sales, thanks to the strong US economy, driving payout growth that will keep the yield on your original buy rising for years.

- As I wrote on June 20 (and have said many times before), a surging payout is the No. 1 driver of share prices.

The bottom line? Now is the time to buy REITs!

So let’s dive into the five I have for you. They either boast a sky-high yield, surging dividend growth … or both.

An Instant 5-REIT Portfolio for Higher Rates

They are: Easterly Government Properties (DEA), Physicians Realty Trust (NYSE:DOC), Life Storage Inc (NYSE:LSI), Preferred Apartment Communities Inc (NYSE:APTS) and Duke Realty Corporation (NYSE:DRE)

You can see that our 5-REIT mini-portfolio represents a range of REIT sectors, with one glaring omission: shopping-mall REITs, whose tenants are being eaten alive by Amazon.com (NASDAQ:AMZN).

You’ll also see that all 5 either have tenants that aren’t going anywhere, like Easterly (its buildings were 100% occupied at the end of the first quarter) and Physicians Realty (when was the last time you heard of doctors being tight for work?) or are benefiting from the surging economy.

The latter group includes Preferred (which sees higher demand for apartments, letting it raise rents), Duke, a warehouse owner that benefits from Amazon, its top tenant; and Life, a self-storage REIT that benefits from the bull market in “stuff.”

Dividends—and Dividend Growth—Look Solid

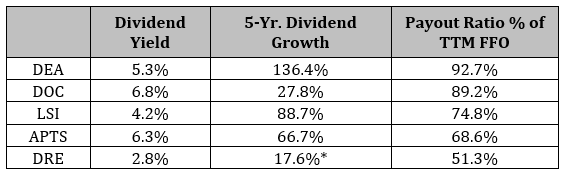

Let’s start with dividends.

You can see below that all five boast either a high yield, soaring payout growth (getting you a higher yield on your initial buy in short order) or both. And they’re backed by safe payout ratios (93% of FFO as dividends is a sustainable number for well-run REITs—especially those with every square inch of space rented out to the government, like DEA).

High Yields and Payout Growth Too!

*Dividend growth figure does not include two special dividends of $0.38 and $0.85,

paid out in 2015 and 2017, respectively.

So you’re already getting a nice 5.1% average dividend here—nearly 3 times more than the average S&P 500 stock pays—and generous payout growth, too.

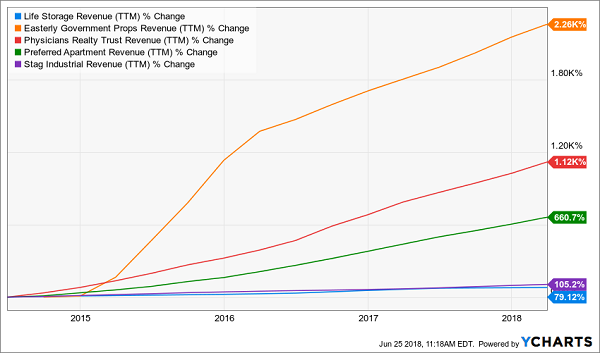

But what about revenue growth, the Achilles heel of the 4 consumer-staples stocks I mentioned off the top?

No problem there, either:

Big Sales Growth From “Boring” Businesses

Finally, valuation. Right now, DEA trades at 17.7 times trailing-twelve-month FFO; DOC clocks in at 15.5; LSI, 18.0; APTS at just 11.4; and DRE at 18.9.

These are great numbers for cash-spinning businesses like these. And they won’t last once the herd realizes that CDs and Treasuries still won’t be enough to retire on.

REVEALED: The Secret to Safe 8% Dividends Paid Monthly

My breakthrough 8% “Monthly Dividend” portfolio gives you 2 unbeatable tools that let you retire rich on a lot less than the so-called “experts” say you need:

- A life-changing 8% dividend yield—enough for you let loose a $40,000-a-year income stream on a $500,000 nest egg.

- Dividends paid monthly, so you don’t have to struggle to manage a cash flow that comes in quarterly while your bills come in every month!

PLUS if you’re not leaning on your portfolio for income, you can parlay these gaudy 8% payouts back into these “elite 8” stocks even faster, growing your nest egg and your dividend stream in the process. It really is a set-it-and-forget-it wealth-building machine!

(I’ll show you this powerful retirement package now—FREE—when you click right here.)

To convert your portfolio over to this 8-stock powerhouse portfolio, you really need to do only 2 things:

- SELL EVERYTHING, including the 2%, 3% and even 4% payers that simply don’t yield enough to matter. And,

- Buy the 8 bargain monthly dividend payers I’ll show you here.

That’s it!

The result? $3,333 in income every month on a $500,000 nest egg, with upside on your initial $500,000 to boot!

And this strategy isn’t capped at $500,000. If you’ve saved a million (or even two), you can just buy more of my 8 monthly payers and boost your passive income to $6,666 or even $13,332 per month.

Don’t be left out while other investors “lock in” their golden years with this powerful new portfolio. Simply CLICK HERE and I’ll give you all 8 of these stocks’ names, tickers, buy-under prices and more right now!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."