Since the Republicans have taken over, it has been quite a tumultuous phase for MedTech. The situation turned dramatic after President Trump took up the task to repeal Obamacare. After quite a few failed attempts, the Trump government resorted to the “skinny repeal” of Obamacare which failed to make any headway in the senate as well.

While the healthcare fraternity has been grappling with the developments at the Capitol Hill over the past one-and-a-half years, the MedTech industry has been content with the government’s policies which include the abolition of the Cadillac tax and the 2.3% MedTech tax.

Although the Cadillac tax has been postponed until 2026, the government has not come up with any concrete plan to suspend the MedTech tax yet.

Going by an article by Peter Sullivan (published in The Hill), the trade group for medical device companies is launching a campaign to push lawmakers to repeal ObamaCare’s tax on medical devices. The future of the MedTech fraternity thus hangs in the balance.

Strike When the Iron is Hot

Thanks to escalating political uncertainty, many MedTech stocks are trading at tantalizing discounts. The low valuations, however, provide investors the deal opportunity to pick high-potential stocks with attractive prospects. In the words of Warren Buffett, "I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful."

Our Screening Parameters

In order to help investors identify the ideal investment choices in the MedTech space, we have used the Zacks Stock Screener.

First, we shortlisted MedTech stocks with a favorable Value Style Score of A or B. Our Value Style Score highlights all valuation metrics and represents them as one score that cautions investors regarding “value traps” and helps them find stocks that are actually trading at a discount.

Finally, we have picked stocks with a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Here are stocks that met all criteria:

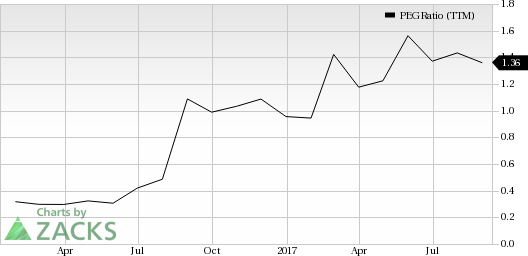

Lantheus Holdings, Inc. (NASDAQ:LNTH) : Headquartered in North Billerica, MA, the company operates as a developer and manufacturer of diagnostic medical imaging agents and also commercializes these products for the diagnosis and treatment of cardiovascular and other diseases worldwide. Lantheus carries a Zacks Rank #2, VGM Score of A and Value Style Score of A. The company also has a favorable Price/Earnings to Growth (PEG) ratio of 1.21 when compared with the broader industry’s 2.63.

Lantheus Holdings, Inc. PEG Ratio (TTM)

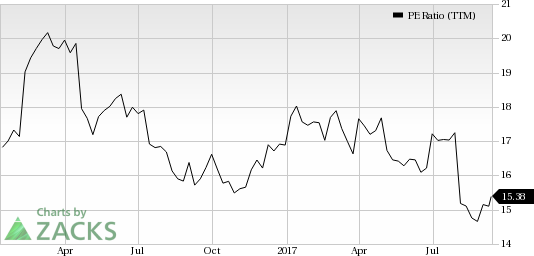

Owens & Minor Inc. (NYSE:OMI) : Based in Mechanicsville, VA, Owens & Minor is a global healthcare services company focused on providing supply chain services to healthcare providers and manufacturers of healthcare products. The company provides logistics services across the spectrum of medical products, ranging from disposable medical supplies to devices and implants. Owens & Minor carries a Zacks Rank #2 and Value Style Score of B. The company has a great Price to Earnings (P/E) ratio of 15 when compared to the broader industry’s 23.

Owens & Minor, Inc. PE Ratio (TTM)

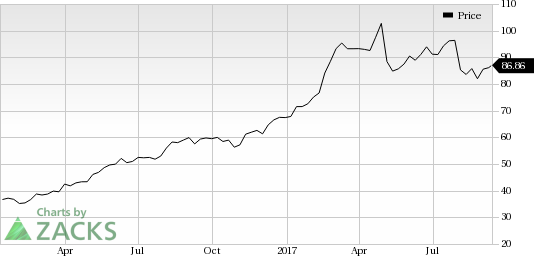

Masimo Corporation (NASDAQ:MASI) : Headquartered in Irvine, CA,Masimo designs, manufactures and sells noninvasive monitoring technologies globally. The stock carries a Zacks Rank #2 and Value Style Score of B. The company has a VGM Score of B. The Zacks Consensus Estimate for current-year earnings has been revised 5.3% up over the last 60 days.

Masimo Corporation Price

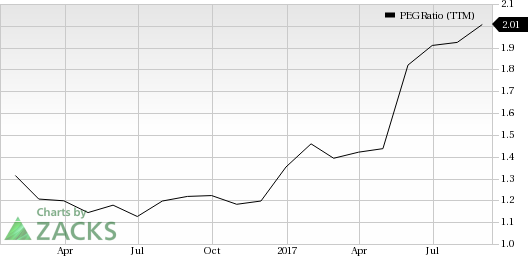

Amedisys, Inc. (NASDAQ:AMED) : Headquartered in Baton Rouge, LA, Amedisys operating through three segments: Home Health, Hospice, and Personal Care., provides healthcare services in the United States. The stock carries a Zacks Rank #2 and Value Style Score of B. The company also has a solid PEG ratio of 1.29 when compared with the broader industry’s 1.98.

Amedisys Inc PEG Ratio (TTM)

PAREXEL International Corporation (NASDAQ:PRXL) : Headquartered in Waltham, MA, this Zacks Rank #2 company provides clinical research and logistics, medical communications, consulting, marketing, and advanced technology products and services to pharmaceutical, biotechnology, and medical device industries globally. The company has a favorable Value Style Score of B. The company also has a stellar PEG ratio of 1.76 when compared with the broader industry’s 1.81.

PAREXEL International Corporation PEG Ratio (TTM)

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Masimo Corporation (MASI): Free Stock Analysis Report

Owens & Minor, Inc. (OMI): Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH): Free Stock Analysis Report

Amedisys Inc (AMED): Free Stock Analysis Report

PAREXEL International Corporation (PRXL): Free Stock Analysis Report

Original post

Zacks Investment Research